Are you gearing up to dive into the world of homeownership, or considering refinancing your current abode? Stay ahead of the game by exploring the top 5 mortgage rate trends today. In this ever-changing landscape, it’s crucial to understand the factors influencing rates to secure the best deal for your dream home or refinance. Our comprehensive guide will walk you through what you need to know, empowering you to make informed decisions that can save you thousands in the long run. Don’t miss out on these key insights – read on to unlock the secrets of today’s mortgage rate trends!

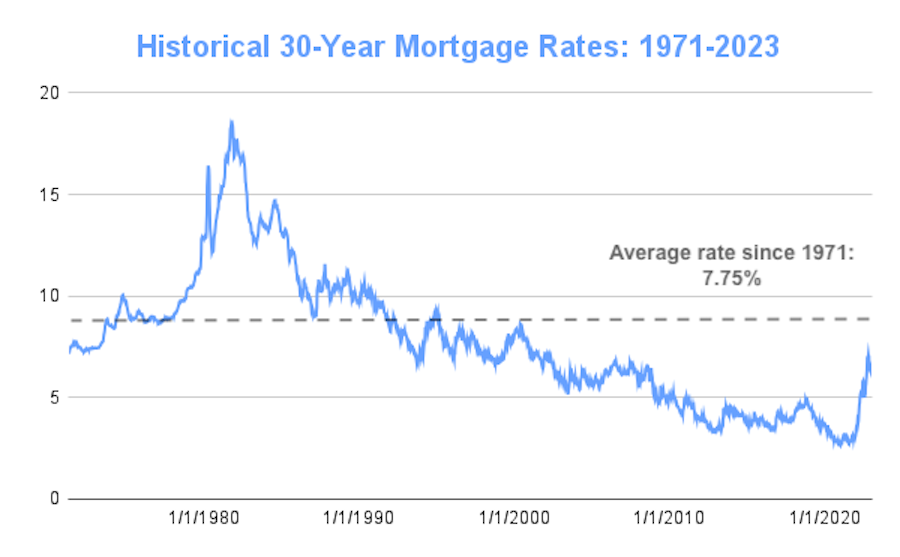

Mortgage rates remain at historic lows: Mortgage rates continue to hover at historic lows due to the economic downturn caused by the COVID-19 pandemic

Mortgage rates remain at historic lows, providing potential homebuyers with a unique opportunity to secure an affordable home loan. The ongoing economic downturn, triggered by the COVID-19 pandemic, has forced central banks to implement aggressive monetary policies to stimulate growth. Consequently, mortgage rates have reached unprecedented lows, making it the perfect time for potential homebuyers to lock in a favorable rate. Despite the uncertainty in the market, these low mortgage rates offer a silver lining for those looking to purchase property. Staying informed about the latest mortgage rate trends is essential for making sound financial decisions in today’s ever-evolving real estate landscape.

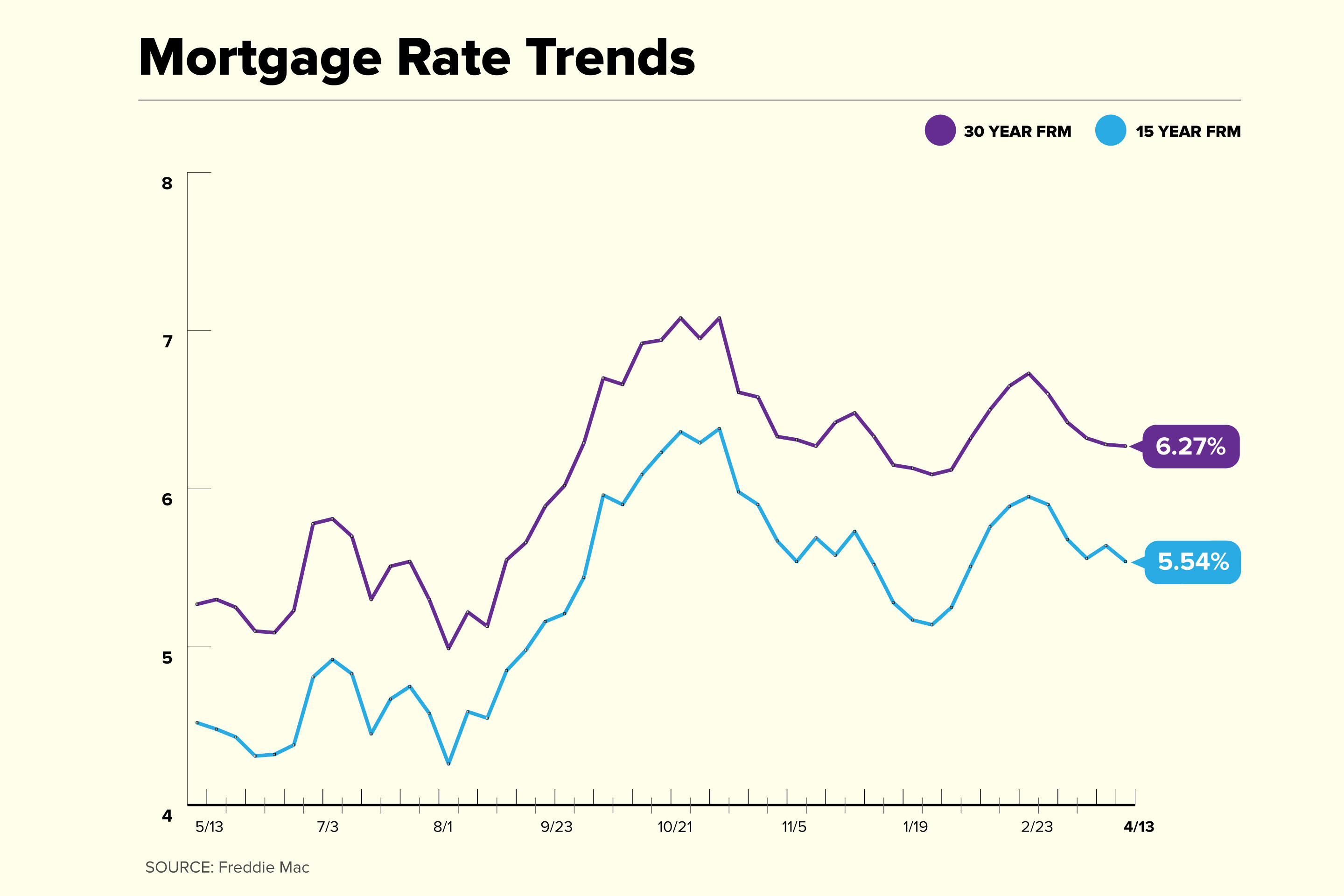

As of September 2021, the average 30-year fixed-rate mortgage is around 3.00%, while the average 15-year fixed-rate mortgage is around 2.30%

September 2021 has brought some significant changes to the mortgage industry, with the average 30-year fixed-rate mortgage settling at approximately 3.00% and the average 15-year fixed-rate mortgage hovering around 2.30%. As potential homebuyers and refinancers navigate the current housing market, understanding these mortgage rate trends is crucial. These historically low rates offer an incredible opportunity for borrowers to lock in a favorable long-term mortgage or refinance their existing loans, potentially saving thousands of dollars over the life of the loan. Staying informed about these trends and acting accordingly can lead to substantial financial benefits in today’s competitive real estate landscape.

These low rates have made it an attractive time for homebuyers and homeowners looking to refinance their existing loans.

The current low mortgage rates have created a favorable environment for both prospective homebuyers and homeowners seeking to refinance their existing loans. As a result, the housing market is experiencing increased demand and competition. With these attractive rates, potential buyers can afford more expensive homes, while refinancers can potentially save thousands of dollars over the life of their loan. Ensuring you stay informed about the latest mortgage rate trends and seeking guidance from industry experts will help you make the most of this unique opportunity. Whether you’re a first-time buyer or looking to refinance, now is the time to take advantage of these historically low rates and achieve your homeownership goals.

Federal Reserve’s influence on mortgage rates: The Federal Reserve plays a crucial role in determining the mortgage rates by setting the federal funds rate, which influences the rate at which banks lend money to each other

The Federal Reserve significantly impacts mortgage rates through its control of the federal funds rate, which directly affects the cost of borrowing for banks. As the Fed adjusts this rate, banks subsequently modify their lending rates to maintain profitability. Consequently, any changes to the federal funds rate will influence the mortgage rates offered by banks to borrowers. Being aware of the Federal Reserve’s monetary policy decisions and understanding the potential implications for mortgage rates is essential for prospective homebuyers and those looking to refinance. Keeping an eye on the Fed’s actions can help you make informed decisions and secure the best possible mortgage rate for your needs.

Although the Fed does not have direct control over mortgage rates, its actions impact the broader

In today’s ever-changing mortgage landscape, it’s crucial to stay informed about the top mortgage rate trends to make smart financial decisions. One key factor to understand is the role of the Federal Reserve (Fed) in influencing mortgage rates. Although the Fed doesn’t directly control these rates, its actions significantly impact the broader financial market. The Fed’s decisions to adjust interest rates or implement monetary policies can lead to fluctuations in mortgage rates, affecting your monthly payments and overall borrowing costs. Keeping a close watch on the Fed’s actions and understanding their implications can help you better navigate the mortgage market and secure a favorable rate for your home loan.