Homebuyers and real estate investors alike are always interested in the latest mortgage interest rates. Knowing what the current rate is can help you decide whether to buy or refinance a home, or help you better understand the costs associated with taking out a loan. In this article, we’ll cover what mortgage interest rates are, how they are calculated, and factors that can influence your rate. With this information, you can make more informed decisions about your financial future.

Overview of Mortgage Interest Rates

Mortgage interest rates are important to understand when it comes to taking out a home loan. It’s important to stay current on the current market rates, as this will give you an idea of how much you’re going to be paying in interest. With rates constantly fluctuating, it can be hard to stay on top of them. But by doing your research and being aware of the changes, you can make an informed decision when it comes to getting a mortgage. Knowing the current interest rates can also help you decide on the best loan terms. That way, you can make sure you get the most out of your mortgage and save money in the long run.

Factors Affecting Mortgage Interest Rates

When it comes to mortgage interest rates, there are a few key factors that can affect the rate you get. Your credit score is one of the most important factors, because it reflects how responsible you are with credit. The higher your score, the more likely you are to get a lower interest rate. Another factor is the type of loan you’re getting. Conventional loans typically have lower interest rates than jumbo loans, for example. Your down payment size can also affect your mortgage interest rate, as lenders may offer lower rates for higher down payments. Finally, the loan term you choose can also have an effect. Shorter-term loans, like 15 or 20 year mortgages, may have lower interest rates than 30 year mortgages. All of these factors should be taken into consideration when shopping for a mortgage.

Benefits of Low Mortgage Interest Rates

Low mortgage interest rates are super beneficial if you’re looking to purchase a home. For starters, they make your monthly payments much more manageable. This means that you won’t have to spend as much money each month, allowing you to save more for the future. Not only that, but you’ll also be able to pay off your mortgage much faster. This can help you build equity in your home more quickly and make it a great investment. Lower mortgage interest rates also make it easier for you to refinance your mortgage if you need to. This can be a great way to get a better rate and save you some money in the long run. All in all, having low mortgage interest rates can be a major asset to your financial situation.

Fixed vs

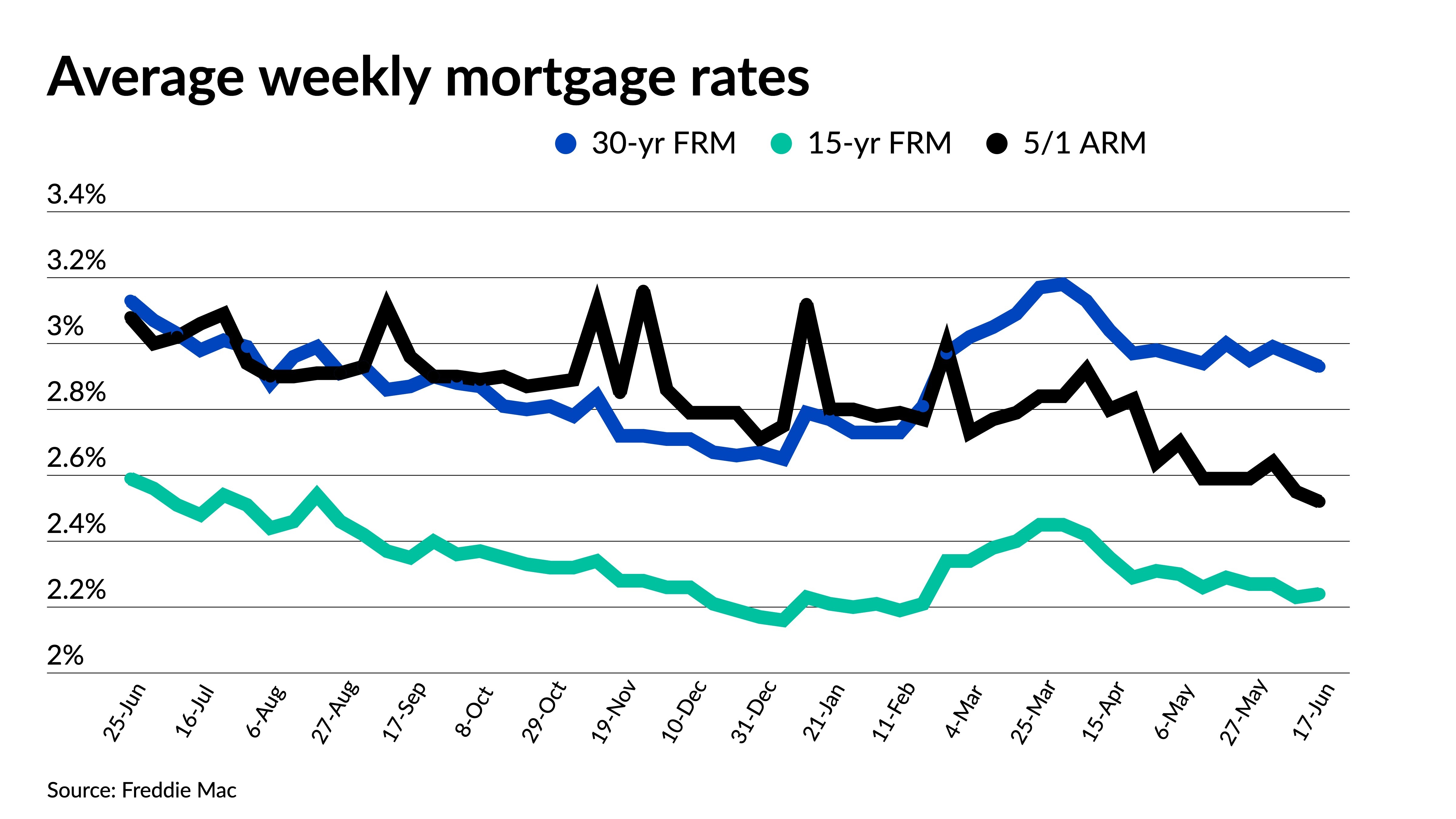

It’s important to know the difference between fixed and adjustable mortgage interest rates when you’re considering taking out a loan for your home. Fixed mortgage interest rates stay the same over the entire loan period, no matter what happens in the economy. This means your monthly payments will stay the same and won’t increase or decrease with changes in the market. On the other hand, adjustable mortgage interest rates can fluctuate over the loan period. This means your monthly payments can change, depending on changes in the market. With an adjustable mortgage, you may have lower payments initially, but your payments could end up being higher in the long run if the market goes up. It’s important to do your research and consider all your options before deciding which type of mortgage interest rate is right for you and your financial situation.

Variable Mortgage Interest Rates

Variable mortgage interest rates are a great option if you are looking for flexibility when it comes to your mortgage. With variable rates, your interest rate can change with the market, which can give you more wiggle room when it comes to budgeting. On the other hand, if the market rate increases, your monthly payments can be higher than those with fixed rates. It’s important to weigh the pros and cons of a variable rate when considering your mortgage options. If you decide it’s the right fit for you, be sure to shop around for the best deal and understand exactly what you’re signing up for.

How to Calculate Your Mortgage Interest Rate

Calculating your mortgage interest rate is an important step in understanding the full cost of your loan. The rate you get will determine how much you pay in interest each month, so it pays to shop around and compare rates to find the best one for you. To calculate your mortgage interest rate, first start by calculating the total amount of interest you’ll pay over the life of the loan. Then, divide that total by the total amount of the loan. The result is your mortgage interest rate. You can also use an online calculator to do the math for you. Knowing your mortgage interest rate can help you budget accordingly and get a better idea of the total cost of your loan.