Searching for the perfect investment property can be an exciting yet challenging endeavor, but securing the best mortgage rates for your investment is essential to maximize your profits. To help you in your quest, we’ve done the research to bring you the top 5 lenders offering the most competitive mortgage rates for investment properties. Dive into our comprehensive guide and explore your financing options with these industry-leading institutions, and discover how you can make your real estate dreams a reality while optimizing your return on investment. Don’t miss out on these incredible opportunities – read on to find the perfect lender for your property investment needs!

Quicken Loans: Quicken Loans is known for its competitive rates and excellent customer service

Quicken Loans, a reputed mortgage lender, has carved a niche for itself in the market by offering competitive rates and outstanding customer service for investment properties. As one of the top lenders in the industry, Quicken Loans provides a seamless online application process and a variety of loan options tailored to suit the needs of property investors. With their expertise in handling investment property mortgages, you can trust them to help you secure the best mortgage rate possible. So, if you’re looking to finance your next investment property, Quicken Loans should definitely be on your list of top 5 lenders to consider.

They offer a variety of mortgage options for investment properties, including fixed-rate and adjustable-rate mortgages

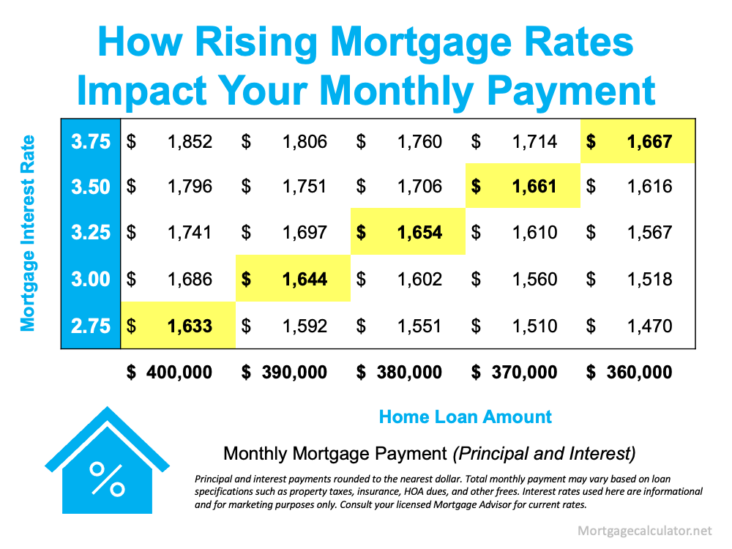

Discover a diverse range of mortgage options for investment properties with our top 5 lenders, offering competitive fixed-rate and adjustable-rate mortgages tailored to your unique financial goals. These lenders strive to provide the best mortgage rates to help investors maximize their returns while minimizing risks. By exploring various loan terms, down payment requirements, and interest rates, you can secure the ideal mortgage solution for your investment property. Stay ahead in the real estate market by partnering with these top-tier lenders and take advantage of their unbeatable mortgage rates for a successful property investment journey.

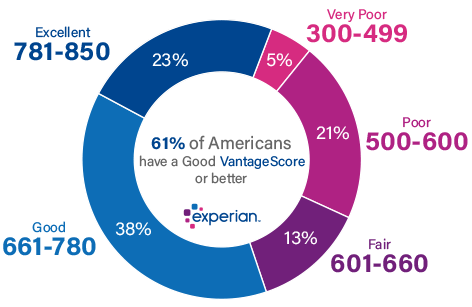

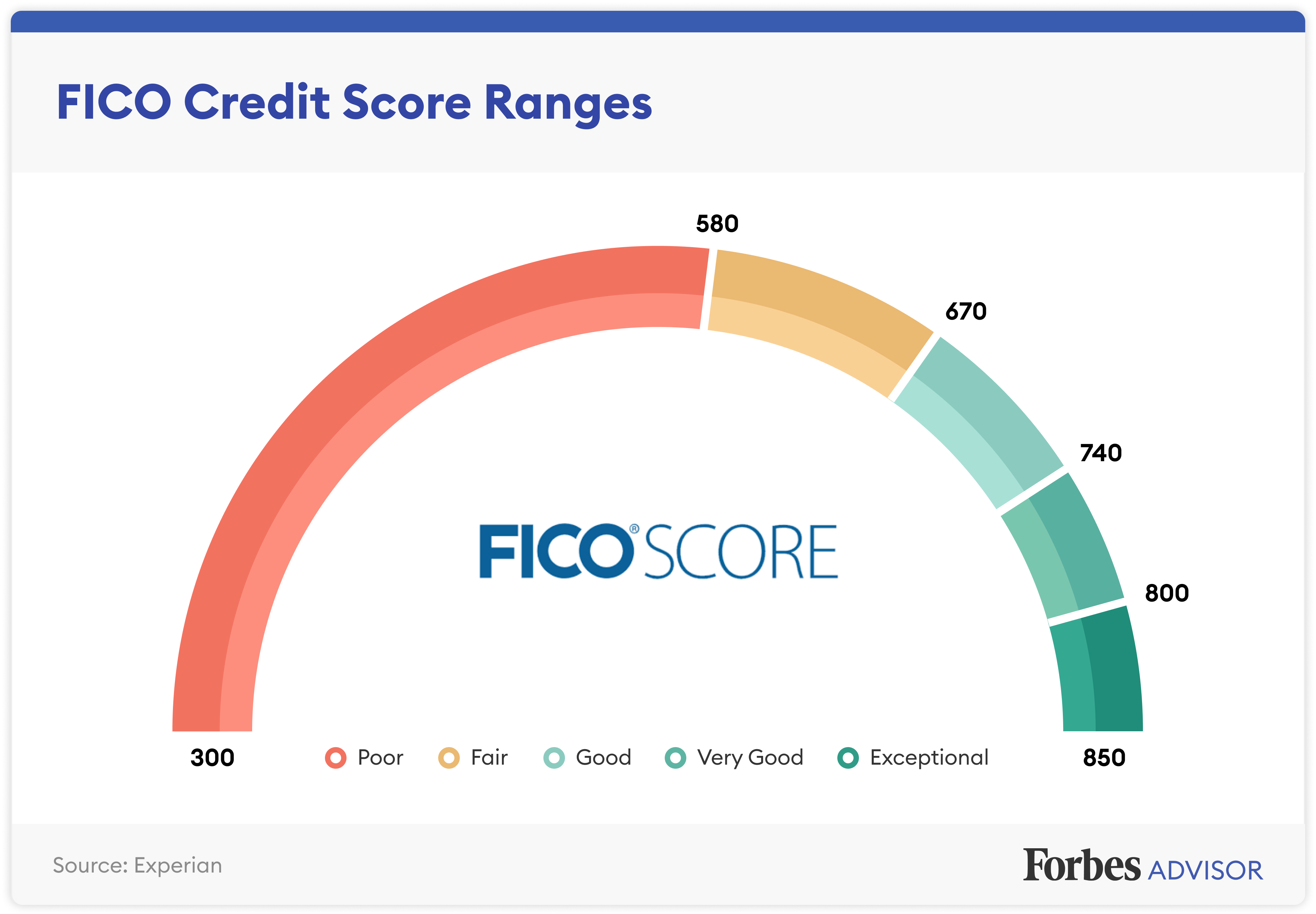

Their minimum credit score requirement is 620 for conventional loans and 580 for FHA loans.

When it comes to securing the most favorable mortgage rates for investment properties, the importance of a good credit score cannot be overstated. Top lenders, such as those featured in our list, typically require a minimum credit score of 620 for conventional loans and 580 for FHA loans. This benchmark ensures that borrowers demonstrate a strong history of responsible credit behavior, reducing the risk for lenders and increasing the likelihood of securing attractive loan terms. By meeting or exceeding these credit score requirements, investors can confidently approach the home buying process, armed with the knowledge that they are well-positioned to secure the best possible mortgage rates for their investment property.

Wells Fargo: Wells Fargo is a well-established bank that offers competitive investment property mortgage rates

Wells Fargo, a leading financial institution in the banking industry, provides investors with exceptional mortgage rates for their investment properties. As a trusted name in the market, Wells Fargo caters to the unique needs of property investors by offering a variety of loan options to suit diverse financial situations. With their competitive rates, seamless customer service, and flexible loan terms, investors can confidently choose Wells Fargo for their investment property mortgages. By taking advantage of the bank’s expertise and resources, property investors can secure the best mortgage rates to maximize their return on investment and grow their real estate portfolio.

They provide a variety of loan options, including fixed-rate and adjustable-rate mortgages, as well as jumbo loans for larger investments

Discover the top 5 lenders offering the most competitive mortgage rates for investment properties, catering to a diverse range of financing needs. These lenders provide an extensive variety of loan options, such as fixed-rate and adjustable-rate mortgages, ensuring a suitable choice for every investor. For those seeking to finance more substantial investments, jumbo loans are also available, providing higher loan limits to meet your requirements. By evaluating and comparing the best mortgage rates in the market, you can secure the most favorable terms for your investment property, ultimately enhancing your financial growth and long-term profitability. Make an informed decision and optimize your investment strategy today.

Wells Fargo requires a minimum credit score of 620 for conventional loans and 640 for government-backed loans.

Wells Fargo, one of the leading mortgage lenders in the industry, offers competitive mortgage rates for investment properties. To qualify for their conventional loan programs, borrowers must have a minimum credit score of 620. For government-backed loans, such as FHA and VA loans, a credit score of 640 is required. Wells Fargo’s stringent credit score requirements ensure that they lend to borrowers who demonstrate a solid credit history and financial stability. By choosing Wells Fargo for your investment property mortgage, you can benefit from their extensive mortgage product offerings and industry expertise, helping you secure the best possible mortgage rate for your investment.

Bank of America: Bank of America offers a wide range of mortgage options for investment properties, including fixed-rate and adjustable-rate

![]()

Bank of America stands out as a top lender for investment property mortgages, providing competitive rates and comprehensive loan solutions. With their various fixed-rate and adjustable-rate mortgage options, investors can find the perfect financing fit for their rental or multi-family properties. Bank of America’s experienced team prioritizes customer satisfaction, offering personalized support and in-depth resources to help borrowers navigate the mortgage process with ease. By choosing Bank of America, property investors can confidently secure the funding they need to expand their portfolios and generate long-term wealth. Experience the advantages of partnering with this trusted financial institution for your investment property mortgage needs.