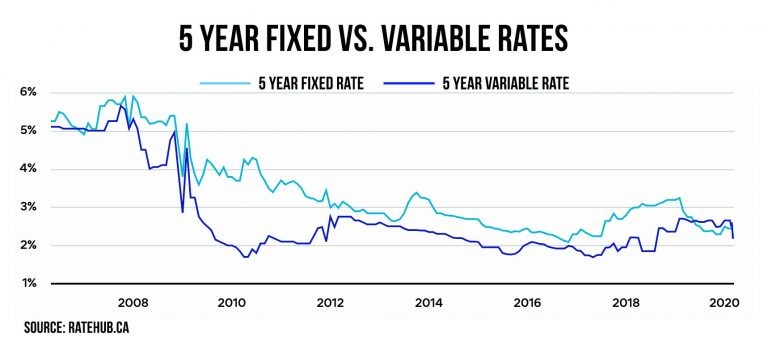

A Variable Rate Mortgage (VRM) can be a great option if you’re looking to save money on your home loan. With a VRM, your mortgage interest rate can change based on changes in a market index, such as the Prime Rate. This makes your payments more flexible, as your rate can go up or down depending on the financial climate. With a VRM, you can take advantage of lower interest rates when the market is favorable, allowing you to save significant amounts of money on your home loan.

Advantages and Disadvantages of Variable Rate Mortgages

Advantages of Variable rate mortgagesOne of the major advantages of a variable rate mortgage is that it typically offers a lower interest rate than a fixed rate mortgage. This means that you could save significantly on the cost of your home loan over time. Additionally, if interest rates drop, you’ll benefit from lower payments. This can give you some financial flexibility and help you to save money on your mortgage.Another benefit of a variable rate mortgage is the potential for increased cash flow. With a variable rate mortgage, you could take advantage of lower rates and choose to pay more than your minimum payment each month. This could help you to pay off your mortgage faster and save you money on interest payments.Disadvantages of Variable rate mortgagesOne of the major drawbacks of a variable rate mortgage is that it can be risky. If interest rates rise, you could end up paying more each month than you had planned on. This could cause financial strain and make it difficult for you to keep up with your payments.Another downside of a variable rate mortgage is that you may not be able to take advantage of rate cuts. This means that if interest rates go down, the lender can adjust your rate to whatever they decide. This could

How to Choose a Variable Rate Mortgage

Choosing the right variable rate mortgage is a big decision. It’s important to take your time and do some research before you commit. Make sure you understand the terms and conditions and that the mortgage aligns with your financial goals. Consider factors like your credit score, loan-to-value ratio, and debt-to-income ratio to help you determine which type of mortgage is best for you. Additionally, review the lender’s customer reviews and ratings to ensure you’re getting the best service possible. Lastly, compare different lenders to make sure you’re getting the best deal. With the right information, you can make an informed decision and find the perfect variable rate mortgage for you.

Understanding the Different Types of Variable Rate Mortgages

Variable rate mortgages come in many different types, all of which offer different benefits and drawbacks. One of the most popular types of variable rate mortgage is an adjustable-rate mortgage (ARM). This type of mortgage has an initial rate that is fixed for a period of time, usually about five years, and then adjusts periodically for the rest of the loan. The rate can go up or down based on market conditions, making it a great option for those who want to take advantage of lower interest rates. Another popular type of variable rate mortgage is a hybrid ARM, which combines the stability of a fixed rate with the potential for lower rates. Hybrid ARMs start with a fixed rate for a period of time, usually three to seven years, and then adjusts periodically based on market conditions. The rate could go up or down, making it a great option for those who are looking for flexibility.

How to Calculate the Costs of a Variable Rate Mortgage

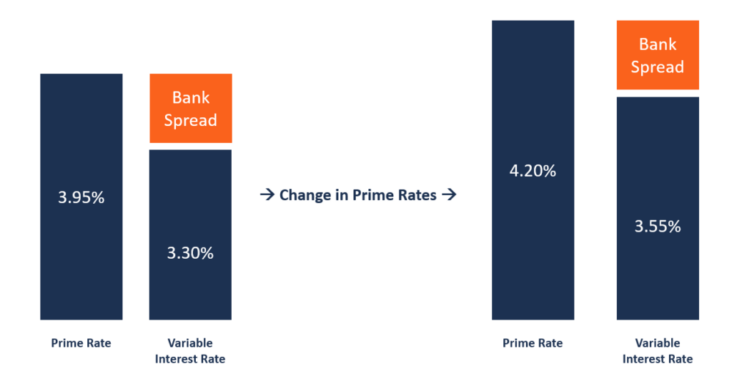

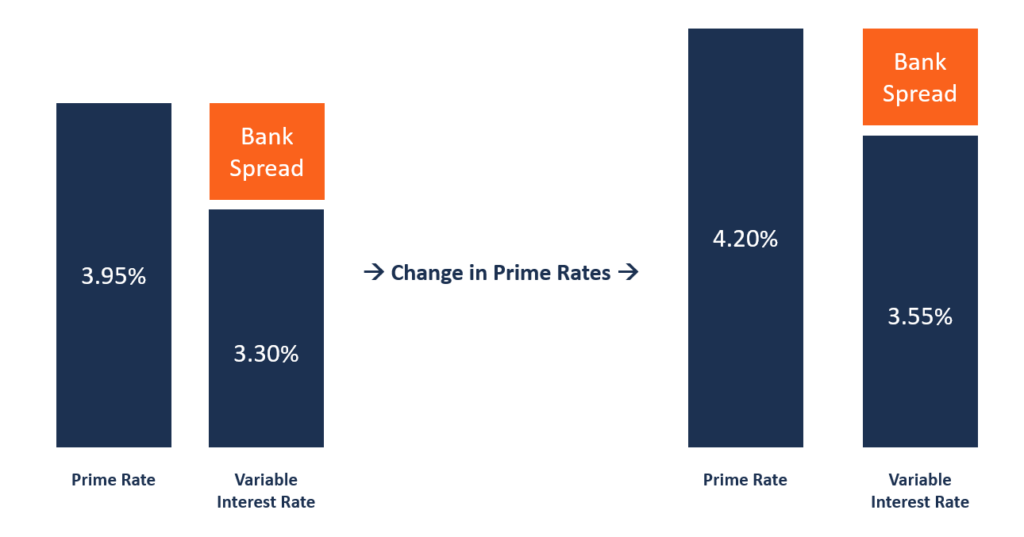

Calculating the cost of a variable rate mortgage is an important step in the home buying process. Knowing the potential costs associated with a variable rate mortgage can help you make an informed decision on whether or not this type of mortgage is right for you. To calculate the cost of a variable rate mortgage, you will need to take into consideration several factors, such as the loan amount, the loan term, the variable interest rate, and any closing costs. The variable interest rate is the most important factor to consider; it will fluctuate over time, meaning your monthly payments could increase or decrease depending on the current rate. You can also calculate the total interest paid over the life of the loan by multiplying the loan amount by the current rate of interest. Finally, make sure to factor in any closing costs associated with the loan; these costs can add up quickly and can significantly increase the total cost of the loan. Taking the time to calculate the cost of a variable rate mortgage is essential to making an informed decision about your mortgage.

Preparing Your Finances for a Variable Rate Mortgage

If you’re looking to take out a variable rate mortgage, it’s important to take the time to prepare your finances accordingly. Before you sign on the dotted line, make sure you understand the risks associated with a variable rate mortgage – this type of loan can be more unpredictable and may cause your monthly payments to fluctuate significantly. To ensure you can handle the potential financial fluctuations, review your budget and make sure you have an emergency fund set aside. Additionally, you should consider refinancing or switching to a fixed-rate loan if your rate gets too high. Taking the time to plan ahead can help you stay on top of your finances and make sure you can make your mortgage payments.