Discover the ins and outs of Freedom Mortgage’s Mortgage Insurance Requirements with our comprehensive guide! Whether you’re a first-time homebuyer or a seasoned homeowner, understanding the intricacies of mortgage insurance is crucial to securing your dream home. Unlock the door to financial freedom by mastering these requirements, which are designed to protect both you and your lender. Sit back, relax, and let us help you navigate the world of mortgage insurance with ease, ensuring a smooth and successful home-buying journey.

Research Freedom Mortgage’s insurance policies.

Dive deep into Freedom Mortgage’s insurance policies to ace your mortgage game! Unravel the ins and outs of their requirements, stay ahead of potential pitfalls, and secure the best deal for your dream home. With a clear understanding of their guidelines, you’ll unlock the door to a hassle-free mortgage journey. #FreedomMortgageMastery

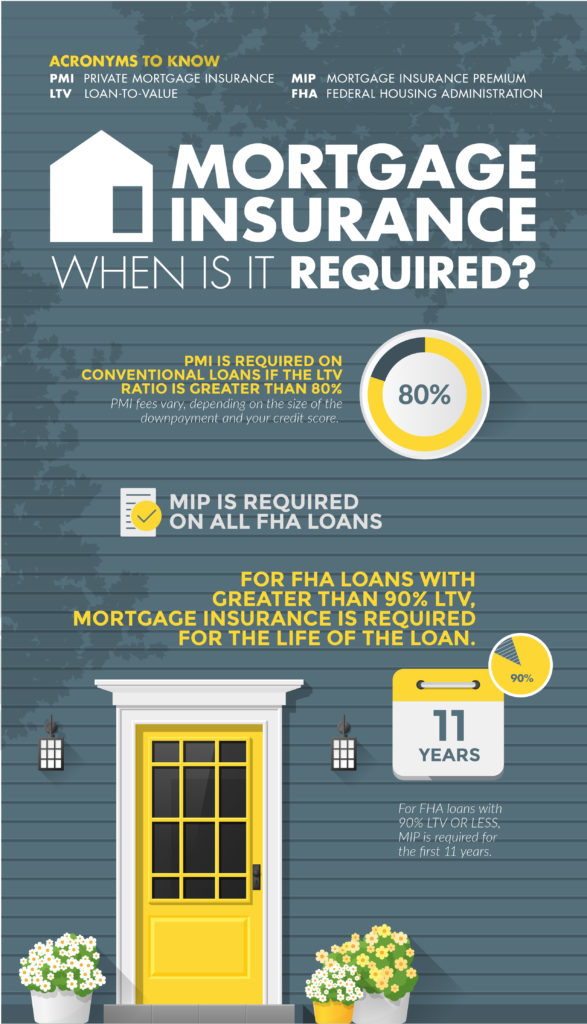

Compare with industry standard requirements.

Dive into the world of mortgage insurance by exploring Freedom Mortgage’s requirements and see how they stack up against industry standards. Stay in the loop about what’s expected of you and how it can protect your investment. Get the lowdown on this essential aspect of homeownership with our easy-to-read blog post.

Investigate borrower eligibility criteria.

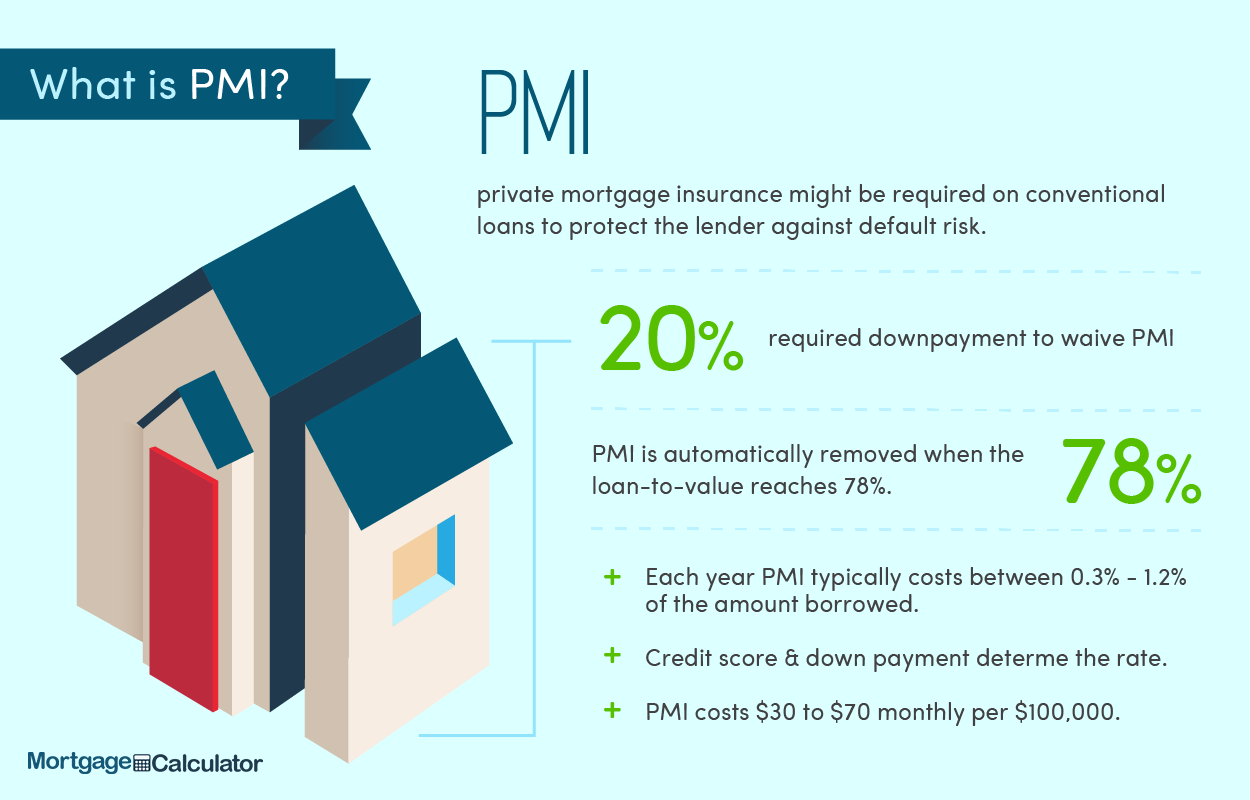

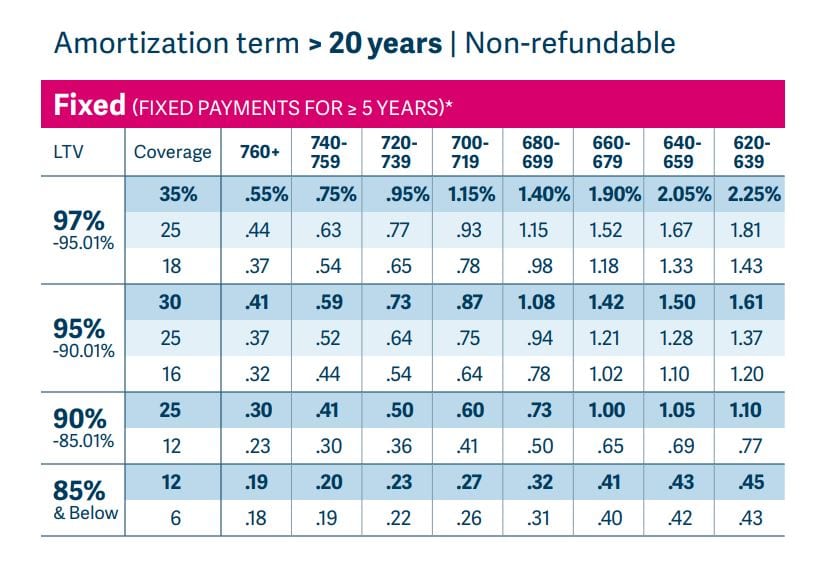

Dive deep into borrower eligibility criteria to fully grasp Freedom Mortgage’s insurance requirements. Familiarize yourself with factors like credit scores, loan-to-value ratios, and debt-to-income ratios that can impact your eligibility for mortgage insurance. This knowledge helps you make confident decisions when seeking mortgage options tailored to your needs.

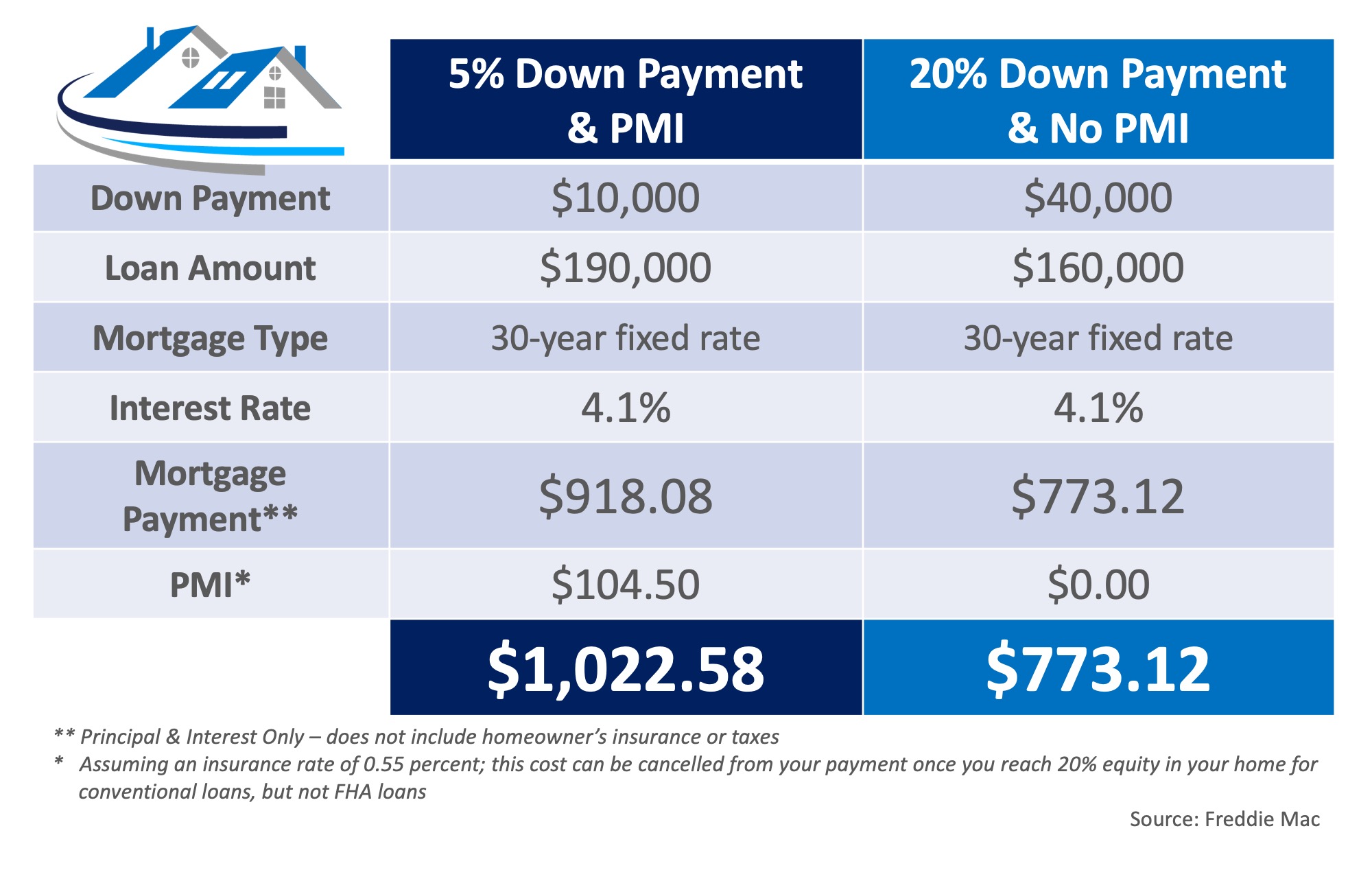

Assess property value and loan amount.

Dive into the deets of property value and loan amount, peeps! Freedom Mortgage Insurance Requirements depend on these two factors, so you gotta know their worth to calculate how much insurance you need. Higher property values and loan amounts typically mean more insurance coverage. Stay woke on this, and you’ll be a mortgage insurance whiz!

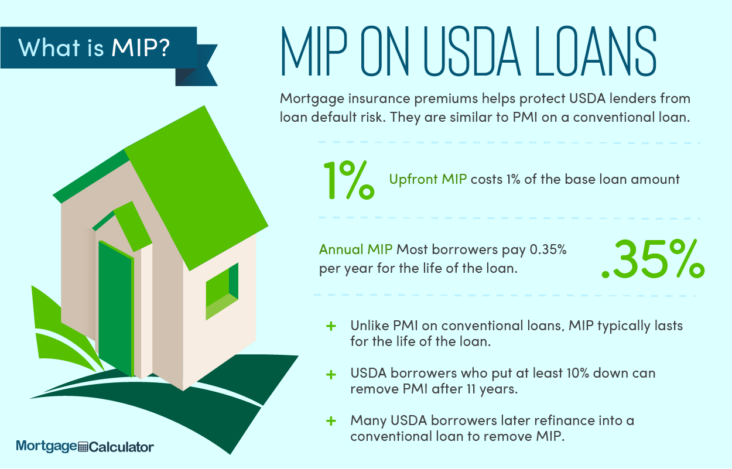

Analyze coverage options and costs.

Dive deep into the world of Freedom Mortgage’s insurance requirements by exploring the different coverage options and costs available. This essential step will help you compare policies, enabling you to choose the best plan for your unique situation. Stay ahead of the game and make an informed decision, securing your dream home without breaking the bank.

Consult a mortgage insurance expert.

Dive into the world of mortgage insurance like a pro by consulting an expert! These knowledgeable folks can break down Freedom Mortgage’s insurance requirements with ease, helping you navigate the process from start to finish. Save time, dodge confusion, and score that perfect mortgage plan with the help of a seasoned professional.