If you’re like me, a student with multiple loans, you know how hard it can be to keep track of them all and make sure you’re making your payments on time. Having multiple loans can also make it hard to budget and make it difficult to pay off your debt. Thankfully, there is a way to make it easier to manage your loans and lower your monthly payments – loan consolidation. In this article, I’m going to explain the benefits of loan consolidation, how to consolidate your loans, and how to lower your monthly payments.

Overview of Loan Consolidation and Its Benefits

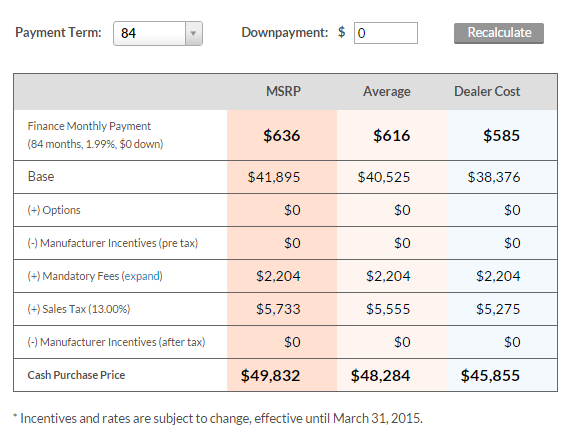

As an 18-year-old student, I am always looking for ways to save money, and loan consolidation is one way to do that. Loan consolidation is a process of combining multiple loans into one and making a single, more affordable payment. This can lower your monthly payments, reduce interest rates and help you stay organized. There are several benefits to consolidating your student loans, such as simplified monthly payments, quicker repayment, and the potential to lower your interest rate. Additionally, loan consolidation can also provide access to alternative repayment plans, such as income-driven repayment and extended repayment plans. Therefore, loan consolidation can be a great way for students to save money and manage their loans more efficiently.

Types of Loans That Can Be Consolidated

When it comes to consolidating loans, there are a few types of loans that can be consolidated into one. These include student loans, credit card debt, medical bills, and other personal loans. By consolidating all of your loans, you can lower your monthly payments, save on interest, and have one easy payment to make each month. This can help you pay off your loans faster, and save you money in the long run. Consolidating can be a great way to get yourself out of debt quickly and easily.

Steps to Consolidate Your Loans

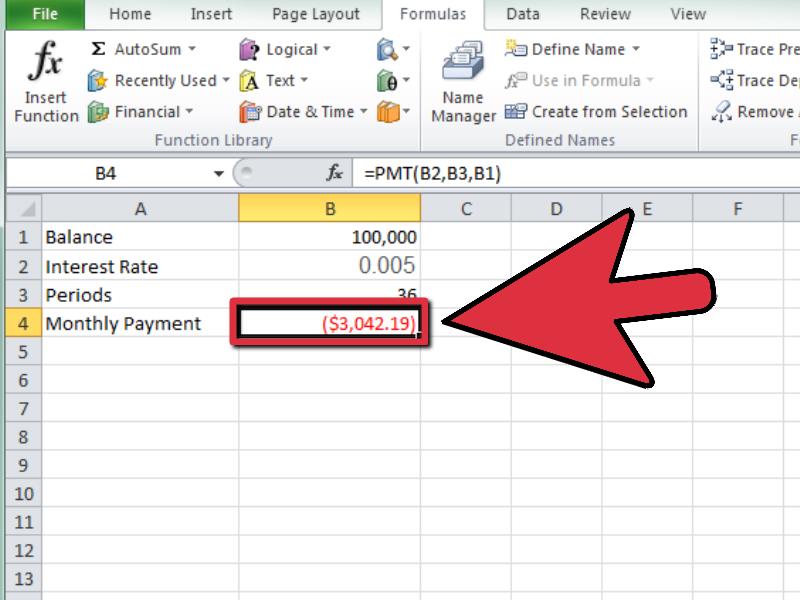

Spending hours and hours to calculate my student loan payments was so confusing and draining. I was determined to find a way to reduce my monthly payments, so I researched more and found out that loan consolidation could be the best solution. To consolidate my loans, I needed to start by finding out which type of loan I had, then I needed to apply for a Direct Consolidation Loan, and finally, I had to select a repayment plan. It was a bit overwhelming but I was determined to make the process easier and lower my monthly payments.

Tips to Save Money When Consolidating Your Loans

If you’re looking to save money on your loan repayments, consolidating your loans can be a great option. Whether you have multiple student loans, credit cards, or car loans, consolidating them into one loan can help reduce your monthly payments and save you money. It can also make it easier to keep track of your payments and manage your finances. Here are some tips to help you save money when consolidating your loans: shop around for the lowest rates and terms; look for a loan with no or low origination fees; and keep your loan term as short as possible. Doing this can help you save hundreds of dollars in interest and save you a lot of money in the long run.

Common Mistakes to Avoid With Loan Consolidation

When it comes to loan consolidation, there are some common mistakes that many young people make. One of the most important things to remember when consolidating your loans is to not over-consolidate. This means that you should only consolidate the loans that will benefit you most, rather than consolidating all of your loans into one. Another mistake to avoid is consolidating too quickly. Before you consolidate, it’s important to make sure you understand all of the terms and conditions associated with the loan. Lastly, don’t forget to compare different lenders to get the best rate. Doing your research and understanding the terms of the loan can help you save money in the long run.