Are you trying to save money on your mortgage? Refinancing your mortgage could be a great way to help you reduce your monthly payments and/or secure a lower interest rate. Refinancing isn’t for everyone, so it’s important to understand the pros and cons before making a decision. In this article, we’ll explore the reasons why you might want to refinance your mortgage and the steps you need to take to do so. We’ll also look at how refinancing can help you save money and reduce your debt. By the end of this article, you’ll be armed with the knowledge you need to make an informed decision about whether refinancing is right for you.

Advantages of Refinancing a Mortgage

Refinancing a mortgage can be a great way to save money and reduce your monthly mortgage payments. There are several advantages to refinancing a mortgage, including the potential for lower interest rates, shorter loan terms, and the ability to access cash for home improvements or other expenses. Lowering your interest rate is one of the most common reasons for refinancing a mortgage. A lower interest rate means lower monthly payments and the potential to save thousands of dollars in interest over the life of the loan. Shorter loan terms can also result in a lower total amount of interest paid over the life of the loan. This can be a great way to reduce the total cost of the loan and to help you pay off your mortgage faster. Refinancing can also be a great way to access cash to use for home improvements or other expenses. This can be done through a cash-out refinance, which allows you to borrow against the equity you have in your home and receive cash for home improvements or other expenses. Refinancing a mortgage can be a great way to save money and reduce your monthly payments, as well as access cash for other purposes.

Benefits of Refinancing to Lower Interest Rates

Refinancing your mortgage can be a great way to save money on interest and lower your monthly payments. With an interest rate reduction, you may be able to avoid paying private mortgage insurance and can also shorten the term of your mortgage. Refinancing your mortgage to a lower interest rate can help you save money in the long run, and could be a smart move when interest rates drop. By refinancing your mortgage, you can also take advantage of cash-out options to use the equity in your home to pay off higher interest debt or make home improvements. Refinancing is a big decision, and it’s important to do your research to make sure it’s the right choice for you. Talk to your lender to find out more about the options that are available to you and to learn more about the benefits of refinancing your mortgage to a lower interest rate.

Understanding Mortgage Refinancing

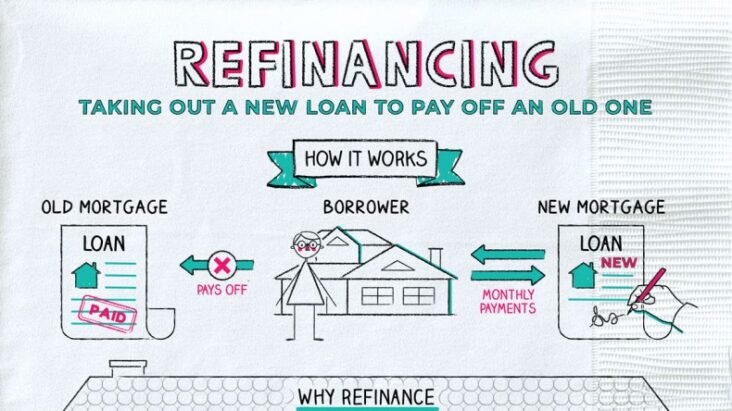

Mortgage refinancing is a great way to save money and take advantage of low interest rates. Understanding the process and benefits of refinancing is important in order to make a well-informed decision. Refinancing involves taking out a new home loan with different terms and conditions than the original loan. This could mean a lower interest rate, different loan term length, and different loan terms. The main reasons to refinance a mortgage include reducing your monthly payments, lowering your interest rate, and taking advantage of cash-out opportunities. One of the most popular reasons to refinance is to secure a lower interest rate, which can save you thousands of dollars over the life of the loan. Additionally, refinancing can also be used to shorten the loan term and reduce the total amount of interest you pay over the life of the loan. Finally, cash-out refinancing can provide access to additional cash for home improvements, debt consolidation, and other investments. Refinancing your mortgage can be a great way to save money, but it’s important to understand all the benefits and risks before making a decision.

Steps to Refinancing a Mortgage

Refinancing a mortgage can be a great way to save money and gain financial flexibility. The process of refinancing a mortgage can be complex, but it’s worth exploring if you’re looking to save money in the long run. Here are the steps to refinancing a mortgage: 1. Research and compare lenders: The first step to refinancing is to research different lenders and compare their mortgage rates and terms. Make sure to consider factors such as closing costs, origination fees, and other applicable charges. 2. Gather paperwork: Once you’ve chosen a lender, you’ll need to provide them with necessary documentation. This will include information about your income, assets, debts, and credit. You may also need to provide additional documentation to verify your identity or address. 3. Submit an application: After you’ve gathered all the necessary paperwork, you can submit your application to the lender. The lender will review your application and verify the information you provide.4. Wait for a decision: After the lender reviews your application, they’ll make a decision. If approved, you’ll receive a loan estimate which will outline the terms of the loan and any applicable fees. 5. Close the loan: The

Finding the Right Refinancing Option for You

Finding the right refinancing option for you is an important part of the refinancing process. When you are looking to refinance your mortgage, you should take time to consider your personal financial goals and what refinancing option best fits them. Before you refinance, you should assess whether you are looking for a lower monthly payment, planning to pay off your loan faster, or looking to access the equity in your home. Additionally, you should compare loan terms, interest rates, and fees from different lenders to ensure you are getting the best deal for your situation. Doing research before refinancing can help you make the best decision for you and your family. It is important to note that refinancing your mortgage can be a complex process, so make sure to consult with a financial expert before making any decisions.