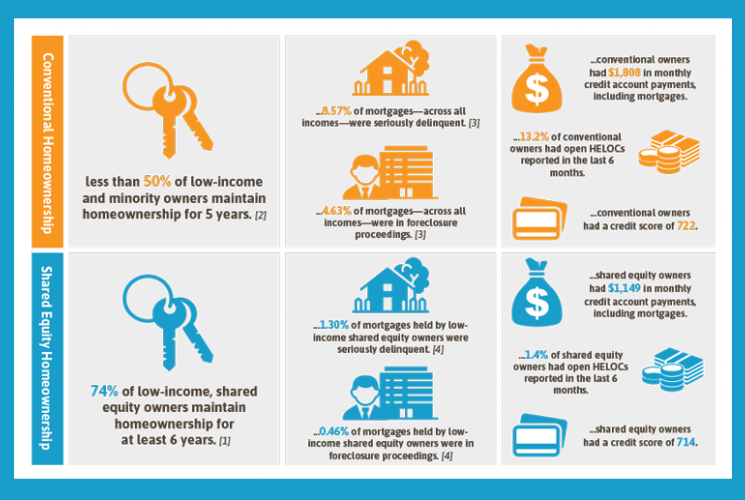

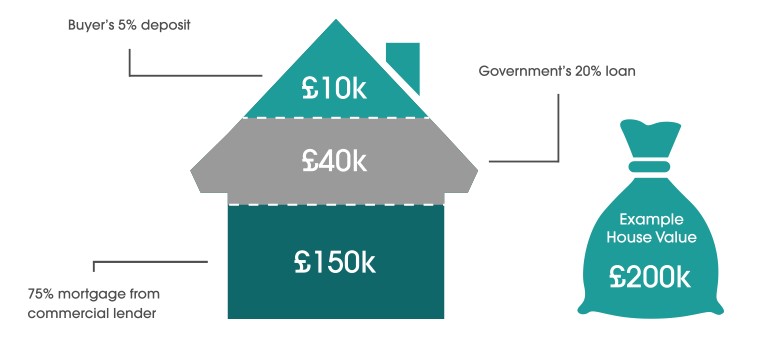

Shared equity mortgages represent a unique opportunity in the home mortgage market – they are a way to purchase a home without a large down payment, and without taking on a large mortgage. Shared equity mortgages allow buyers to purchase a home with a smaller down payment, while still maintaining ownership of the home. Through a shared equity mortgage, a lender enables the buyer to purchase a home by providing a portion of the down payment, as well as sharing in the appreciation of the home’s value. In exchange, the lender receives a portion of the appreciation when the home is sold. With a shared equity mortgage, buyers can take advantage of today’s low interest rates and borrow more money than they could with a traditional mortgage. If you’re looking for an alternative to traditional mortgage financing, a shared equity mortgage may be the right choice for you.

Overview of Shared Equity Mortgages

Shared equity mortgages are a great way to get into the housing market without breaking the bank. With a shared equity mortgage, you only pay a portion of the home’s value and the lender covers the rest. This means that you don’t have to pay the full mortgage amount, making it easier to afford a home that would otherwise be out of reach. You also benefit from having a lower monthly payment, which can help you save money for other important things. With a shared equity mortgage, you can purchase a more expensive home than you would have been able to otherwise, and it’s a great way to get onto the property ladder quickly. Plus, you’re protected from any sudden drops in the housing market, so you can rest easy knowing that you’re financially secure. If you’re looking for a way to get into the housing market without having to take on huge amounts of debt, then a shared equity mortgage could be the perfect solution for you.

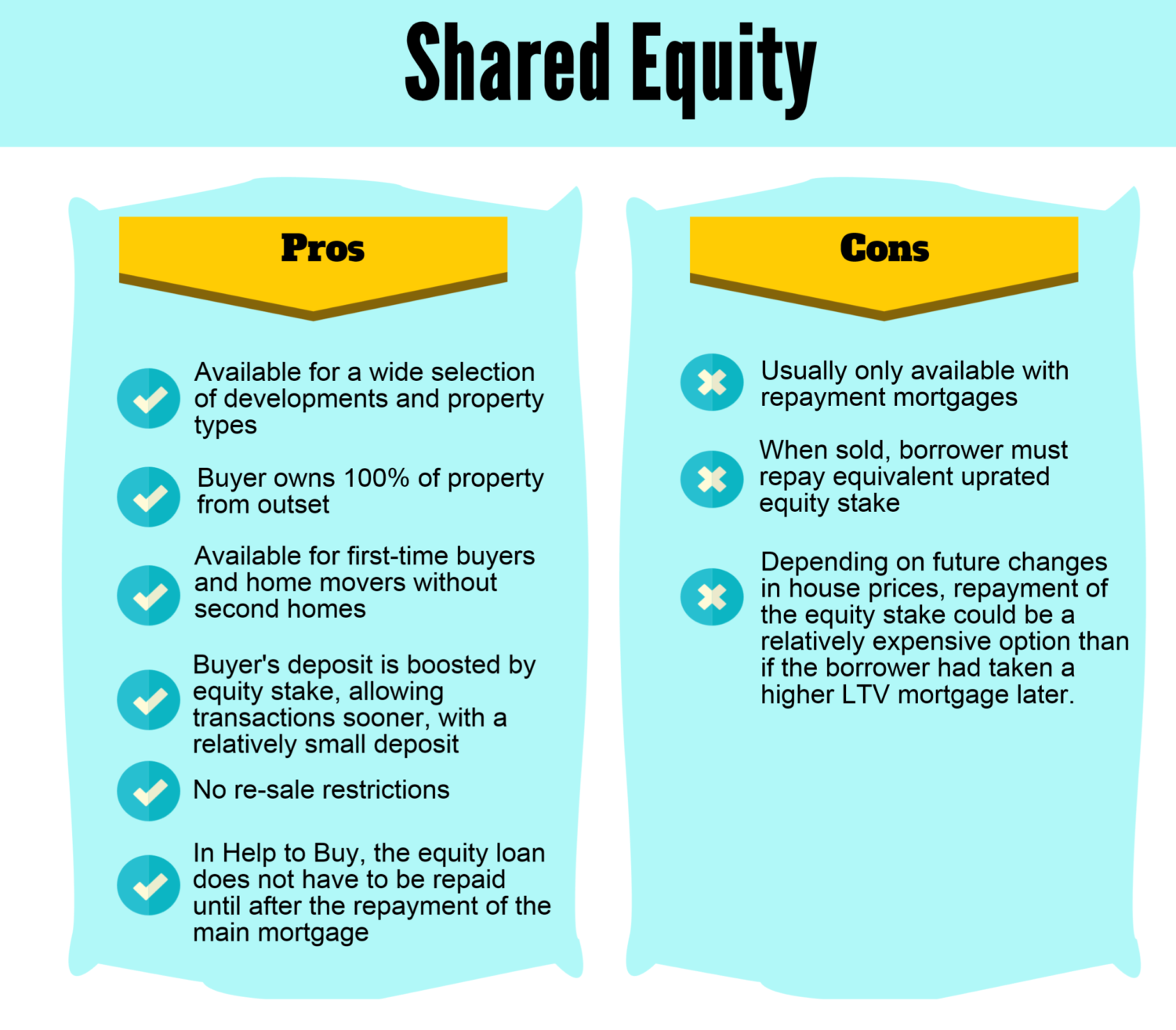

Benefits of Shared Equity Mortgages

Shared equity mortgages are a great way to get into homeownership without having to take on a huge mortgage. With a shared equity mortgage, you get the benefits of owning a home while still being able to keep your monthly payments low. It’s a great option for those who don’t have a large down payment saved up but still want to get in on the housing market. With a shared equity mortgage, you can put down less money upfront, and the lender will provide the rest of the financing. This allows you to get into a home with a smaller down payment and lower monthly payments. Plus, you can get the tax benefits that come with owning a home. All in all, shared equity mortgages are a great way to take the first step into homeownership without having to break the bank.

What Kinds of Properties are Eligible for Shared Equity Mortgages?

When it comes to shared equity mortgages, it’s important to understand that not all properties are eligible. Generally speaking, shared equity mortgages are most commonly used on single family homes, condos, and townhomes. However, some lenders may offer shared equity mortgages on other types of properties, such as multi-family properties or investment properties. Before you begin the application process, it’s important to make sure the property you’re interested in qualifies for a shared equity mortgage. Keep in mind that some lenders may have more strict requirements when it comes to the type of property they accept. Additionally, certain lenders may not allow shared equity mortgages on certain types of properties, such as vacation homes or rental properties. Be sure to understand the rules and regulations of the lender you’re working with to ensure that your property is eligible for a shared equity mortgage.

What Are the Requirements for Shared Equity Mortgages?

Shared equity mortgages have some pretty strict requirements that must be met in order for you to be approved for one. First and foremost, you must have good credit and a steady income. You’ll also need to have a good history of paying your bills on time and not have any major debts. Additionally, lenders may require that you have a certain amount of home equity in order to qualify. You’ll also need to provide proof of your ability to make the payments on time and in full each month. Lastly, lenders may also require that you have a legal interest in the property. If you meet all of these requirements, then you should be in good shape to get a shared equity mortgage.

What to Consider Before Taking Out a Shared Equity Mortgage

If you’re thinking of taking out a shared equity mortgage, there are a few things to consider before you commit. First, you need to make sure you understand how shared equity mortgages work, and what risks are associated with them. You should also consider whether or not the loan terms are right for you and your financial goals. Additionally, you should be aware of the potential tax implications associated with taking out a shared equity mortgage. And finally, it is important to ensure that you are comfortable with the potential risks associated with the loan. Taking out a shared equity mortgage can be a great way to purchase a home, but it is important to make sure you are fully informed before you make any decisions.