Are you looking for a way to purchase a home with little to no money down and a competitive interest rate? Look no further than a USDA mortgage, which is a government-backed loan program that can help you finance your dream home with relatively low payments. In this full guide, we’ll explain everything you need to know about a USDA mortgage, from eligibility requirements to interest rates and more.

What is a USDA Mortgage?

A USDA mortgage is a government-backed loan that can help you purchase a home in rural or suburban areas. These loans are designed to make it easier for people to buy homes in areas where access to financing can be limited. With a USDA loan, you don’t need a down payment, and you may be able to get a lower interest rate than you would with a traditional mortgage. Plus, there are no income restrictions or property eligibility requirements, so almost anyone can qualify. With the help of a USDA mortgage, you can get the keys to your dream home without breaking the bank.

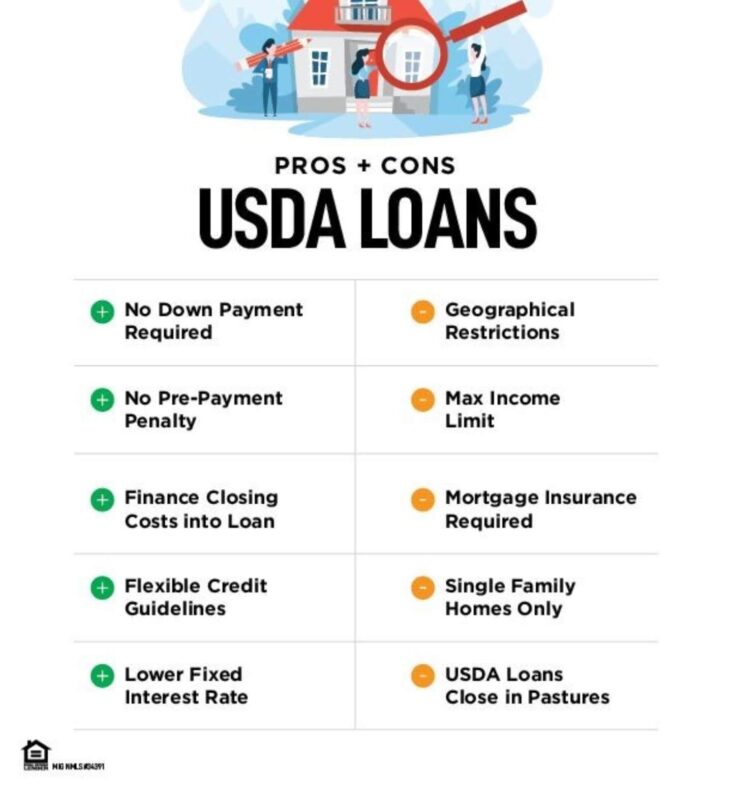

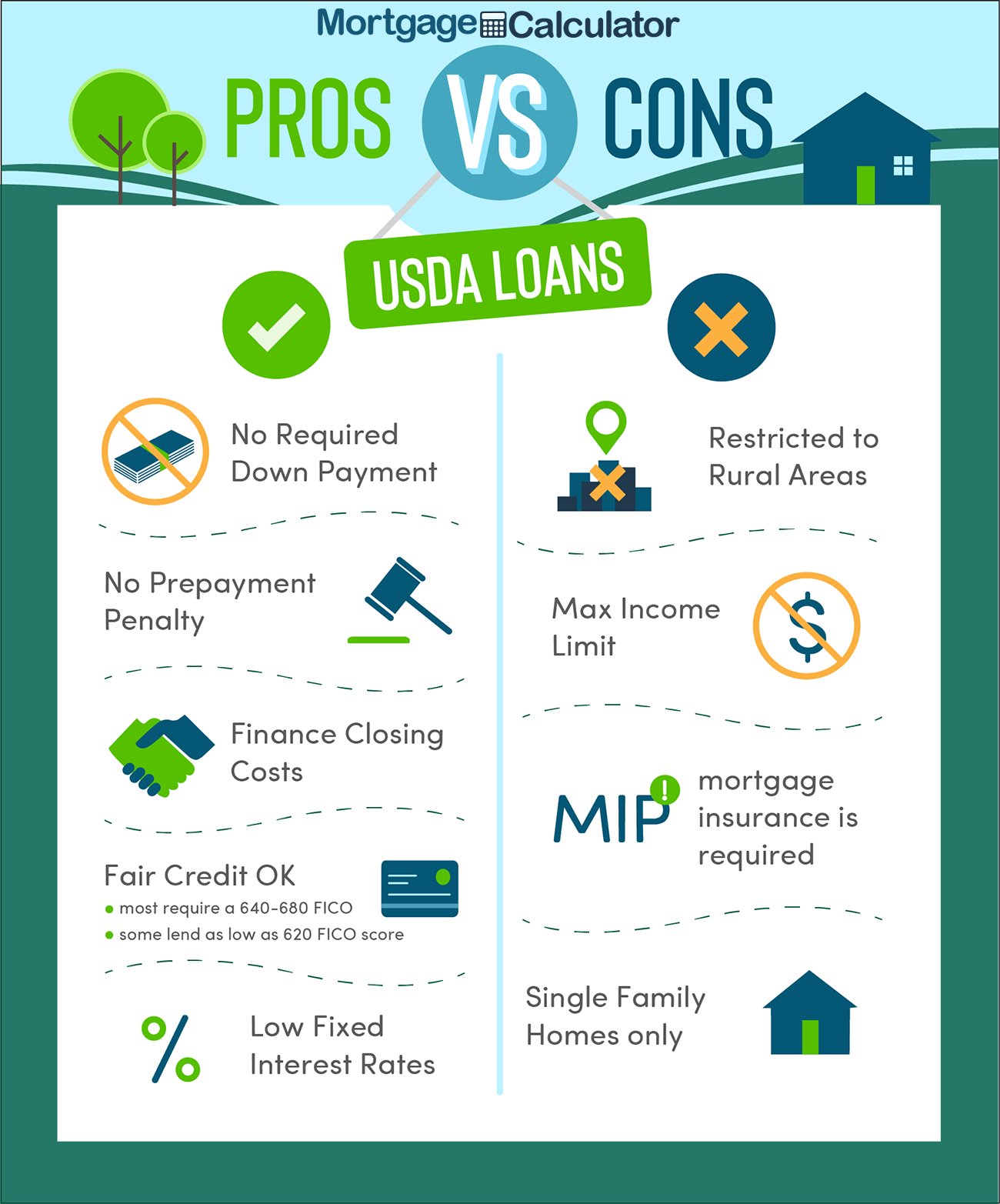

Benefits of a USDA Mortgage

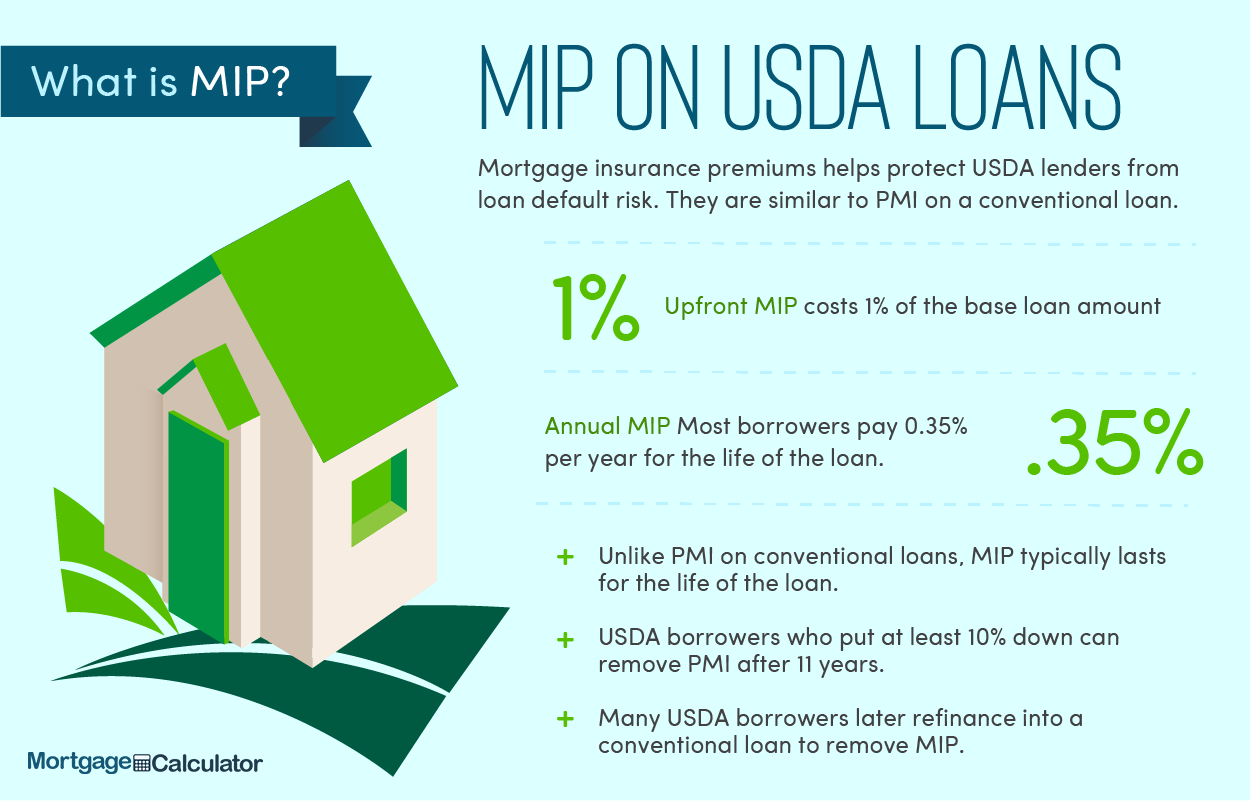

USDA Mortgages are an awesome way to get into a new home without breaking the bank. Not only are these mortgages backed by the US Department of Agriculture, but they come with tons of benefits, like low interest rates, no down payment required, and no mortgage insurance premiums. Plus, the USDA offers generous income limits, so you can still qualify for this type of loan even if you don’t make a lot of money. And if you’re a veteran, you can get even more generous terms and even lower interest rates. With all these perks, it’s no wonder why so many people are turning to USDA Mortgages to finance their new homes.

Eligibility Requirements for a USDA Mortgage

If you’re looking to purchase a home in a rural or suburban area, you may be eligible for a USDA mortgage. To qualify, you need to meet certain eligibility requirements, like having a steady income, good credit score, and a debt-to-income ratio of no more than 41%. You also need to meet the USDA’s income limits, which vary by location. Additionally, you’ll need to purchase a property in an eligible area and use the home as your primary residence. Meeting all of these criteria can be a challenge, but if you’re able to do so, you could be eligible for a great deal on a home with a USDA mortgage.

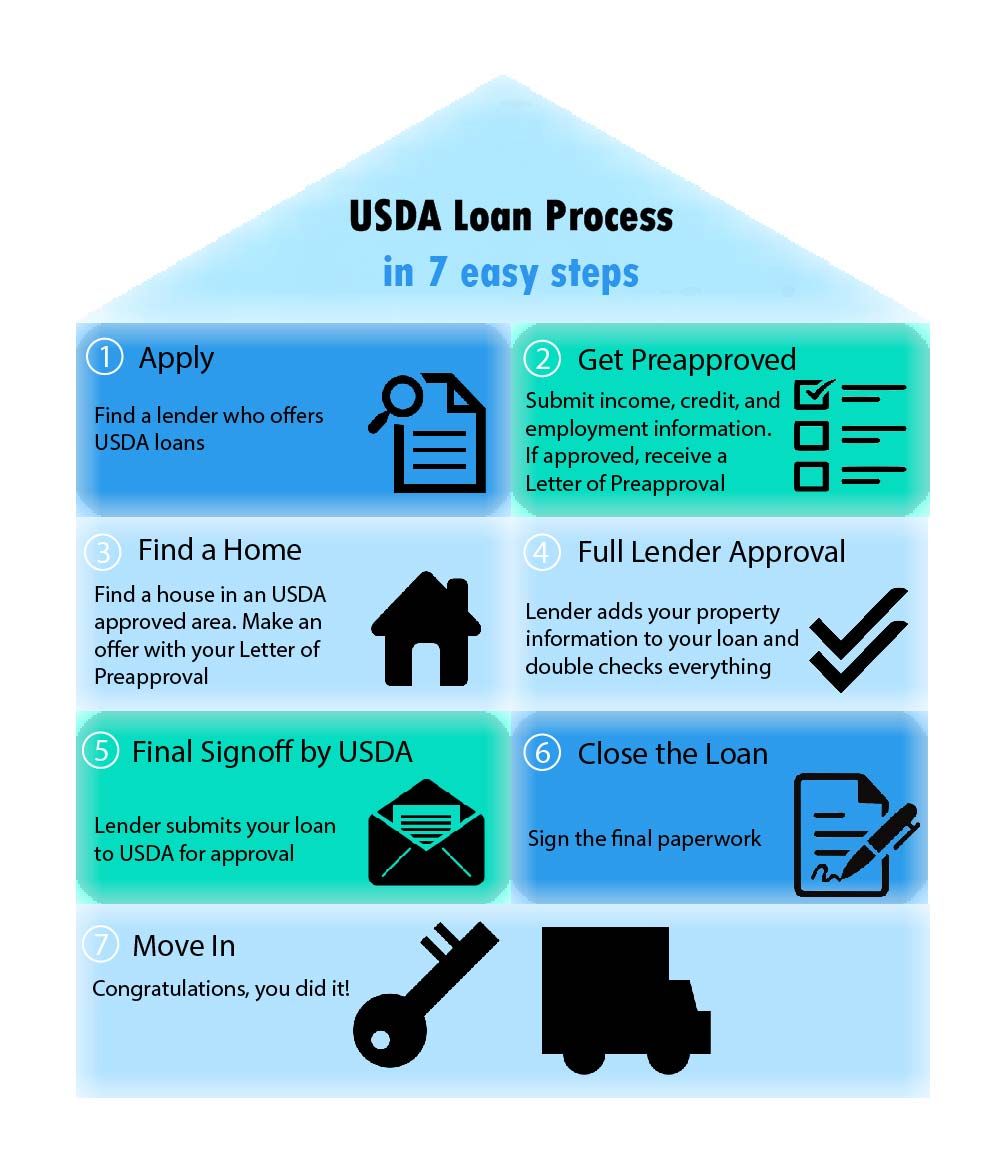

Applying for a USDA Mortgage

Applying for a USDA Mortgage is a great option for potential home buyers looking to purchase a home in a rural area. The process is relatively straightforward, and the application can be filled out online. Before starting the application process, it’s important to have all the necessary documentation and information ready. This includes proof of income and identity, documents that show your credit score and payment history, and a complete list of assets. Once all the required documentation is gathered, potential buyers can start the application process. The USDA Mortgage team will review the application and contact the applicant to discuss the next steps. After the application has been approved, the buyer can start shopping for a home and eventually close on the loan. The USDA Mortgage team is also available to answer any questions or concerns throughout the entire process.

Tips for Avoiding Plagiarism with a USDA Mortgage Guide

When you’re writing a USDA mortgage guide, it’s important to make sure you’re not committing plagiarism. Plagiarism can get you into a lot of trouble, so it’s best to avoid it altogether. Here are some tips for avoiding plagiarism when writing your USDA mortgage guide:• Always give credit where credit is due. Cite your sources and mention any material you’ve borrowed from someone else.• Rewrite any material that you’ve borrowed from another source. Even if you are using someone else’s words, make sure that it’s in your own voice and you’ve put your own spin on it.• Don’t copy and paste. If you’re using someone else’s work, make sure you’ve rewritten it in your own words and that it’s different enough from the original source to avoid plagiarism.• When in doubt, cite it. If you’re not sure if a certain piece of information is original or if it’s been borrowed from another source, make sure you cite it anyway just to be safe.By following these tips