Are you struggling with a less-than-perfect credit score and seeking to secure a mortgage in 2023? Look no further! We have carefully researched and compiled a list of the top 5 best mortgage lenders for bad credit, so you can confidently take the first step towards your dream home. Our comprehensive guide provides valuable insights on these mortgage lenders, who specialize in offering flexible financing solutions for borrowers with low credit scores. Explore your options and start turning your homeownership aspirations into reality, despite your credit challenges. Get ready to unlock the door to your new home with our top picks for bad credit mortgage lenders in 2023.

Quicken Loans: Quicken Loans is one of the largest mortgage lenders in the United States and offers a variety of loan options for borrowers with bad credit

Quicken Loans, a leading mortgage lender in the United States, emerges as a top choice for borrowers with bad credit in 2023, providing a diverse range of loan options tailored to meet their unique financial needs. With an unwavering commitment to simplifying the mortgage process and ensuring a seamless experience, Quicken Loans employs advanced technology and a team of dedicated professionals to guide applicants through each step. Moreover, their user-friendly online platform allows for convenient comparison of loan products, empowering borrowers with bad credit to make informed decisions and secure a mortgage that aligns with their financial goals.

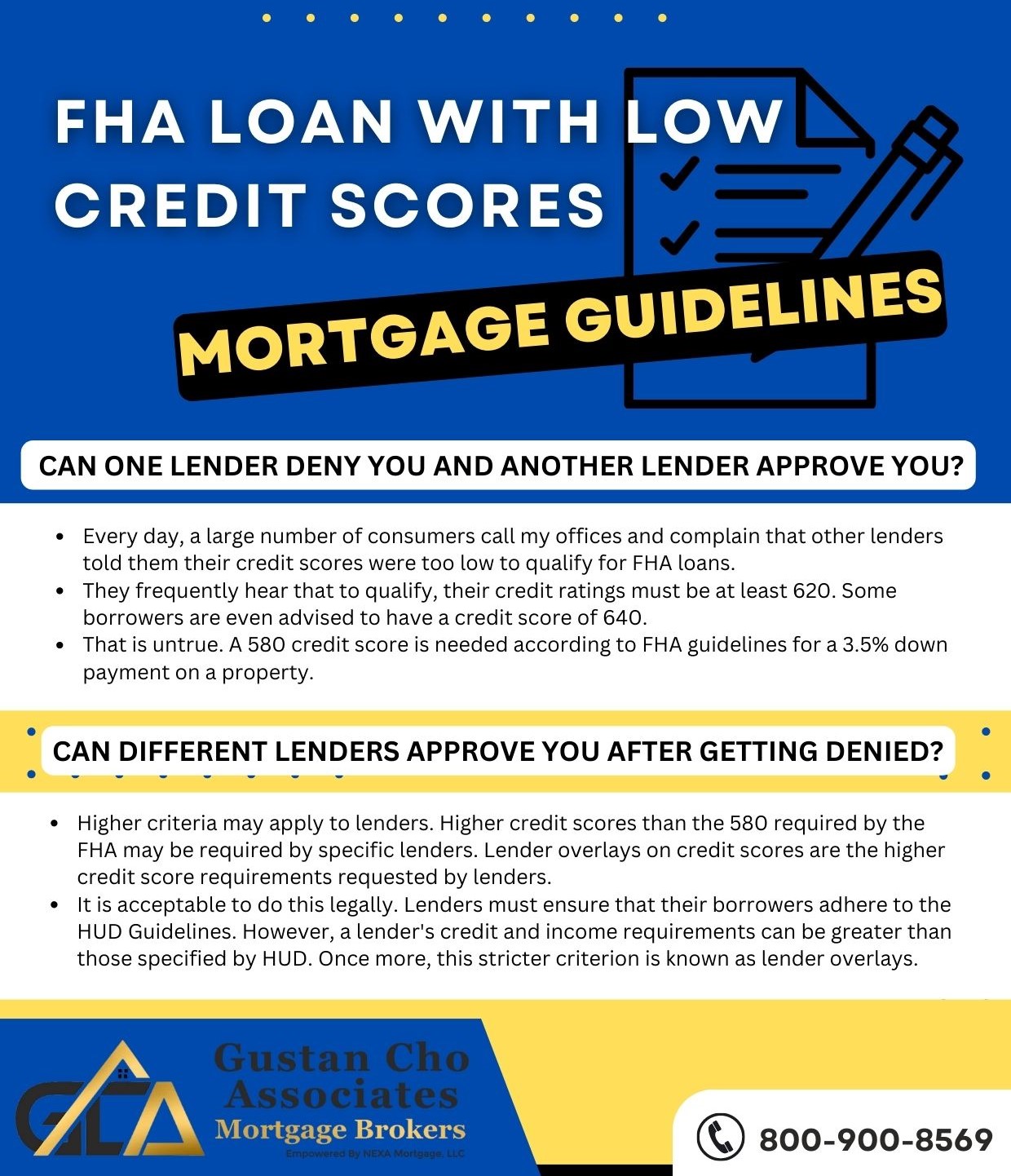

They have a minimum credit score requirement of 580 for FHA loans, which makes it a popular choice for those with less-than-perfect credit.

In 2023, one of the top mortgage lenders for borrowers with bad credit is undoubtedly the one offering FHA loans with a minimum credit score requirement of just 580. This low threshold makes it an attractive option for individuals struggling with less-than-perfect credit scores. FHA loans, backed by the Federal Housing Administration, are designed to help low-to-moderate-income borrowers achieve their dream of homeownership. By offering more lenient credit score requirements and down payment options as low as 3.5%, these mortgage lenders aim to provide accessible and affordable financing solutions. If you’re searching for a mortgage lender that caters to your unique credit situation, consider exploring the benefits of an FHA loan with a 580 credit score requirement.

New American Funding: New American Funding is a direct lender that specializes in helping borrowers with bad credit secure home loans

New American Funding is an exceptional choice for those seeking the top mortgage lenders for bad credit in 2023. As a direct lender, they provide personalized solutions and unique loan options tailored to meet the needs of borrowers with less-than-perfect credit scores. Their team of experts understands that financial setbacks can happen to anyone, and they strive to offer affordable home loans that empower individuals to achieve their dream of homeownership. With an array of programs, such as FHA loans, VA loans, and down payment assistance, New American Funding has established itself as a reliable and trustworthy lender for individuals with bad credit, helping them secure their financial future.

They offer FHA loans, VA loans, and non-prime loans for borrowers with credit scores as low as 500.

In 2023, the top mortgage lenders for bad credit stand out by providing a variety of flexible loan options to accommodate a range of credit scores. These lenders specialize in offering FHA loans, VA loans, and non-prime loans, catering to borrowers with credit scores as low as 500. FHA loans, backed by the Federal Housing Administration, are renowned for their low down payment requirements and lenient credit standards, making them an ideal option for first-time homebuyers with less-than-perfect credit. VA loans, backed by the Department of Veterans Affairs, are exclusively available for eligible veterans and military personnel, offering competitive rates and no down payment options. Non-prime loans, on the other hand, are designed for borrowers with low credit scores, providing them with an opportunity to secure a mortgage despite their financial setbacks. By exploring these versatile loan options, homebuyers with bad credit can successfully navigate the mortgage landscape and secure their dream home in 2023.

Carrington Mortgage Services: Carrington Mortgage Services is a lender that focuses on helping borrowers with bad credit and other financial challenges

Carrington Mortgage Services stands out as one of the top mortgage lenders for borrowers with bad credit in 2023. Specializing in assisting individuals facing financial difficulties, Carrington offers a range of flexible loan options tailored to suit each client’s unique needs. Their expertise in managing credit challenges ensures that potential homeowners can secure the best possible mortgage solutions for their circumstances. With a strong commitment to providing exceptional customer service and support, Carrington Mortgage Services aims to simplify the home loan process, making homeownership achievable for those with less-than-perfect credit. Trust Carrington as your go-to mortgage lender for a smooth, stress-free home buying experience.

They offer FHA, VA, and USDA loans for borrowers with

In 2023, finding the best mortgage lenders for bad credit is essential for securing a favorable home loan. Among the top 5 lenders, they offer FHA, VA, and USDA loans specifically designed for borrowers with less-than-perfect credit scores. These government-backed loan programs provide low down payment options, flexible credit requirements, and competitive interest rates, making homeownership more accessible for those with bad credit. By researching and comparing these top lenders, borrowers can find a mortgage solution that suits their unique financial situation and helps them achieve their dream of homeownership. Remember, a low credit score doesn’t have to be an obstacle in obtaining a mortgage – with the right lender, it’s possible to secure a loan that meets your needs.