Are you looking for ways to save money on your mortgage? Refinancing your mortgage can be an effective way to reduce your payments and work toward financial freedom. But what are the types of mortgage refinance available to you? In this article, we will discuss the different types of mortgage refinance and how they can help you save money. So read on to learn more about this important financial decision.

Overview of Mortgage Refinancing

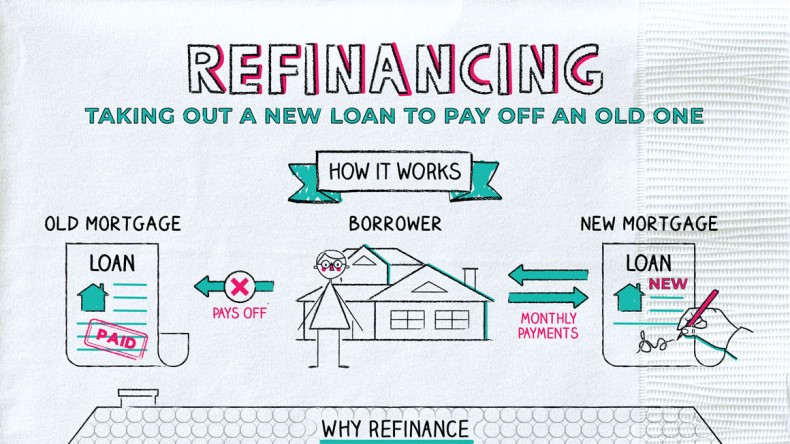

Mortgage refinancing is a great way to save money on your home loan by reducing your interest rate, lowering your monthly payments, or both. With mortgage refinancing, you can also access the equity in your home to use for home improvements, debt consolidation, or other large expenses. Refinancing can also help you switch to a loan with a different term length or payment structure. It’s important to understand the different types of mortgage refinance available so you can make the best possible decision for your financial situation. The most common type of mortgage refinance is the rate and term refinance. This type of refinance is used when the borrower wants to reduce the interest rate and monthly payment on their loan. This type of refinance does not change the loan amount, loan term, or loan type. Rate and term refinance is the most straightforward type of mortgage refinance, and is often the best option for borrowers looking to reduce their monthly payments or interest rate.The other type of mortgage refinance is the cash-out refinance, which enables borrowers to access the equity in their home and use it for home improvements, debt consolidation, or other large expenses. This type of refinance requires the borrower to take out a new loan

Benefits of Refinancing a Mortgage

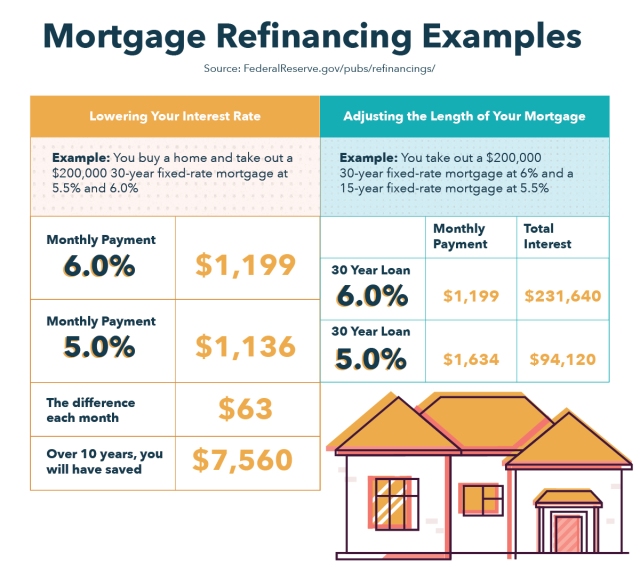

Refinancing a mortgage can be beneficial in a variety of ways. First, it can help homeowners save money on their monthly payments. By refinancing, you may be able to take advantage of lower interest rates, which can help you save money on your mortgage payments each month. Additionally, refinancing can help you pay off your mortgage faster; if you refinance into a shorter-term loan you can make larger payments each month and pay off your loan more quickly. Additionally, refinancing could help you get access to cash; if you have built up equity in your home you may be able to use a cash-out refinance to tap into that equity. This can be a great way to get access to funds for home improvement projects or other large purchases. Finally, refinancing may be able to help you adjust the terms of your loan; you may be able to change the length of your loan or adjust the type of loan you have, such as changing from an adjustable rate mortgage to a fixed rate mortgage.

Types of Mortgage Refinancing

Mortgage refinancing is a great way to save money and become debt-free faster. It allows you to renegotiate the terms of your existing mortgage and replace it with a new loan that better suits your current financial situation. There are several types of mortgage refinance to choose from, each with their own set of pros and cons. The most common type is a rate-and-term refinance, which allows you to change the interest rate, loan term, or both. This is a great option if you want to reduce your monthly payments or the overall cost of your loan. Another type is a cash-out refinance, which is ideal if you want to use the equity in your home to pay off other debts or make home improvements. Finally, there’s the streamline refinance, which is a faster and easier way to refinance an existing Freddie Mac or Fannie Mae loan. No matter which type of mortgage refinance you choose, it’s important to understand the process and the terms of your new loan before making a decision. A good mortgage lender can help you explore your options and find the best deal for you. It’s also important to consider the costs associated with refinancing,

Factors to Consider When Refinancing

When considering a mortgage refinance, there are several factors to consider. First, it is important to determine whether or not the mortgage refinance will save you money in the long run. Consider the interest rate, closing costs, and other fees associated with the refinance. Additionally, understand the terms of the new loan and the length of time it will take to pay off the loan. It is also essential to compare the financial benefits of a loan with different lenders, as they may offer different rates and terms. Other factors to consider include the loan-to-value ratio, credit score, and the financial stability of the lender. Finally, it is important to consider the impact of a refinance on your taxes, as some refinance options may be tax deductible. Taking the time to research and compare mortgage refinancing options can help ensure that you make the best decision for your financial situation.

Steps Involved in Refinancing a Mortgage

Refinancing a mortgage is a great way to save money on your monthly mortgage payments and potentially lower your interest rate. It can also help you pay off your loan faster. But before you start the refinance process, it’s important to understand the steps involved. The first step in refinancing your mortgage is to shop around for lenders that offer the best rates and terms. You’ll want to compare the APR, points, and closing costs. You may also want to consider other factors such as customer service, online banking options, and any special programs or incentives. Once you’ve chosen a lender, you’ll need to complete an application. This will require you to provide detailed information about your financial situation, including your income, assets, and debts. Your lender will also need to know how much you owe on your current mortgage. Your lender will then review your application and decide whether or not to approve the refinance. If approved, you’ll need to sign the loan agreement and provide any necessary documentation. Your lender may order an appraisal of your property to make sure the new loan amount is appropriate. The closing process is the final step of refinancing. You