Are you considering a high ratio mortgage for your next home purchase? It can be a complicated process, but with our full guide, you’ll have all the information you need to make an informed decision. We’ll cover topics such as the different types of high ratio mortgages, the eligibility requirements, and the associated risks. With this comprehensive resource, you’ll have all the information you need to secure a high ratio mortgage and make the right decision for your financial future.

What is a High Ratio Mortgage?

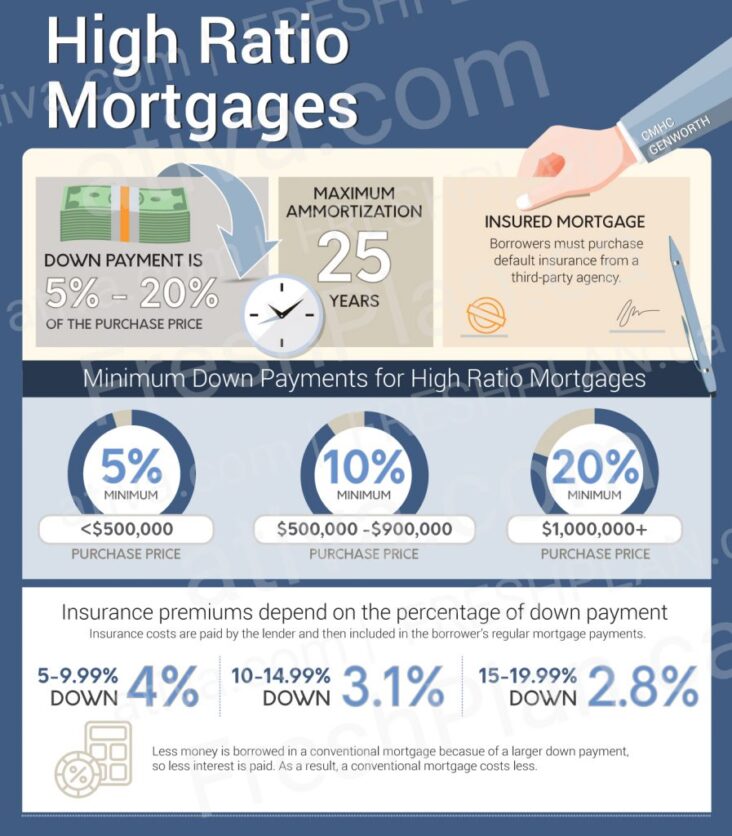

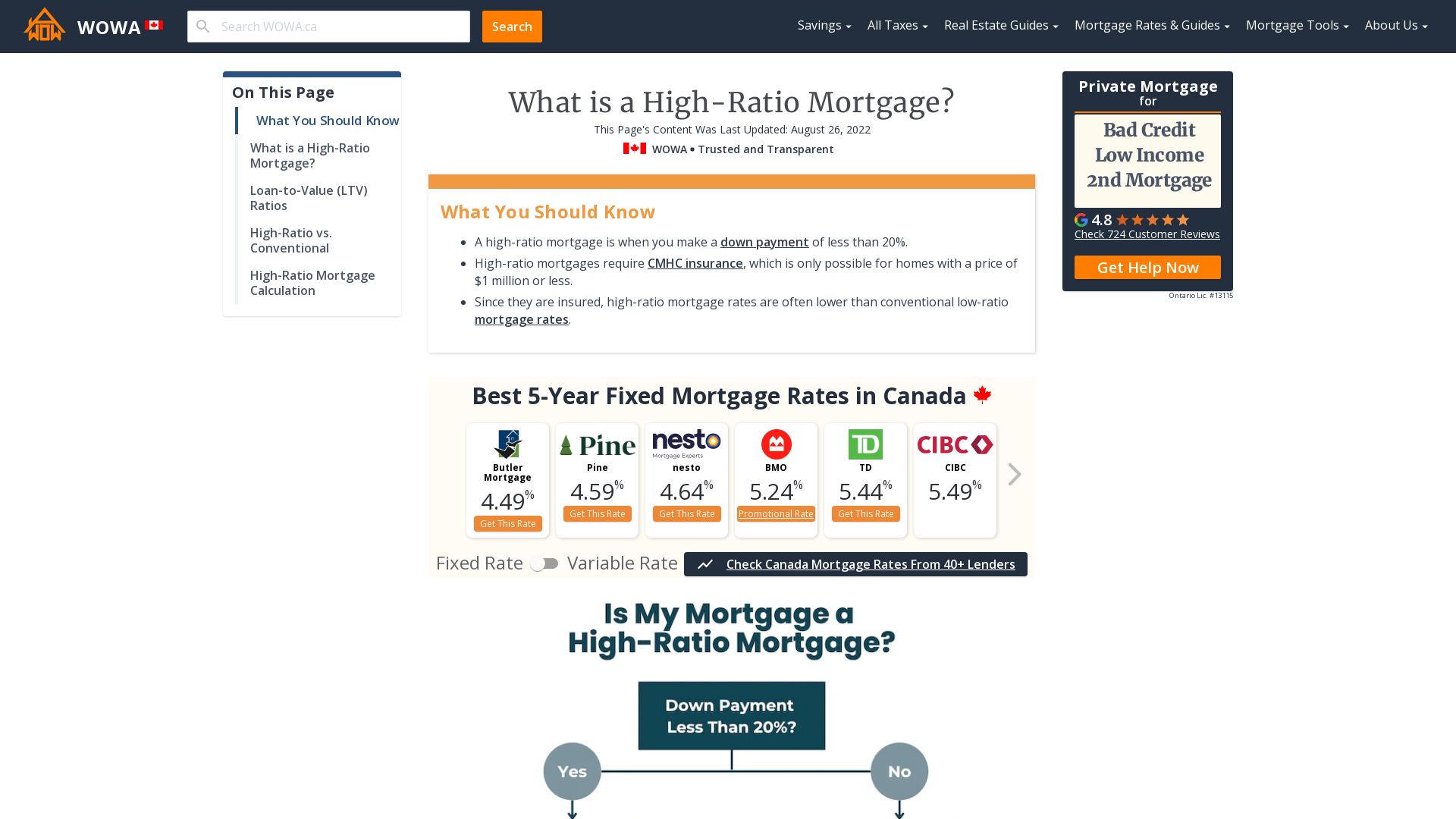

A high ratio mortgage is a loan that is much higher than the value of the property being purchased. This type of mortgage typically requires the borrower to have a large down payment and the lender to provide mortgage default insurance. High ratio mortgages are generally more expensive than standard mortgages since they require the lender to take on more risk. This type of mortgage can be a great option for first-time home buyers who don’t have a large down payment saved up, but it’s important to understand the risks and compare rates before signing on the dotted line.

Benefits of Taking Out a High Ratio Mortgage

If you’re looking to purchase a home, taking out a high ratio mortgage can be a great option. Not only can it get you into your home faster, but it also offers a number of other benefits. One of the biggest advantages of taking out a high ratio mortgage is that you’ll need to put less money down. This makes it easier for those who don’t have a lot of money saved up to buy a home. In addition, you’ll likely be able to get a better interest rate since you’re putting down less money. Finally, you’ll also be able to save money on closing costs since you’re taking out a smaller mortgage. All these benefits make taking out a high ratio mortgage a smart move for those looking to buy a home on a budget.

Risks Associated with High Ratio Mortgages

If you’re considering taking out a High Ratio mortgage, it’s important to understand the risks associated with these types of loans. High Ratio mortgages require that borrowers put down a larger than average down payment, so if the value of the home drops, you could end up owing more than the home is worth. That means you could end up being ‘underwater’ and be unable to make payments. Another risk is that if you don’t make your payments on time, you risk having your home foreclosed on. So it’s important to make sure you can afford the payments before taking out a High Ratio mortgage. It’s also important to do your research and shop around to get the best deal. A High Ratio mortgage can be a great way to get into a home, but it’s important to understand the risks and be prepared to handle them.

How to Qualify for a High Ratio Mortgage

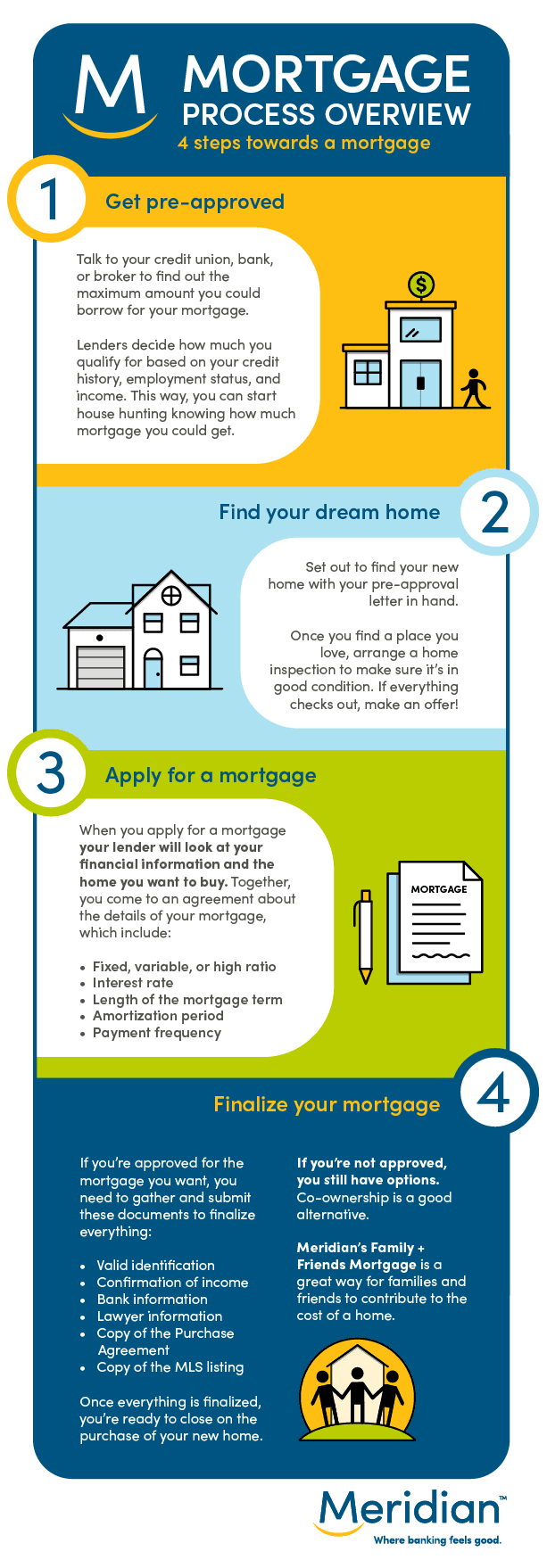

When it comes to qualifying for a high ratio mortgage, there are a few factors to consider. First, you’ll need to have a solid credit score and a steady income, which will help you get the best rate. You’ll also need to have a down payment of at least 20%, as well as other closing costs. And lastly, you’ll need to provide a documented proof of income and assets to show that you can make your mortgage payments on time and in full. With these things in place, you’ll be in a good position to qualify for a high ratio mortgage and take advantage of the many benefits it can offer.

Tips for Avoiding Plagiarism When Writing About High Ratio Mortgages

When it comes to writing about high ratio mortgages, it’s important to make sure you’re avoiding plagiarism. Plagiarism is when you use someone else’s words or ideas without giving them credit, and it’s a big no-no when it comes to writing about any subject. To avoid plagiarism when writing about high ratio mortgages, you should make sure to always do your research and cite your sources. Use your own words to explain complex topics, and if you do quote someone, always include the source. Additionally, double-check all your work with a plagiarism checker to make sure you haven’t inadvertently copied something that someone else has written. With a little extra effort, you can make sure your writing about high ratio mortgages is up to scratch and completely plagiarism-free.