Are you a student thinking about starting a business? Perhaps you’ve heard about business loans but you’re not sure what types of loans there are or how to get one. Don’t worry, you’re not alone! Understanding the different types of business loans can be complicated and intimidating, but it doesn’t have to be. In this article, we’ll break down the different types of business loans and explain how to get the one that best suits your needs.

What to Know Before Applying for a Business Loan

Before applying for a business loan, it’s important to understand the different types of loans available to you. Whether you’re looking for a short-term loan to cover operational costs or a long-term loan for major investments, there is an option available to fit your needs. Knowing your credit score, the amount you want to borrow, and the repayment terms are all essential when you’re applying for a loan. You should also be aware of the additional fees and interest rates associated with the loan. Finally, take the time to research different lenders and compare the rates and terms they offer. Doing your due diligence can help you find the loan that best fits your business’s needs.

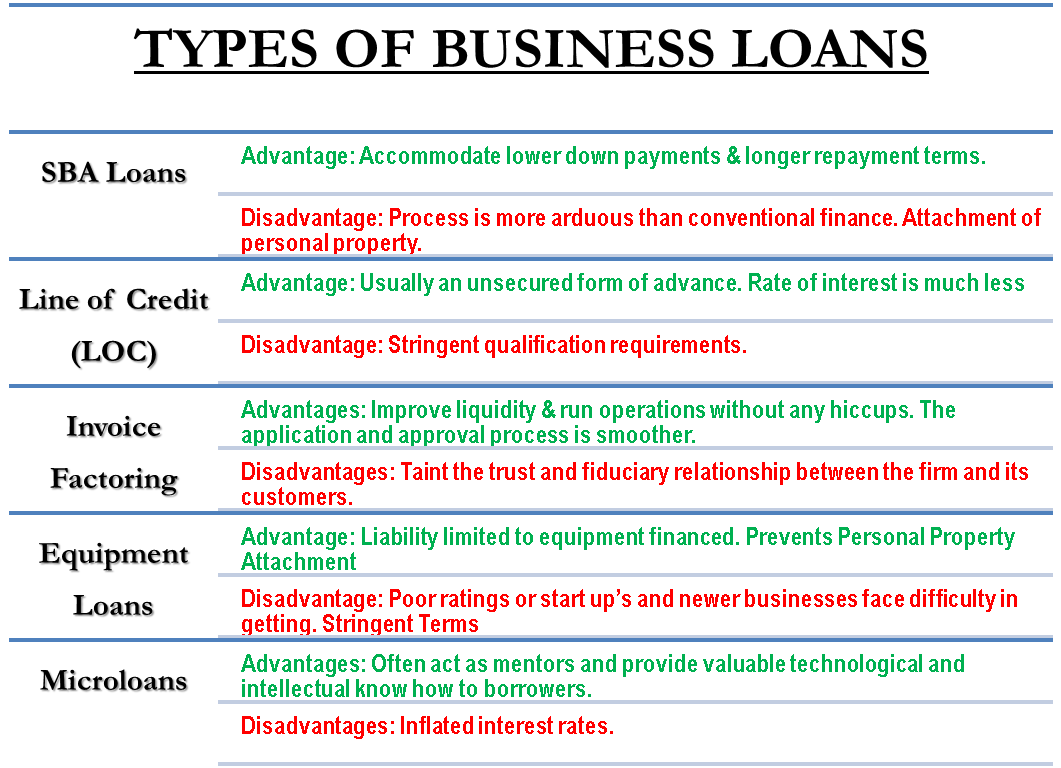

Exploring Different Types of Business Loans

There are many different types of business loans available depending on your business needs. Short-term loans are great for covering expenses that are needed immediately, such as inventory, marketing or payroll costs. Long-term loans can provide more substantial financing for larger projects, such as purchasing a piece of equipment or renovating a building. Unsecured loans are not backed by any collateral, but they tend to come with higher interest rates and shorter repayment periods. Secured loans are backed by some form of collateral, such as a house or car, and they tend to come with lower interest rates and longer repayment periods. Lines of credit provide flexibility and can be used as needed, but they come with higher interest rates and shorter repayment periods. Understanding the different types of business loans and what they offer can help you make the right choice for your business.

How to Find the Right Business Loan for Your Needs

Finding the right business loan for your needs can be tricky, especially if you’re a student. Luckily, there are tons of resources out there to help you compare different loan products and find one that works for you. Start by researching online and looking into what different lenders have to offer. Be sure to look at the interest rates, repayment terms, and other important details. You can also talk to your local bank or credit union to discuss their loan options. Lastly, don’t forget to read reviews and ask around to get other people’s opinions on the best business loans. With the right research and preparation, you can find the perfect loan to help your business grow.

Common Pitfalls to Avoid when Seeking a Business Loan

When looking for a business loan, it’s important to be aware of the common pitfalls to avoid. First, make sure you’re aware of all the potential fees associated with the loan and have a clear understanding of the repayment terms. Also, be sure to shop around for the best rates and terms for the loan you’re seeking. Finally, don’t be afraid to ask the lender questions and don’t be afraid to walk away if the loan doesn’t feel right. Taking the time to research and compare loan offers can save you money in the long run.

Strategies for Maximizing the Benefits of a Business Loan

Maximizing the benefits of a business loan requires a good strategy. As an entrepreneur, you should conduct thorough market research and create a business plan to identify the most suitable loan for your needs. Additionally, it’s recommended to shop around for the best terms, asking for quotes from different lenders. Negotiate for lower interest rates and more flexible repayment terms. Also, review the types of collateral you can use to secure the loan and decide which is the most suitable for your business. Finally, take advantage of educational resources to understand the loan better and make sure you’re getting the best deal.