Discover the top 5 best mortgage lenders for self-employed borrowers in 2023, as we unveil the perfect solutions to help you secure your dream home. As a self-employed individual, you deserve a mortgage lender who understands your unique financial situation and offers tailored solutions to meet your needs. So, whether you’re a freelancer, a small business owner, or an entrepreneur, our comprehensive guide will equip you with the insights to make an informed decision. Dive into our expertly curated list, designed to help you unlock the door to your new home, and step confidently into the future with the best mortgage lenders for self-employed borrowers.

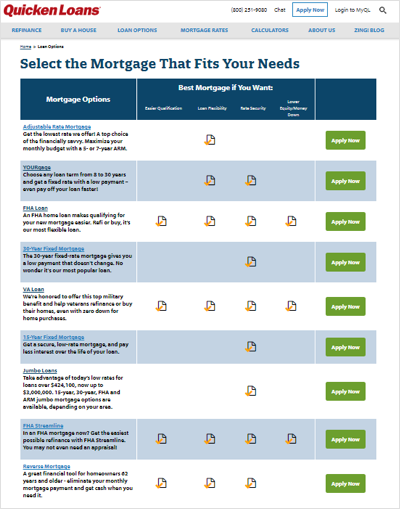

Quicken Loans: As one of the largest mortgage lenders in the US, Quicken Loans offers a variety of mortgage products designed specifically for self-employed borrowers

Quicken Loans, a leading mortgage lender in the US, caters to the unique needs of self-employed borrowers with tailored mortgage solutions. Recognizing the distinct financial landscape of entrepreneurs and freelancers, Quicken Loans provides an array of options that accommodate fluctuating income, tax deductions, and alternative documentation. Their innovative technology and streamlined process make it easier than ever for self-employed individuals to secure a mortgage that aligns with their financial goals. In 2023, Quicken Loans continues to be a top choice for self-employed borrowers seeking a hassle-free, customized mortgage experience.

Their flexible underwriting guidelines and streamlined application process make it easy for those with non-traditional income sources to qualify for a loan.

In 2023, the top mortgage lenders for self-employed borrowers truly stand out with their innovative solutions, catering to the unique needs of freelancers, business owners, and gig workers. Their flexible underwriting guidelines and streamlined application process make it a breeze for those with non-traditional income sources to secure a home loan. By considering various financial documentation and offering tailored mortgage products, these lenders simplify the approval journey for self-employed applicants. Their digital platforms and customer-centric approach further enhance the borrowing experience, ensuring a seamless and hassle-free loan process. So, if you’re part of the growing self-employed community, look no further than these top mortgage lenders to finance your dream home.

Bank of America: With a wide range of loan programs and a strong presence nationwide, Bank of America is a top choice for self-employed borrowers

Bank of America, with its extensive nationwide presence and diverse loan offerings, ranks among the top 5 best mortgage lenders for self-employed borrowers in 2023. This well-established financial institution caters to the unique needs of self-employed individuals by providing tailored mortgage solutions and flexible underwriting guidelines. Moreover, Bank of America’s seamless online application process, coupled with their exceptional customer support, ensures a smooth and hassle-free experience for busy entrepreneurs. By prioritizing accessibility and convenience, Bank of America solidifies its position as a leading mortgage provider for the self-employed community.

They offer competitive rates, flexible underwriting criteria, and a variety of mortgage options, including portfolio loans designed specifically for self-employed individuals.

In 2023, self-employed borrowers can enjoy the benefits of top mortgage lenders offering competitive rates, flexible underwriting criteria, and a variety of mortgage options tailored to their unique financial situations. These lenders understand the challenges faced by self-employed individuals, and have created innovative portfolio loans that cater specifically to their needs. With customizable mortgage solutions, these lenders help self-employed borrowers secure their dream homes while maintaining a healthy financial outlook. By providing competitive interest rates and flexible underwriting standards, the top 5 mortgage lenders for self-employed borrowers in 2023 are committed to supporting the growing number of entrepreneurs and freelancers in today’s dynamic economy.

Guaranteed Rate: This online mortgage lender offers a range of mortgage products tailored to the needs of self-employed borrowers

Guaranteed Rate stands out as one of the top mortgage lenders for self-employed borrowers in 2023. This innovative online lender specializes in providing a diverse array of mortgage products, specifically designed to cater to the unique financial circumstances of self-employed individuals. With their user-friendly digital platform, Guaranteed Rate simplifies the loan application process, ensuring quick and seamless transactions. They also offer competitive interest rates and flexible loan terms, making it easier for self-employed borrowers to secure an ideal mortgage solution. By prioritizing the customer experience and understanding the distinct needs of self-employed borrowers, Guaranteed Rate solidifies its position as a top choice in the mortgage industry.

With competitive rates and flexible guidelines, Guaranteed

In 2023, Guaranteed Rate stands out as one of the top mortgage lenders for self-employed borrowers, thanks to its competitive rates and flexible guidelines. As a self-employed individual, you’ll appreciate their accommodating underwriting process, which takes into account your unique income situation. Guaranteed Rate offers various loan products, including interest-only and adjustable-rate mortgages, to cater to the diverse needs of self-employed professionals. Plus, their cutting-edge digital platform simplifies the application process, making it easier to secure the mortgage that suits your financial goals. Choose Guaranteed Rate for a seamless, customized mortgage experience tailored to the self-employed borrower.