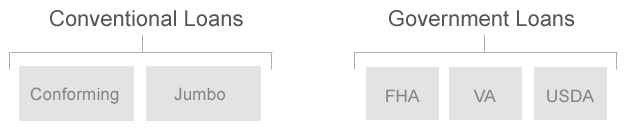

Are you looking to buy a home but don’t have the financial security to get a traditional mortgage? A government-insured mortgage may be the perfect solution. These mortgages are backed by the federal government, so they come with more relaxed qualification requirements and lower down payments. In this guide, we’ll walk you through the process of applying for a government-insured mortgage, from understanding the requirements to finding the best lender for your needs. Read on to start your journey towards homeownership today!

Research government-insured mortgages.

Researching government-insured mortgages can be intimidating, but taking the time to review your options can help you find the right loan for your needs.

Compare lenders & rates.

Before committing to a lender, make sure to compare rates from multiple institutions to get the best deal possible.

Check credit score.

It is important to check your credit score before applying for a government-insured mortgage. Knowing your credit score can give you an idea of whether you qualify for this type of loan and what your interest rate might be.

Gather paperwork & documents.

Gathering the required paperwork and documents to apply for a government-insured mortgage is an important step in the process. Make sure to have all the information you need on hand before submitting your application.

Submit loan application.

Once you’ve decided to pursue a government-insured mortgage, the next step is to submit a loan application. This should include all the necessary details such as income, employment history and other financial information, in order to get your loan approved. Here, it’s important to ensure accuracy and provide all the required documents to avoid any delays.

Wait for approval.

It’s important to be patient while waiting for approval as the process can take several weeks. Make sure to check in every few days to ensure your application is progressing.