Are you looking for help to fund your next home renovation project? Whether you’re a student looking to spruce up your space or a homeowner looking to make some improvements, there are lots of loan options available to choose from. In this article, we’ll break down the 5 best loans for home renovations, so you can get the funds you need to bring your renovation dreams to life!

What Types of Loans Are Available for Home Renovations?

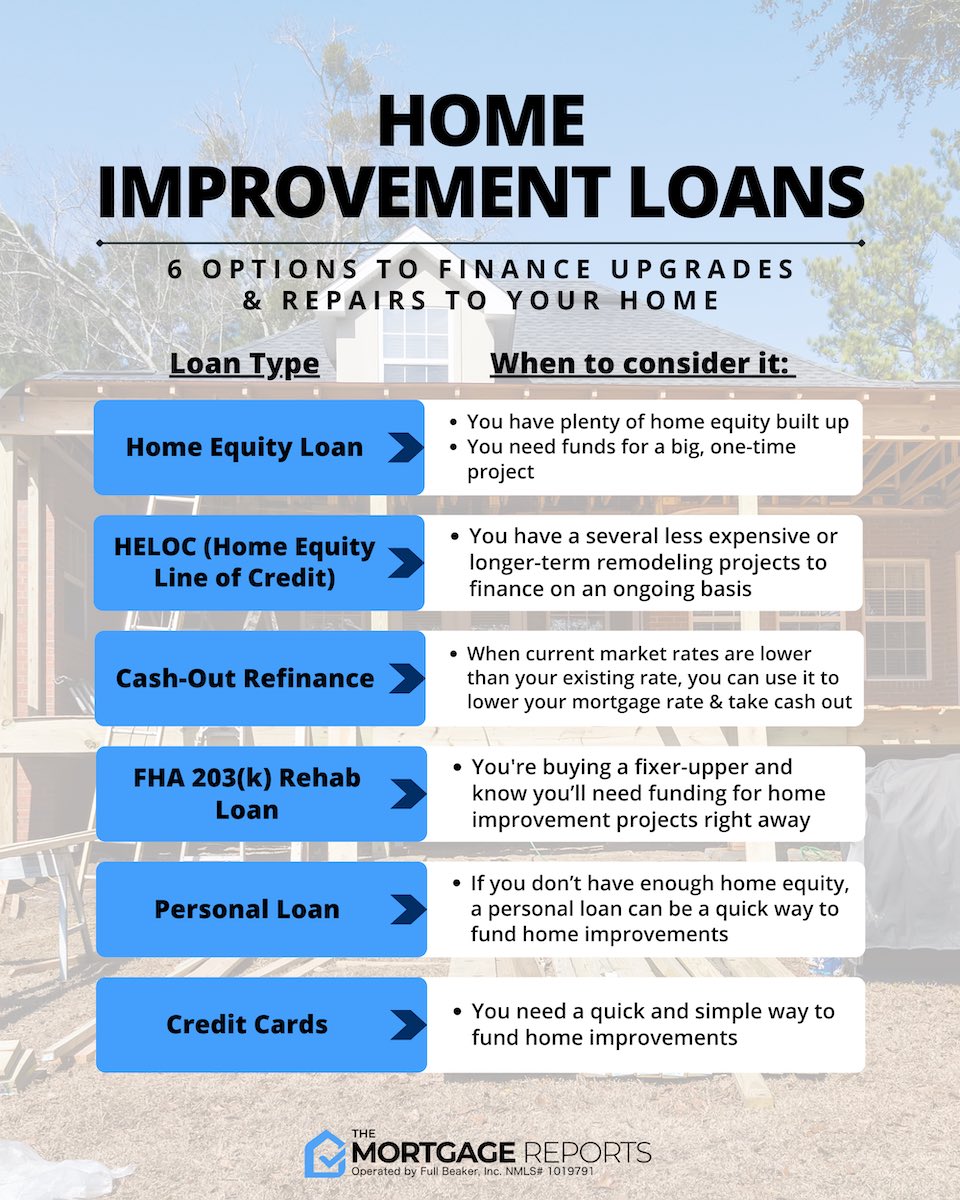

When it comes to financing home renovations, there are lots of different loan types available. Most common are personal loans, home equity loans, home equity lines of credit, and cash-out refinances. Personal loans are unsecured loans that can be used for almost any purpose. Home equity loans are secured loans that use the equity in your home as collateral. Home equity lines of credit are similar but are more like a revolving line of credit instead of a one-time loan. Cash-out refinances allow you to borrow against the equity in your home to get cash for your renovations. Each loan type has its own pros and cons, so it’s important to do your research and find the best loan for your needs.

How to Choose the Right Loan for Your Home Renovation Project

Choosing the right loan for home renovations can be tricky since there are so many options available. Before committing to a loan, it is important to consider the terms of the loan, the interest rate, and the payment options. Additionally, it is important to determine how much you are able to borrow and the length of the loan. With the right loan, you can save money and make your home renovations easier. Doing research and comparing loan options is a great way to choose the right loan for your home renovation project. Keep in mind that short term loans may have higher interest rates, so be sure to weigh the pros and cons of each loan before making a decision.

Benefits of Using a Loan for Home Renovations

If you’re thinking about home renovations, taking out a loan to cover the costs can be a great idea. It’s important to compare different loan options to find the best one for your needs. Taking out a loan for home renovations can offer a number of benefits, such as: gaining access to more funds, having the option of a fixed rate loan, and being able to spread the cost of the renovations over time. Additionally, loan rates are generally lower than other financing options, and you can often get a loan that is tailored to your specific needs. With the right loan, you can make your home renovation dreams come true.

The Pros and Cons of Using Personal Loans for Home Renovations

Using personal loans for home renovations can be a great option for those who need to borrow money quickly. The pros of a personal loan include flexibility, as you can use the money for whatever you need, including home improvements. You also won’t have to put up any collateral, which is a great bonus. The cons include the potential for high interest rates, which can make it difficult to pay back the loan. Additionally, you’re taking on a lot of risk by using a personal loan, as you’re personally responsible for any missed payments, which could damage your credit score. Ultimately, it’s important to do your research and find the best loan option for your situation.

Tips for Finding the Best Loan for Home Renovations

If you’re planning a home renovation, it’s important to find the best loan for your needs. Here are some tips to help you find the right loan:1. Research different loan options and compare interest rates, repayment terms, and other fees.2. Look for a loan with a low interest rate and reasonable fees.3. Consider applying for a loan with a fixed interest rate, so you don’t have to worry about fluctuating rates.4. Consider the loan terms and make sure you can afford the monthly payments.5. Make sure the loan can be used for the renovations you need and that it fits within your budget.