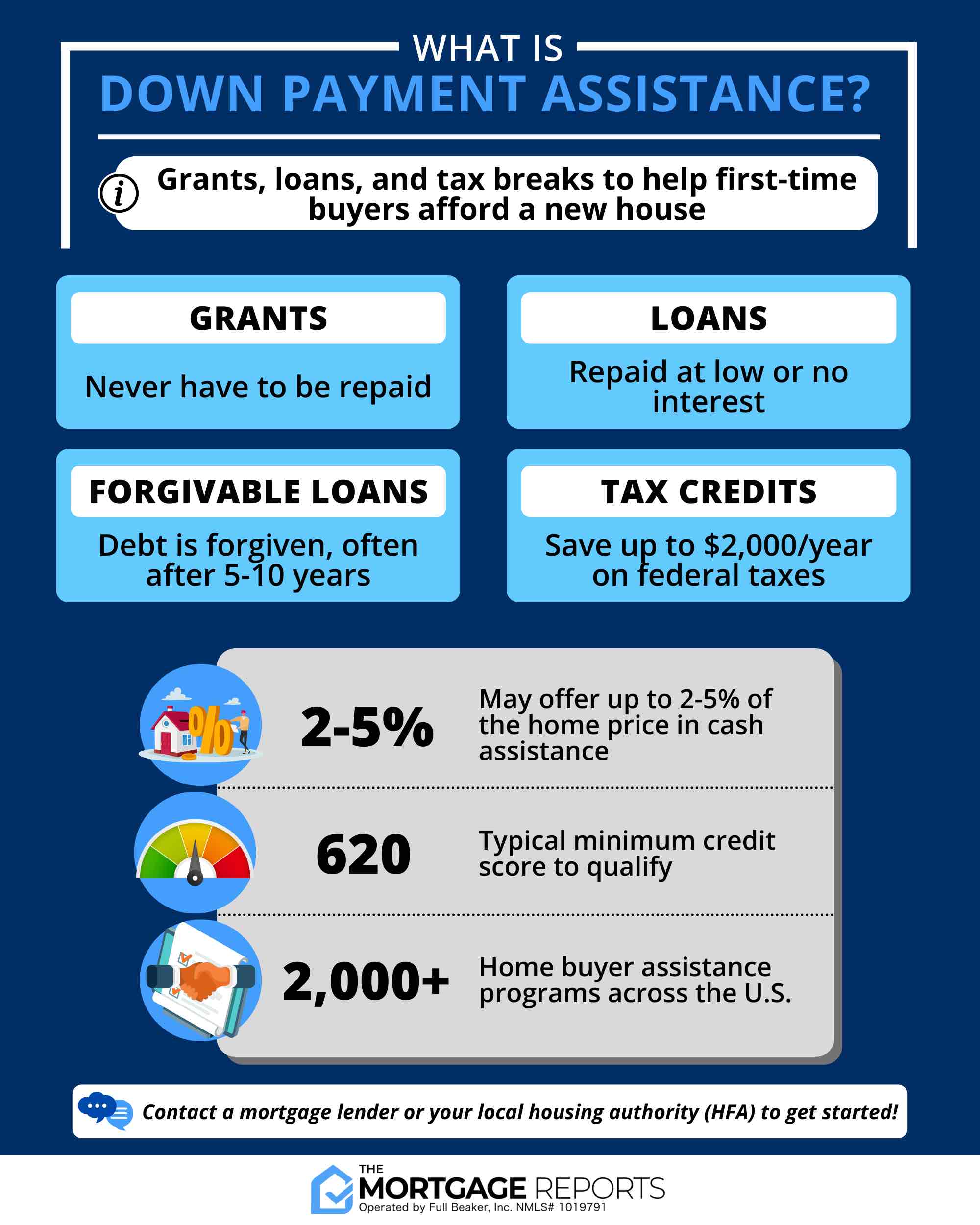

Are you looking to make the leap into homeownership but feeling weighed down by the burden of a hefty down payment? Worry no more! Freedom Mortgage’s Down Payment Assistance Programs are here to give you the financial boost you need to secure your dream home. In this must-read article, we’ll explore the ins and outs of these game-changing programs, designed to empower you with the financial freedom you deserve. Say goodbye to rental woes and hello to a bright future as a proud homeowner—discover how to unlock the full potential of Freedom Mortgage’s Down Payment Assistance Programs today!

Research Freedom Mortgage assistance programs.

Discover the perks of Freedom Mortgage’s down payment assistance programs by diving into your research! Learn about the variety of options available to help you secure your dream home, while saving money in the process. Don’t miss out on these opportunities designed to make homeownership more accessible for young adults like you.

Determine eligibility for chosen program.

Kick-start your homeownership journey by first determining your eligibility for Freedom Mortgage’s Down Payment Assistance Programs. It’s crucial to understand the specific requirements of the program you’re eyeing, as they may vary. So, do thorough research, ask questions, and evaluate your financial situation to find the perfect match!

Gather necessary financial documentation.

Unlock the full potential of Freedom Mortgage’s Down Payment Assistance Programs by diligently gathering all essential financial documentation. This crucial step will streamline the application process, ensuring you’re well-prepared to secure the best possible assistance package. So, gather your pay stubs, bank statements, and tax returns, and get ready to make homeownership a reality!

Complete application with accurate information.

Unlock the door to your dream home by accurately completing your Freedom Mortgage application for their Down Payment Assistance Programs. When you provide precise information, you’re already one step closer to homeownership. So, say goodbye to rental life and hello to a space that’s truly yours! Let’s ace that application, shall we?

Attend required homebuyer education courses.

Unlock the door to your dream home by attending mandatory homebuyer education courses, a vital step in Freedom Mortgage’s Down Payment Assistance Programs. These courses equip you with essential knowledge and confidence, ensuring a smooth home-buying journey. Master the art of budgeting, financing, and homeownership while boosting your home-purchase chances!

Finalize mortgage and enjoy homeownership.

Finally, the moment you’ve been waiting for—homeownership! After securing your dream home using Freedom Mortgage’s Down Payment Assistance Programs, you can now finalize your mortgage and revel in your new home sweet home. Get ready to make unforgettable memories, create your personal space, and watch your investment grow. Cheers to your homeowner journey!