Are you looking for the best mortgage interest rates on the market? We can help! In this article, we’ll discuss what good mortgage interest rates look like, how to compare different rates, and how to get the best one. We’ll also provide some helpful tips on how to maximize your savings and make the most of your mortgage. So if you’re ready to learn more, read on to learn all about the best mortgage interest rates available!

Understanding Mortgage Interest Rates

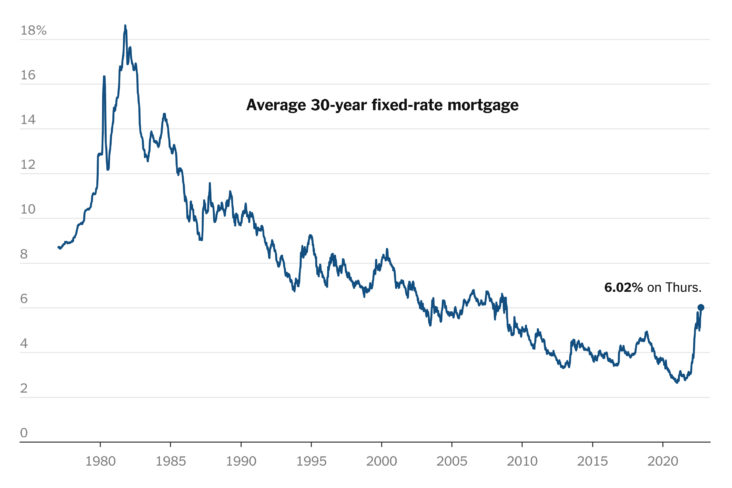

Mortgage interest rates can be a confusing topic, and it’s important to understand what they are and how they affect your mortgage payments. Mortgage interest rates are the cost of borrowing money to purchase a home, and they’re based on a number of factors, including your credit score, the type of loan you’re getting, and the current market conditions. Generally, the lower your credit score, the higher your interest rate will be, so it’s important to have good credit if you’re looking to get a good deal. Additionally, fixed-rate mortgages tend to offer lower rates than adjustable-rate mortgages, so if you’re looking for a long-term loan, a fixed-rate mortgage may be the best choice. Lastly, interest rates are also affected by the current market conditions, so if you’re looking for the best rate, it’s important to keep an eye on the current market and see what rates lenders are offering. All in all, understanding mortgage interest rates is key to getting the best deal possible.

The Different Types of Mortgage Interest Rates

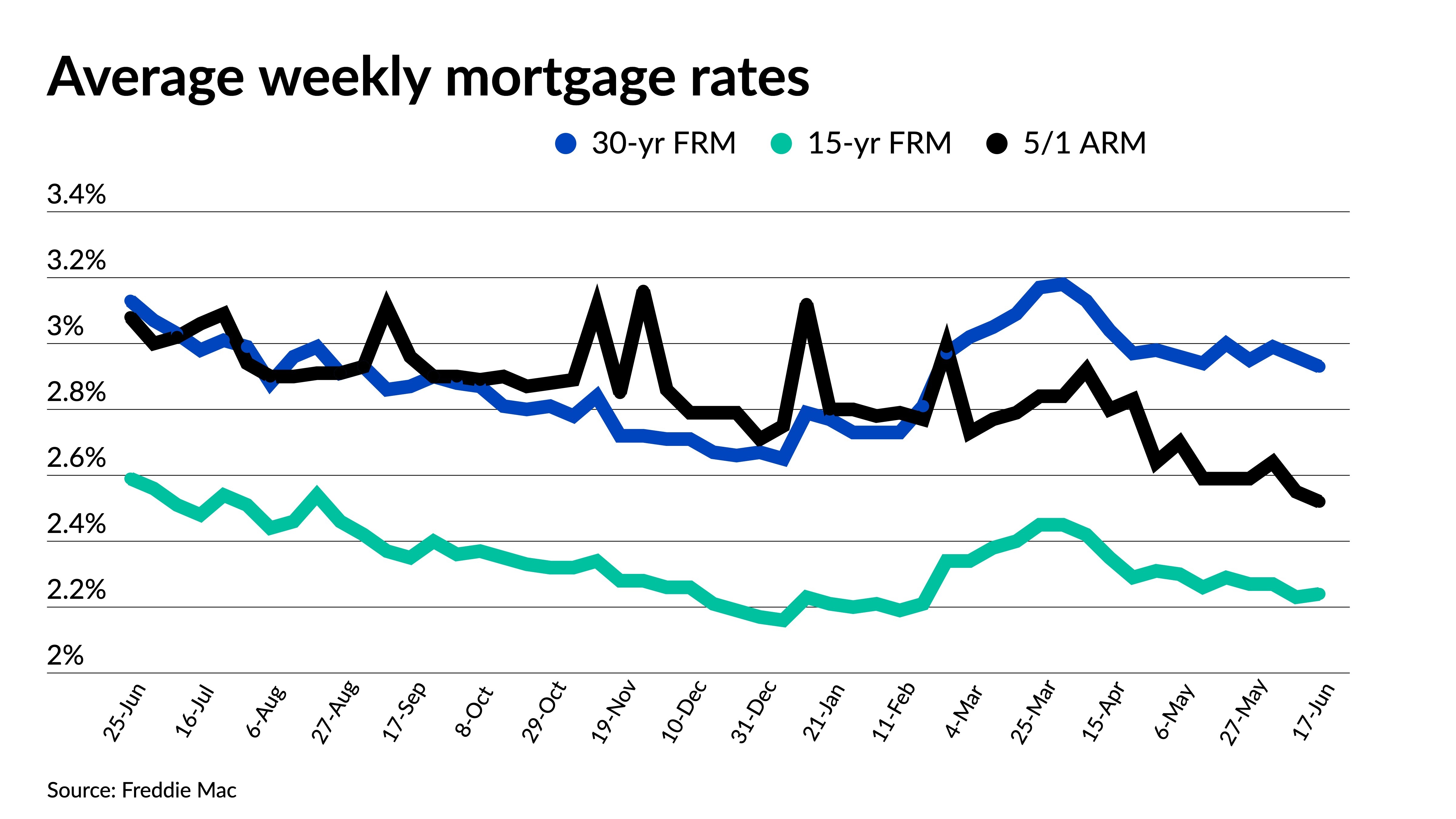

When it comes to mortgages, there are different types of interest rates, each with its own benefits and drawbacks. Fixed-rate mortgages, for example, offer the stability of an unchanging interest rate throughout the life of the loan, which makes budgeting easier. But if interest rates fall, you won’t be able to take advantage of the lower rate. Adjustable-rate mortgages, on the other hand, can offer lower rates, but your rate can change over the life of the loan, potentially making budgeting more difficult. There are also hybrid mortgages that offer a combination of fixed and adjustable rates, which can give you some of the benefits of both. Whatever type of mortgage you choose, it’s important to shop around to make sure you’re getting the best rate possible.

Factors to Consider When Choosing a Mortgage Interest Rate

When it comes to choosing a mortgage interest rate, there are a few factors you should consider. First and foremost, you’ll want to make sure you’re getting the best rate possible. Compare different lenders and compare the rates they offer to get the best deal. You’ll also want to consider the type of mortgage you’re getting. Different types of mortgages have different rates, so make sure you do your research to find the best option for you. Additionally, the length of your loan term can have an effect on the rate you get. Longer loan terms tend to come with lower interest rates, so if you’re looking for the lowest rate, it might be worth considering a longer loan term. Lastly, your credit score can also affect the rate you get. A higher credit score typically leads to a lower interest rate, so if you’re trying to get the best rate, it’s important to make sure your credit score is as high as possible. All of these factors can affect the rate you get, so take the time to research and compare different options to make sure you’re getting the best deal.

How to Get the Best Mortgage Interest Rate

If you’re looking for the best mortgage interest rate, you’re probably feeling a little overwhelmed. Finding the right rate can be a tricky task and it can be hard to know where to start. However, with a little bit of research and the right strategy, you can get a great mortgage rate that suits your financial needs. Start by researching the current market to get a better understanding of the mortgage rates available. Compare rates from different lenders and look into any discounts or incentives they may be offering. Make sure to review the terms and length of each loan and determine which one works best for your situation. Finally, consider your credit score and any down payment you may be able to make. These factors can affect the mortgage rates you qualify for, so it’s important to review them carefully. With the right research and strategy, you can get a competitive mortgage interest rate that works for you.

Tips for Saving Money on Your Mortgage Interest Rate

Saving money on your mortgage interest rate is a great way to ensure you get the best deal for your loan. Here are some tips for saving money on your mortgage interest rate: Shop around – Don’t just go with the first lender you find. Take the time to shop around and compare different lenders to find the best rate and terms. Check your credit score – Your credit score can have a big impact on your mortgage interest rate, so make sure you know what it is before you start shopping. Work to improve it if necessary. Consider a shorter loan term – A shorter loan term means a higher monthly payment, but it can also mean lower interest rates, so it may be worth considering. Negotiate – Don’t be afraid to negotiate with your lender. You may be able to get a better interest rate if you ask.