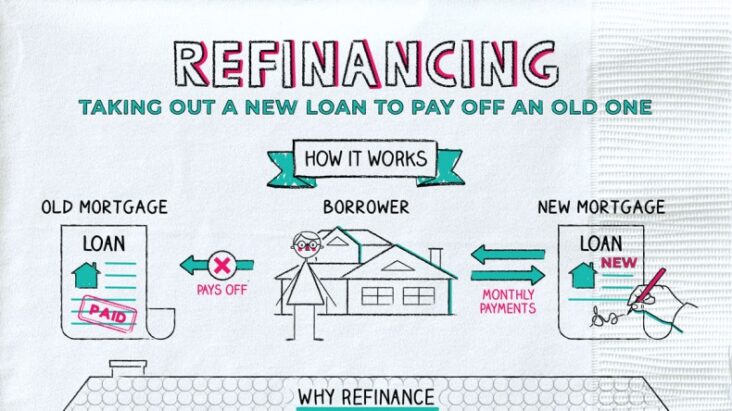

Are you feeling overwhelmed by the high payments on your current mortgage? Refinancing your mortgage could be the perfect way to save money and reduce your monthly payments. With the right information, you can make an informed decision about when and how to refinance your mortgage in order to get the best rate possible. In this article, we’ll discuss the different steps you need to take to successfully refinance your mortgage and secure a lower interest rate. Read on to learn more about how to refinance your mortgage and save your hard-earned money.

The Benefits of Refinancing Your Mortgage

Refinancing your mortgage can provide a number of benefits, depending on your circumstances and goals. By refinancing, you can access a lower interest rate, potentially resulting in lower monthly payments or a shorter loan term. This could save you thousands of dollars in interest over the lifetime of your loan. Additionally, if you are able to convert from an adjustable-rate mortgage to a fixed-rate mortgage, you can lock in a lower interest rate. Refinancing can also provide you with the opportunity to tap into your equity and take out a cash-out refinance, allowing you to consolidate debt or make home improvements. Lastly, if you are in a situation where you are unable to make your mortgage payments due to a financial hardship, you may be able to refinance your loan and take advantage of a more affordable payment plan.

Assessing Your Financial Situation Before Deciding to Refinance

Before deciding to refinance your mortgage, it is important to assess your financial situation carefully. You should make sure that you have a thorough understanding of your finances, including your income, debts, and credit score. Additionally, you should consider any other expenses that you may have such as car payments, student loans, or other loans. It is important to make sure that you are able to cover all of your expenses, including your mortgage payment, before you decide to refinance. Additionally, you should make sure that the savings you will get from refinancing will be enough to justify the time and effort of going through the process. It is important to take into account all of these factors before deciding to refinance your mortgage.

Understanding the Different Types of Refinancing Loans

Refinancing your mortgage can be a great way to lower your monthly payments, reduce the overall cost of your loan, and even tap into the equity you’ve built in your home. Understanding the different types of refinancing loans can be an important step in the process. There are many different options available, and the right one for you will depend on your individual financial situation. Cash-out refinancing is a popular option that allows you to tap into the equity of your home and receive cash in exchange for a larger loan amount. This can be a great option if you need cash to make home improvements, pay down debt, or even make a large purchase. The downside to this type of loan is that you’ll be paying more interest in the long run, so it’s important to weigh the pros and cons before taking this route. Rate and term refinancing is another popular option. This type of loan allows you to refinance without taking out additional cash. Instead, you’ll be able to take advantage of today’s low-interest rates and secure a lower monthly payment. This can be a great way to save money and make your mortgage more affordable. Finally, FHA

Finding the Best Refinance Rates

Finding the best refinance rates is an important step in the refinancing process. Refinancing your mortgage can be a great way to save money, improve your financial situation, and take advantage of low interest rates. To get the best possible rate, it’s important to shop around and compare rates from multiple lenders. This will help you to find the lowest rates and get the most favorable terms.When looking for the best refinance rates, it’s important to consider more than just the interest rate. You’ll also want to compare fees, closing costs, and other terms. Make sure to ask about any other costs associated with the loan, such as application fees and origination fees. It’s also important to consider the repayment terms and any potential prepayment penalties.Lastly, make sure to compare not just the interest rate and fees but also the lender’s overall reputation. Read reviews and research the company to make sure they’re reputable and trustworthy. You want to make sure that the company you choose is reliable and will provide you with the best possible service.

How to Prepare for a Refinance Application Process

When refinancing your mortgage, one of the most important steps is to prepare for the application process. Taking the time to get organized and understand the requirements of the lender can help make the process smoother and more efficient. Here are some tips to help you prepare for a refinance application process. First, review your current mortgage agreement and determine what your goals are for the refinance. Consider whether you’re looking to reduce your monthly payment, shorten the term of the loan, or access cash. Knowing what your financial goals are will help you better select the right refinance option. Next, gather the necessary documents you’ll need to apply. This can include proof of income, such as recent pay stubs or tax returns, as well as proof of assets, such as bank statements or investment accounts. You’ll also need to provide information about your current mortgage, such as the balance, interest rate, and payment amount. Finally, review your credit report and credit score. Lenders will use this information to assess your ability to repay the loan, so it’s important to make sure the information is accurate. Knowing your credit score can also help you decide which type of loan is best for you. By taking the time