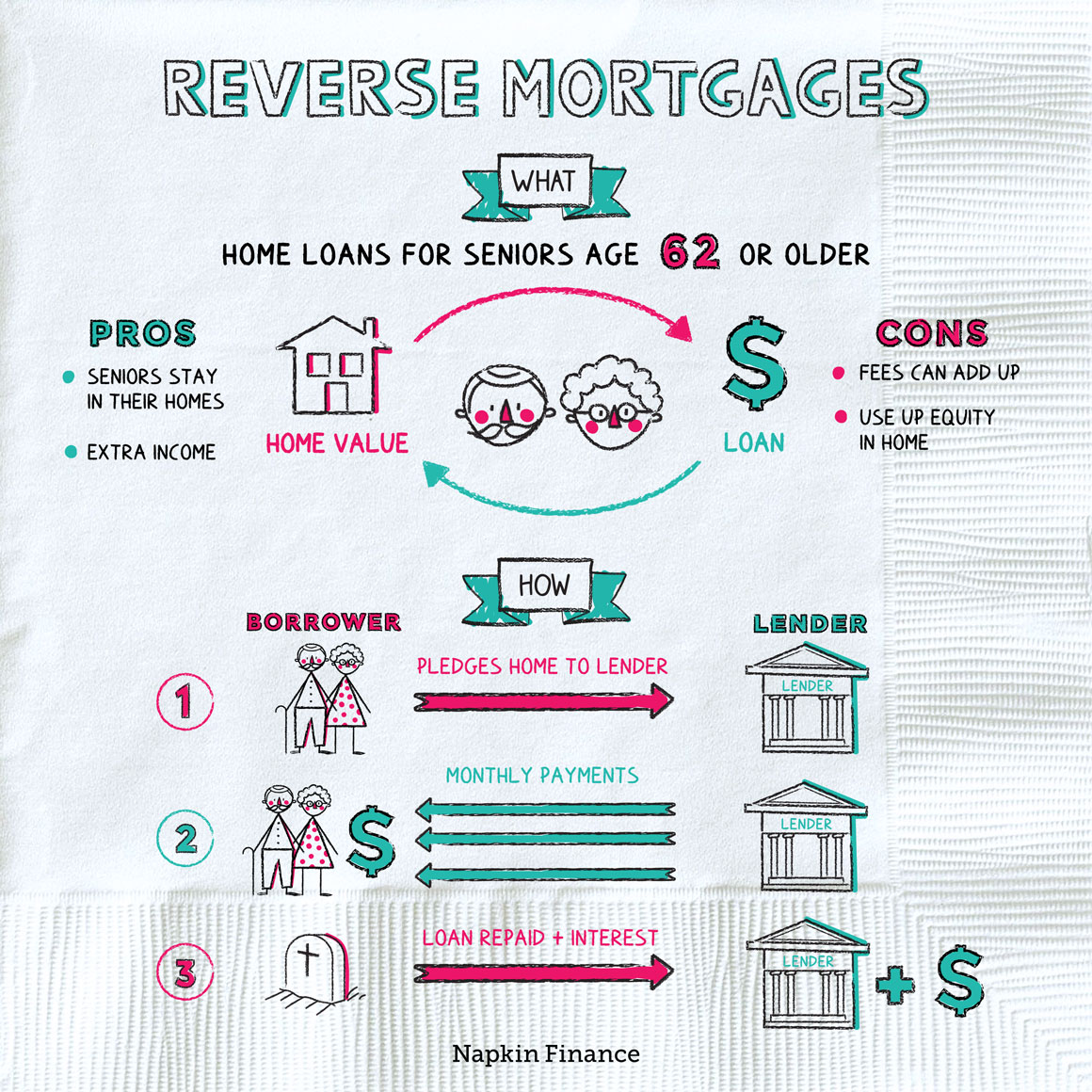

Having a secure financial future is something that everyone dreams of, but achieving it can be difficult. One way to get there is through a reverse mortgage, which can provide seniors with a steady income stream while they remain in their home. In this article, we’ll show you how to get a reverse mortgage and the steps you’ll need to take to make the process as smooth and hassle-free as possible. From understanding the different reverse mortgage types to applying for one, we’ve got you covered!

Research lenders and options.

When researching lenders and options for a reverse mortgage, it is important to compare rates, fees, and repayment options to ensure you are getting the best deal.

Meet with a lender.

Meeting with a lender is an important step in the reverse mortgage process. It’s the best way to make sure you understand all the details and find the right product for your needs.

Complete application.

Completing a reverse mortgage application can be a daunting task. To help make the process smoother, it is important to make sure all the necessary paperwork is gathered, the form is filled out accurately, and the right documents are provided.

Submit financial documents.

When applying for a reverse mortgage, it is important to submit financial documents such as income, asset, and credit history. This helps ensure that you are able to receive the best loan terms possible based on your current financial situation.

Get mortgage approved.

Getting your reverse mortgage approved is not a difficult process, just make sure you meet the necessary requirements. Working with a knowledgeable and experienced lender can help streamline the process.

Receive funds.

When getting a reverse mortgage, you can choose to receive your funds in different ways. Some of these options include a lump sum payment, monthly payments, or a line of credit.