Are you a homeowner looking to maximize your income and reduce your monthly mortgage payment? A wraparound mortgage, also known as a “wrap” loan, could be the perfect solution. Wraparounds enable you to refinance and consolidate multiple mortgages into one loan with a single monthly payment. This type of loan is ideal for those who have multiple mortgages, as it allows you to combine all your loans into one, and may even result in a lower interest rate. Read on to learn more about the benefits and risks of a wraparound mortgage and find out if this type of loan could be the right fit for you.

What Benefits Does a Wraparound Mortgage Offer?

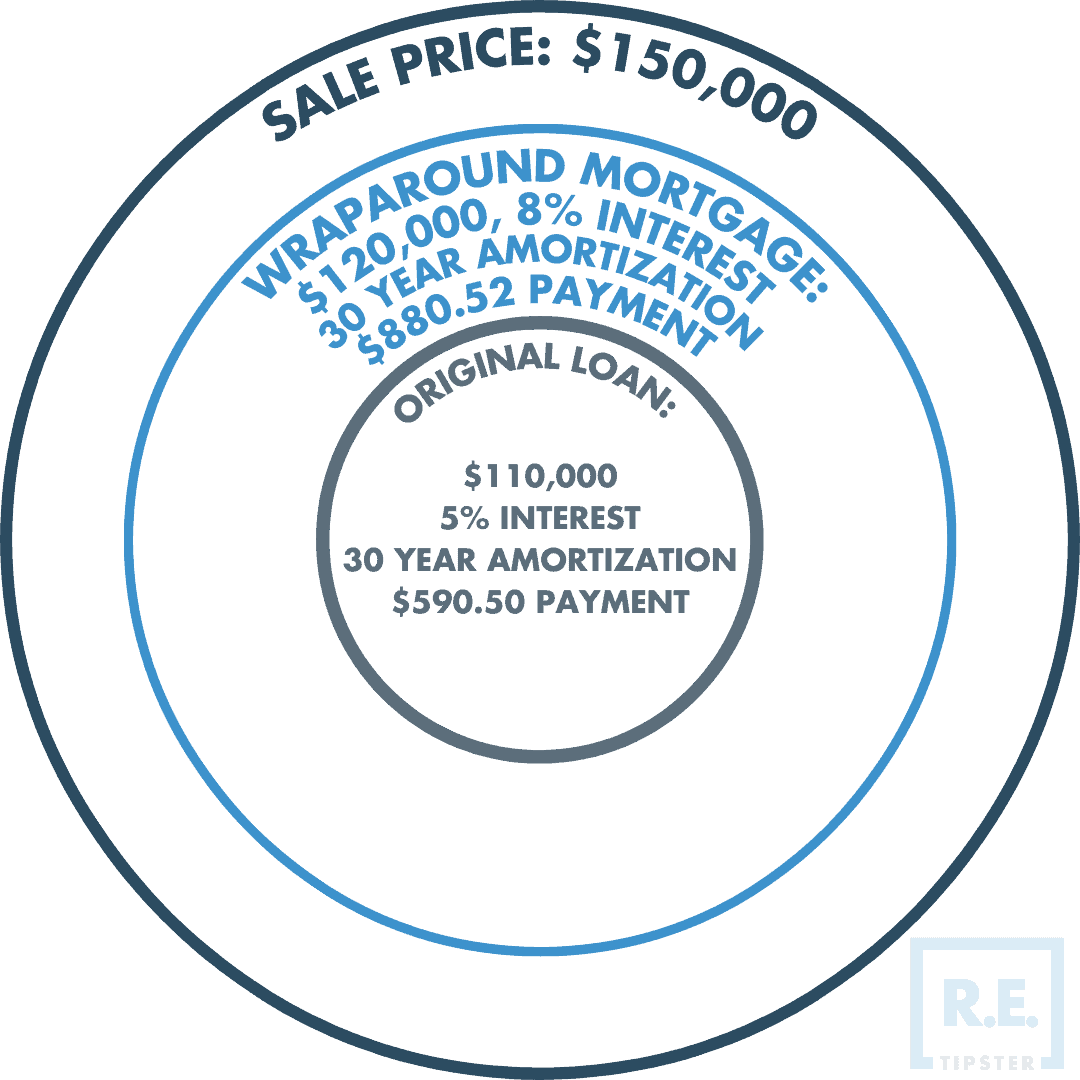

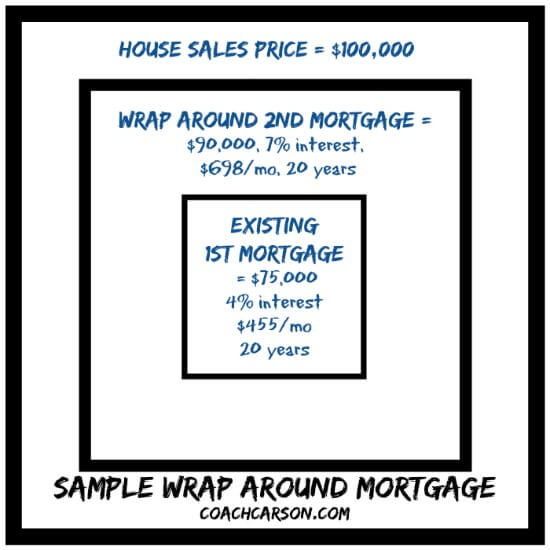

Wraparound mortgages are a great way to benefit from the equity you have in your home. With this type of mortgage, you can take advantage of lower interest rates and monthly payments. The benefits of a wraparound mortgage include the ability to keep your existing mortgage, access to a lower interest rate, and the ability to keep your existing mortgage payment. With a wraparound mortgage, you can also save money on closing costs and other fees associated with getting a new mortgage. You can also benefit from the ability to refinance your mortgage and make it more affordable. With a wraparound mortgage, you can also pay off your loan faster, freeing up more of your money for other investments.

What Are the Risks of a Wraparound Mortgage?

Having a wraparound mortgage can be a risky venture, so it’s important to understand the potential pitfalls before you take the plunge. The biggest risk is that if you don’t keep up with the payments on the underlying mortgage, you could be foreclosed on and lose the property. Additionally, you could be held liable for the unpaid balance of the underlying loan if the lender forecloses on the property. You could also face legal action from the lender or from the seller if you’re unable to make payments on the loan. Furthermore, if the buyer defaults on the loan, you could be held responsible for the balance of the loan. Lastly, if the value of the property decreases, you could end up owing more than the property is worth. It’s important to weigh the risks and benefits of a wraparound mortgage before committing to one.

Who Is Eligible for a Wraparound Mortgage?

If you’re considering a wraparound mortgage, you’ve probably already heard that they are a great way to get financing without the hassle of traditional lenders. But who exactly is eligible for a wraparound mortgage? Generally, the borrower must be a homeowner, have sufficient equity in their home, and be able to afford the payments. The original lender must also agree to the terms of the wraparound mortgage agreement. In addition, the borrower must have good credit and have no history of delinquencies or defaults on their mortgage. It’s also important to note that a wraparound mortgage is not for everyone. It’s a riskier form of financing, with a higher interest rate, so it’s important to do your research and make sure that you understand all the terms and conditions of a wraparound mortgage before you sign on the dotted line.

How Do You Qualify for a Wraparound Mortgage?

Qualifying for a wraparound mortgage is not as hard as it sounds. To be eligible, you need to have an existing mortgage on the property that you’re trying to refinance. This existing mortgage will be paid off with the help of the wraparound mortgage. You also need to have enough equity in the property so that the lender can be assured that they will receive the full amount of the loan. Additionally, you must be able to demonstrate that you have the financial capacity to make the payments on the new loan. Lastly, you must have a good credit score, which can be determined by your past payment history. With all these qualifications in place, you should be able to get approved for a wraparound mortgage.

What Factors Should You Consider Before Taking Out a Wraparound Mortgage?

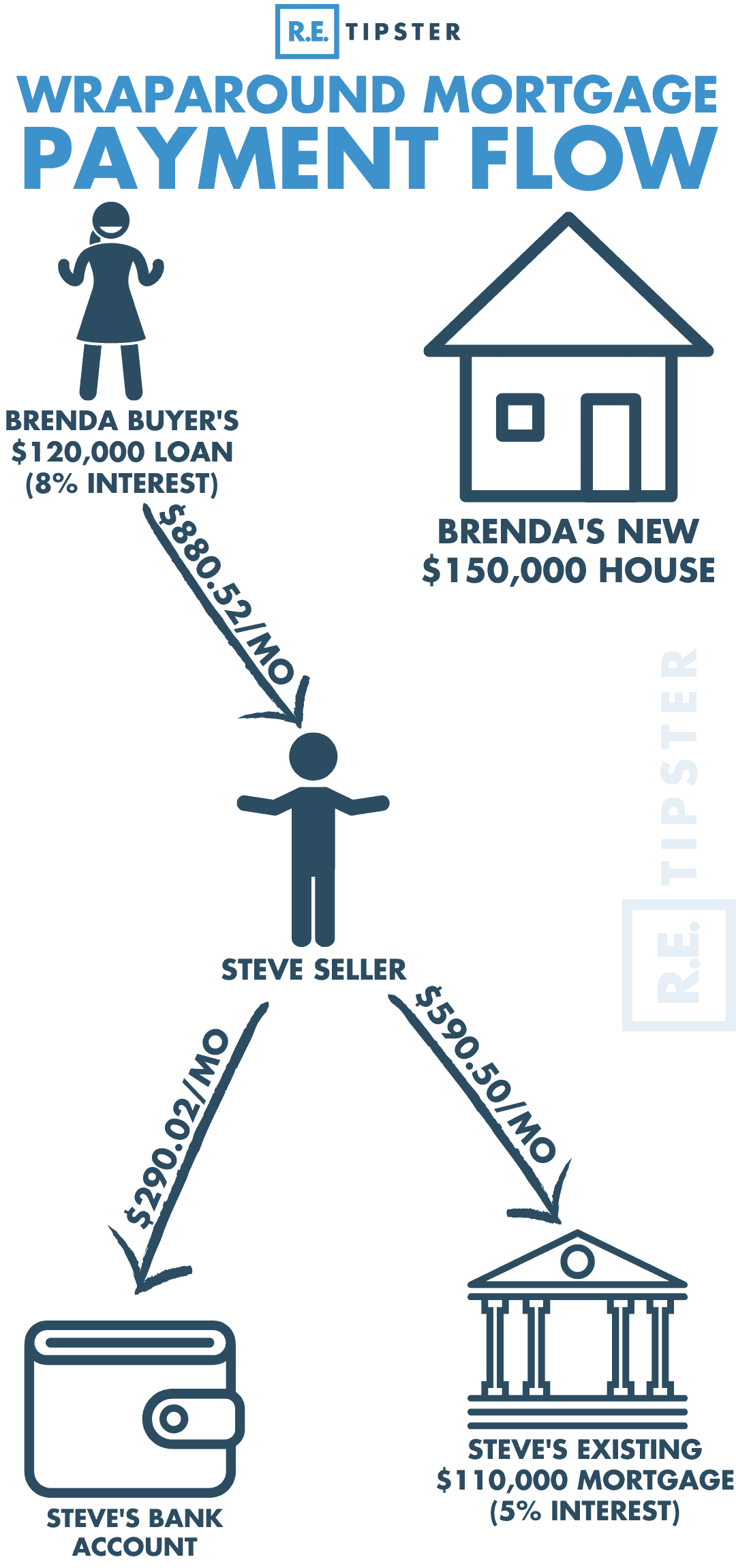

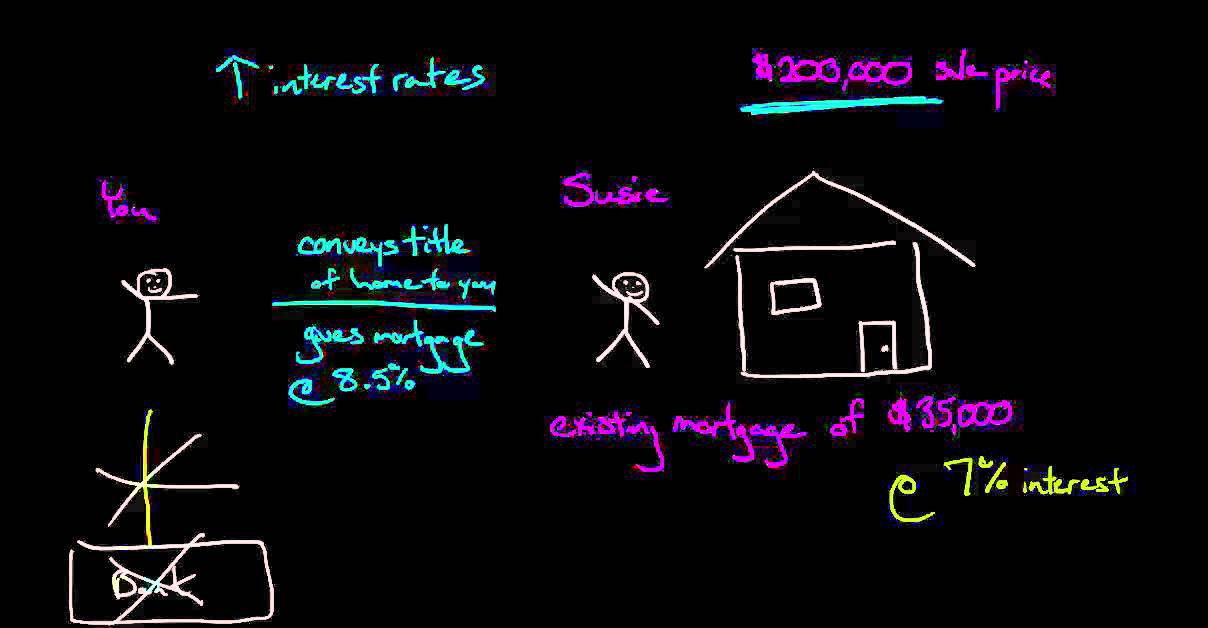

Before taking out a wraparound mortgage, it’s important to consider a few factors. First, make sure you understand the terms of the original loan. You need to know the payment amount and the interest rate of the loan you’re wrapping. It’s also important to understand the terms of the new loan and how they will fit in with the original loan. For example, you should know the interest rate and payment amount of the new loan, as well as when it will come due. You should also think about whether you can afford to pay both loans at the same time. Additionally, you should consider the possible tax implications of a wraparound mortgage, and make sure that you fully understand all the costs involved. Lastly, make sure you know the risks involved with a wraparound mortgage before taking the plunge. It’s important to weigh the pros and cons before signing any loan documents. Taking the time to consider all of these factors before taking out a wraparound mortgage can help ensure that you make a decision that’s best for you and your finances.