Discover the secrets to conquering your student loan debt with our Ultimate Guide to Student Loan Forgiveness Programs: Everything You Need to Know! In today’s fast-paced and ever-changing world, education is key to unlocking a bright future. But for many, the burden of student loans can feel insurmountable. Fear not, as we’re here to help you navigate the complex world of student loan forgiveness programs. This comprehensive guide will provide you with invaluable insights, expert tips, and step-by-step instructions to unlock the full potential of various forgiveness options that could potentially save you thousands of dollars. Say goodbye to sleepless nights spent worrying about your student loans and hello to a debt-free future!

Exploring the Top Federal Student Loan Forgiveness Programs: Which One is Right for You?

Discover the best Federal Student Loan Forgiveness Programs tailored to your unique needs, as we delve into the top options designed to alleviate your financial burden. Learn about the Public Service Loan Forgiveness (PSLF) program, Teacher Loan Forgiveness, Income-Driven Repayment (IDR) Forgiveness, and more. Understand the eligibility criteria, application process, and potential benefits of each program, empowering you to make informed decisions on the path to financial freedom. Say goodbye to overwhelming student debt by finding the right forgiveness program that fits your career goals and paves the way for a brighter future.

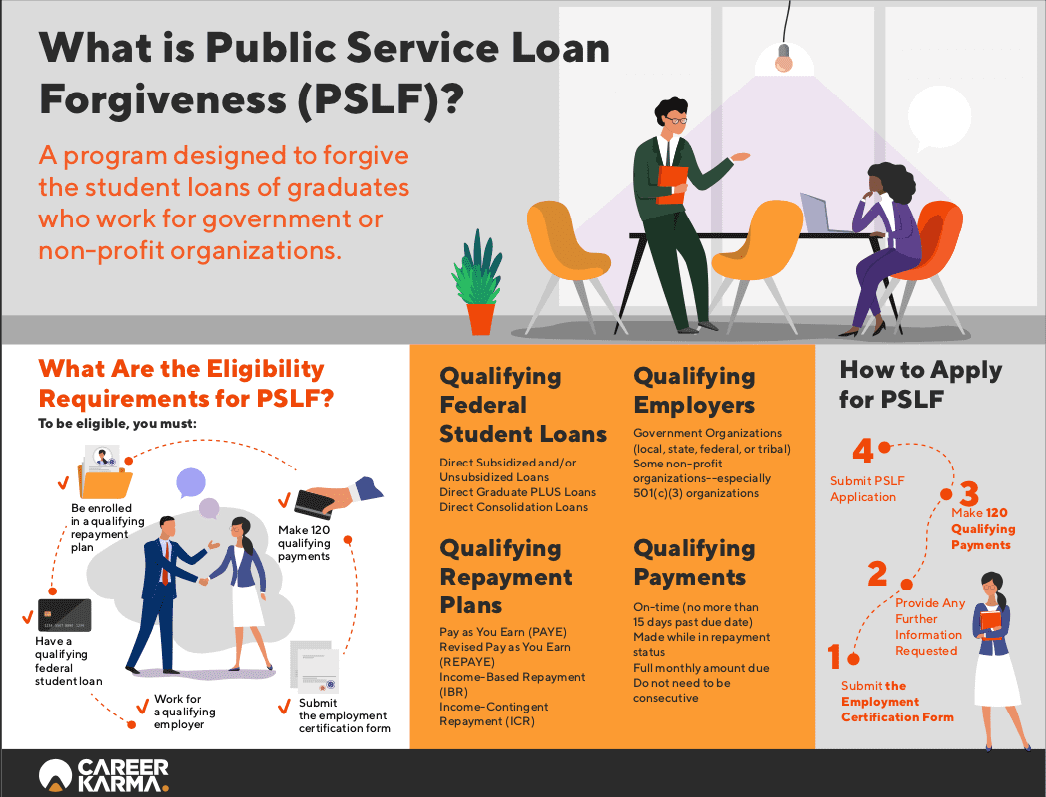

Public Service Loan Forgiveness (PSLF): How to Qualify and Maximize Your Benefits

The Public Service Loan Forgiveness (PSLF) program is a valuable opportunity for student loan borrowers working in qualifying public service roles, allowing them to achieve freedom from debt more efficiently. To maximize your PSLF benefits, you need to ensure you meet the required criteria, including having Direct Loans, enrolling in a qualifying repayment plan, and working for an eligible employer. Keeping detailed records and submitting your Employment Certification Form annually helps verify your progress towards the 120 qualifying payments. By staying informed and organized, you can optimize your chances of benefiting from PSLF and achieve a brighter financial future.

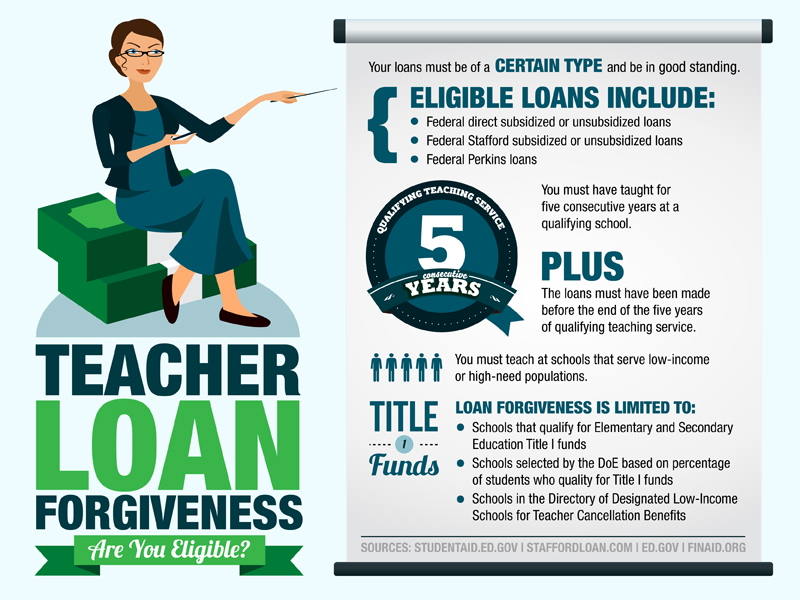

Navigating Teacher Loan Forgiveness Programs: Eligibility Criteria, Application Process, and Success Stories

Navigating Teacher Loan Forgiveness Programs can be a daunting task, but with the right guidance, you can successfully ease your student loan burden. To be eligible for these programs, you must meet specific criteria such as teaching in a low-income or high-need field. The application process involves gathering crucial documentation and adhering to deadlines, therefore, staying organized is key. Our Ultimate Guide to Student Loan Forgiveness Programs shares inspiring success stories of educators who have benefited from these initiatives, providing motivation and useful tips for your journey. Discover the ins and outs of Teacher Loan Forgiveness Programs and empower your financial future with our comprehensive guide.

Income-Driven Repayment Plans: A Comprehensive Guide to Reducing Your Loan Burden and Achieving Forgiveness

Introducing our comprehensive guide to Income-Driven Repayment (IDR) Plans – your ultimate resource for reducing your student loan burden and achieving eventual forgiveness! As an essential component of student loan forgiveness programs, IDR plans base your monthly payments on your income and family size, providing a more affordable and manageable solution for borrowers. In this guide, we’ll explore the various available IDR plans, delve into their unique features and benefits, and offer expert tips on selecting the right plan for your financial situation. With our help, you’ll be well on your way to a debt-free future!

Beyond Federal Programs: Uncovering Alternative Student Loan Forgiveness Opportunities in 202

In 2022, exploring alternative student loan forgiveness opportunities beyond federal programs is crucial for borrowers seeking financial relief. State-specific initiatives, professional associations, and employer-sponsored plans offer a wide range of options to help reduce or eliminate student loan debt. By conducting thorough research and understanding eligibility requirements, you can find tailored solutions that fit your unique financial and career needs. Don’t miss out on these lesser-known but equally valuable opportunities to achieve your debt-free goals and focus on building a successful future. Stay updated on the latest trends and developments in student loan forgiveness to maximize your chances of benefiting from these programs.