Are you ready to become a homeowner but not sure how to get a conventional mortgage? Don’t worry, you’re not alone! Many prospective home buyers are overwhelmed by the process and the overwhelming amount of financial jargon involved in obtaining a conventional mortgage. But with the right information and guidance, you can find the right loan for your situation and move into your dream home. In this article, we’ll discuss the steps you need to take to get a conventional mortgage and the options available to you. Read on to learn more about how to get a conventional mortgage loan and find the best fit for your needs.

Gather documents/records

Gathering documents and records is an important step to obtaining a conventional mortgage. Make sure to have all the necessary documents and records ready prior to applying such as proof of income, employment verification, credit history, and assets. It is also important to keep in mind that conventional mortgage lenders have stricter guidelines when it comes to credit scores and debt-to-income ratio.

Determine creditworthiness

When considering a conventional mortgage, determining creditworthiness is key. A good credit score is essential when applying for a loan, and lenders will look at your credit history, payment history, debt-to-income ratio, and other financial factors to decide if you are a suitable candidate.

Find lender/mortgage broker

Finding a lender or mortgage broker who can provide you with a conventional mortgage can be a daunting task. To make the process easier, start by researching the various lenders and brokers in your area to determine which one offers the best rates and terms. Ask friends and family for referrals and read online reviews to get an idea of the quality of service each lender or broker provides.

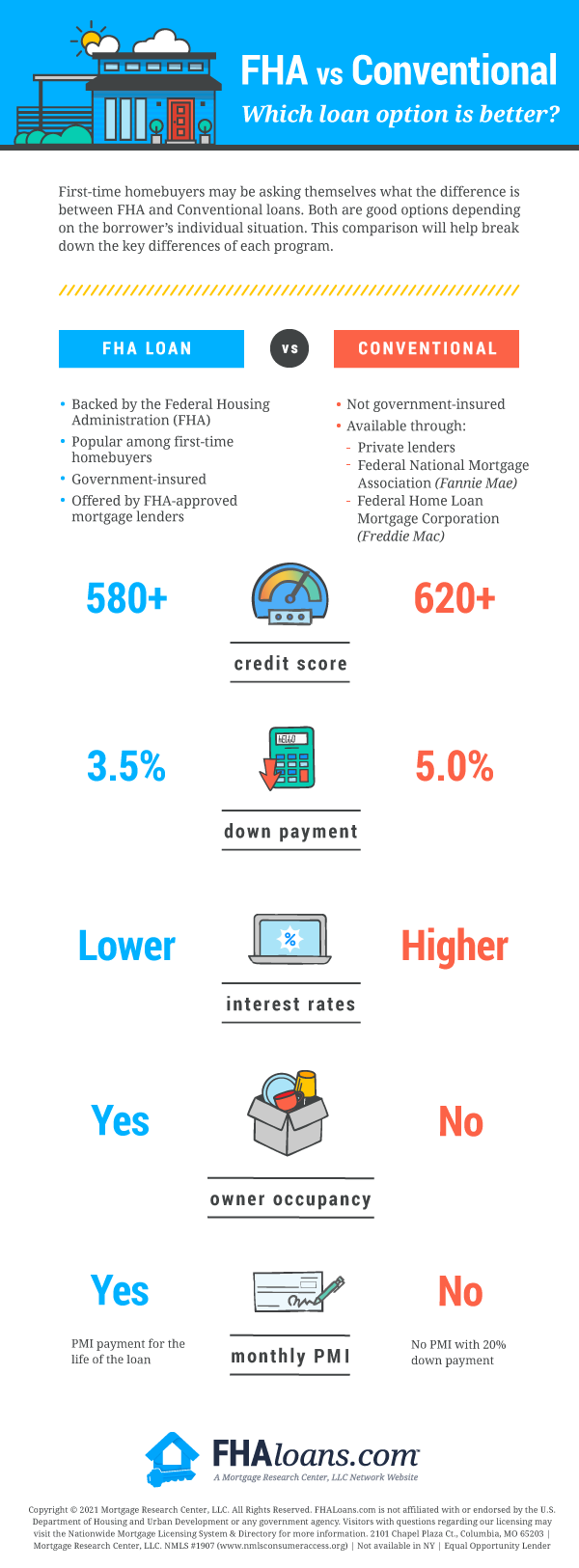

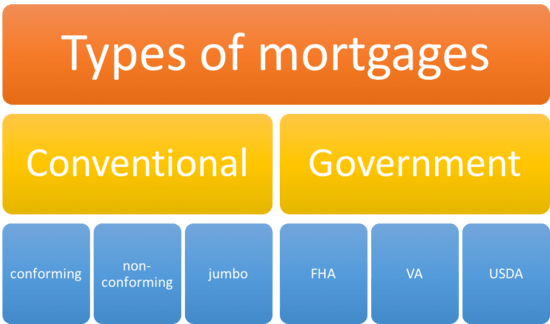

Compare loan options

Comparing loan options can be daunting, so it’s important to take the time to understand your options. Researching and comparing different lenders, loan products, and interest rates is a great way to ensure you get the best deal on your conventional mortgage.

Submit loan application

When applying for a conventional mortgage, submitting the loan application is the first step. This includes providing documents such as tax returns, pay stubs, and bank statements. It is important to make sure all paperwork is accurate and up-to-date so that the lender can review the application quickly and efficiently.

Receive loan approval

After submitting your application, you’ll need to wait for loan approval. During this time, the lender will review your credit, income, and other financial documents to ensure you meet their eligibility requirements. If approved, you’ll receive a loan commitment letter outlining the terms of your loan.