Hey everyone! Are you a young adult just starting out and looking to buy your first car, but don’t have any credit history? Don’t worry, I got you! Getting a car loan with no credit history might seem like a daunting task, but it’s actually much easier than you would think. In this article, I’m going to show you exactly how to get a car loan with no credit history. With my tips, you’ll be driving off in your dream car in no time!

Understand the Basics of Car Loans and Credit History

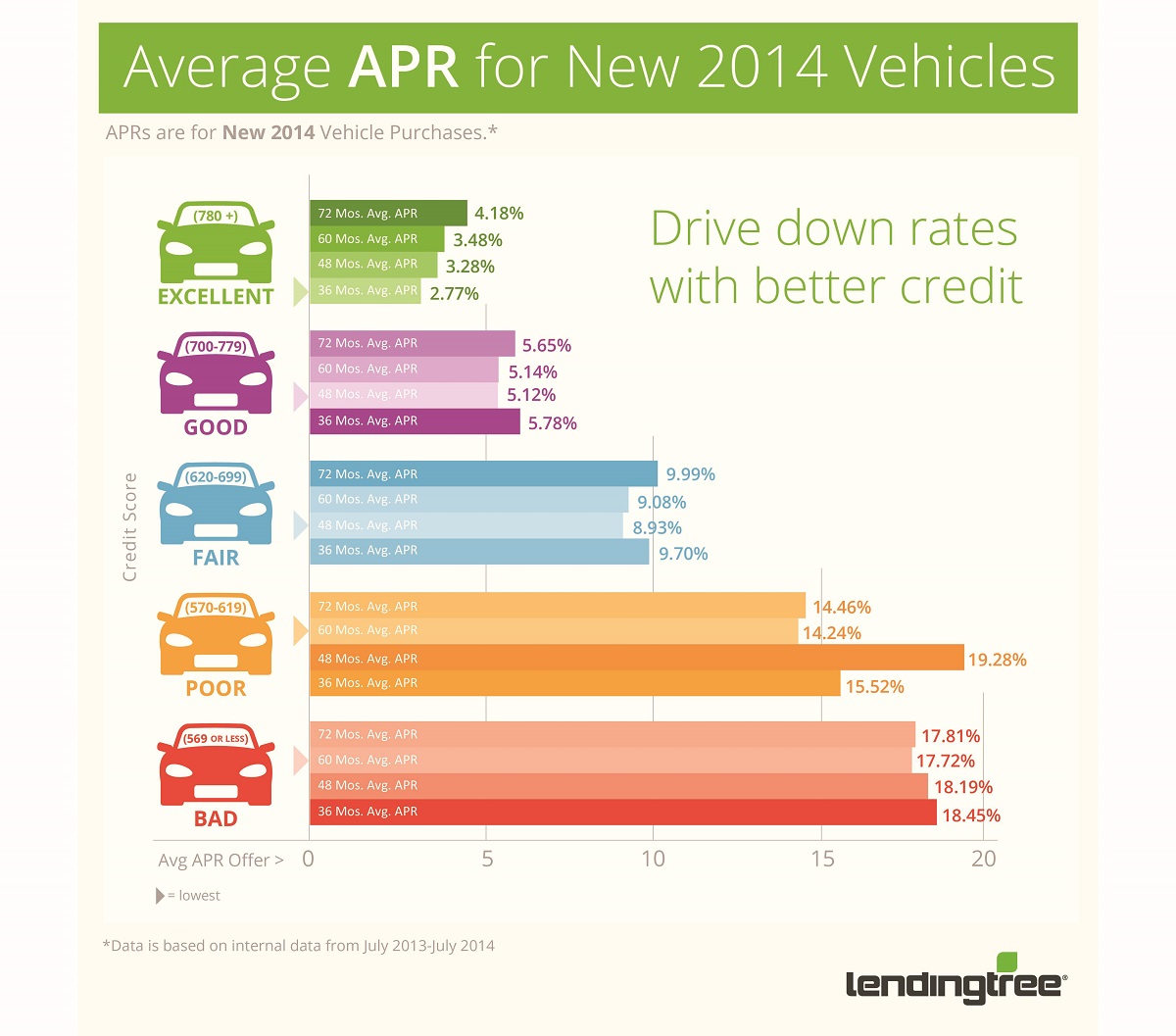

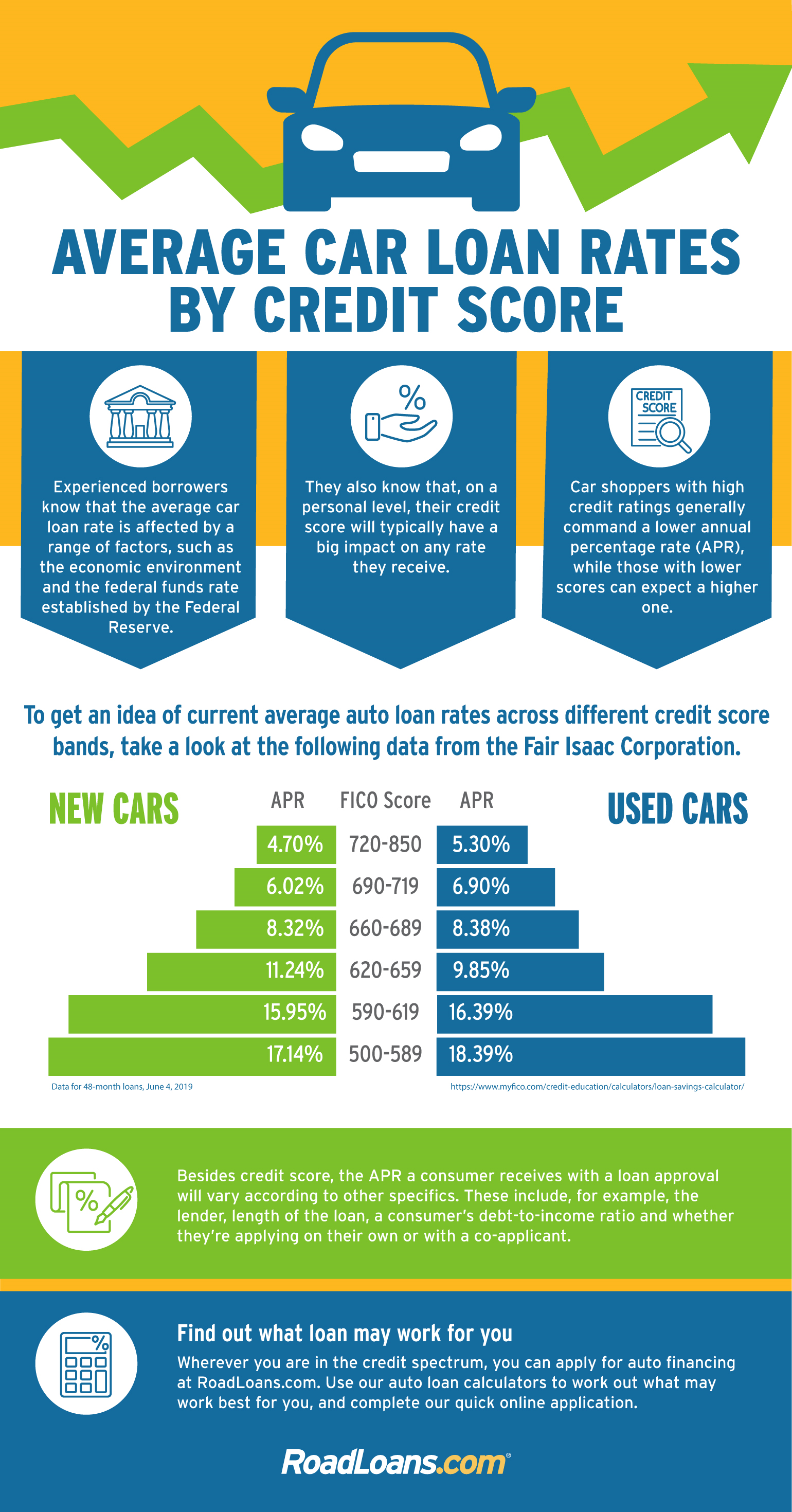

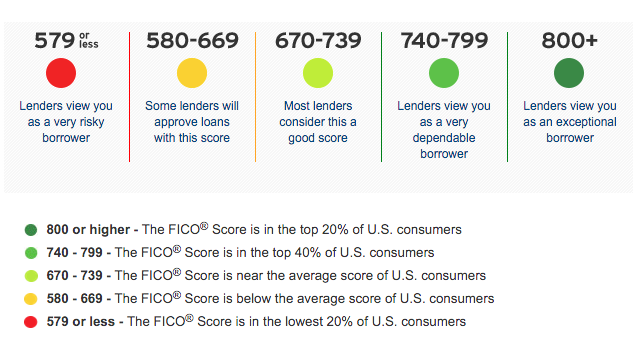

Getting a car loan with no credit history can be a daunting task. As a college student, I understand that it can be hard to build credit if you’re just starting out. It’s important to understand the basics of car loans and credit history if you want to find success. Your credit score is the most important factor when it comes to getting a car loan with no credit. A good credit score will open up more loan opportunities and better interest rates. It’s also important to understand how a car loan works. Research the different types of loans, interest rates, and repayment terms before making any decisions. Knowing these basics can help you make an informed decision and ensure you get the best car loan for your situation.

Know Your Credit Score and Improve It

As an 18 year old student, I understand the importance of having a good credit score. Knowing your credit score is essential when it comes to applying for a car loan. It’s important to realize that if you don’t have any credit history, you can still improve your credit score. You can start by applying for a secured credit card, using it responsibly and paying it off on time. You can also look into getting a co-signer or using a cosigner loan to help you qualify for a car loan. With some effort and dedication, you can improve your credit score and increase your chances of getting a car loan with no credit history.

Locate the Right Lender for Your Situation

Finding the right lender for your situation can be difficult when you have no credit history. To get the best deal on a car loan, I’d recommend doing research on different lenders to compare rates and terms. You should also make sure you understand the loan terms and conditions, including any fees or prepayment penalties. Additionally, make sure that the lender is reputable and reliable. Check online reviews, ask friends and family for referrals, and read up on customer service ratings. With the right lender, you can get a car loan without having any credit history.

Research the Loan Options Available

Researching loan options available can be quite intimidating if you don’t know where to start. As an 18-year-old student, I found out that there are some car loan options for people with no credit history. I began by checking the banks I already have accounts with, to find out if they offer no credit auto loans. I also looked into credit unions, which usually have more flexible requirements for borrowing money. Finally, I looked at online lenders, who could provide more competitive rates than traditional lenders. I found out that by doing my research, I was able to get a car loan with no credit history.

Find the Right Car and Negotiate a Good Loan Deal

As an 18 year old, I understand how difficult it is to get a car loan with no credit history. But it is still possible to get a car loan without any credit history. The key is to find the right car and negotiate a good loan deal. The first step is to shop around for a car that fits your budget. Once you find a car, do your research to figure out a good price for it. Then use this research to negotiate a lower price. Once you get a good loan deal, you can use your savings to pay the down payment and apply for the loan. With a good loan deal and a good down payment, you can get a car loan even with no credit history.