Mortgage amortization is an important concept to understand when buying a home. It’s a process that helps you pay off your debt in a structured, manageable way. By understanding a few basics and the benefits of mortgage amortization, you can make more informed decisions when it comes to financing your home. In this article, we’ll provide a comprehensive overview on what a mortgage amortization is and how it can help you manage your debt.

What is Mortgage Amortization?

Mortgage amortization is the process of paying off a loan with a series of regular payments over a specific period of time. These payments are broken down into two parts: the principal, which is the amount borrowed, and the interest, which is the cost of borrowing the money. Over time, these payments reduce the amount of money owed, allowing the borrower to eventually pay off the loan. Mortgage amortization is an important part of the loan process, as it allows for the borrower to have a clear understanding of how long it will take to repay the loan and how much of their monthly payment will go towards paying the principal and interest. This process is often used to calculate the monthly payments and overall cost of the loan. Additionally, mortgage amortization helps borrowers plan for the future, as each payment will be made with the same amount of principal and interest. At the beginning of the amortization period, most of the payments will go towards interest, with a smaller percentage towards the principal. As the loan is paid off, the amount of interest decreases while the amount of principal increases. This allows the borrower to gain equity in the property while repaying the loan. Overall, mortgage amortization

How Does Mortgage Amortization Work?

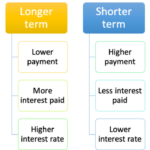

Mortgage amortization is the process of paying off a loan over time. It works by transferring a portion of each payment to the loan’s principal balance, and the rest to the interest due. Over the lifetime of the loan, the principal balance decreases and the interest decreases, which means that the amount of the monthly payment that is applied to the principal increases. This process is known as amortization. The key to understanding how mortgage amortization works is to understand the nature of the loan and its terms. For example, while a fixed-rate loan will have a fixed interest rate, an adjustable-rate mortgage (ARM) may have an initial fixed rate that changes periodically over the life of the loan. Additionally, the loan term, or the length of time it takes to repay the loan, will determine the loan’s amortization schedule. The loan’s amortization schedule will also be affected by the frequency of loan payments, such as monthly or bi-weekly, and the payment amount. Finally, the amortization schedule will be affected by any additional payments or prepayments made over the life of the loan, which can help to reduce the overall interest paid.

Benefits of Mortgage Amortization

Mortgage amortization has many benefits for borrowers. For starters, it allows for more manageable monthly payments. When you take out a loan, the amount you pay each month is determined by the length of the loan. Mortgage amortization helps you spread out the cost of the loan over a longer period of time, so your payments are much more manageable. This also makes it easier to plan for future expenses, since you won’t have to worry about a large payment coming due all at once. In addition, mortgage amortization can help you save money in the long run. When you amortize your loan, the interest you pay each month is spread out over the life of the loan. This means that more of your payments go towards the principal, and less towards the interest. This can potentially save you thousands of dollars over the life of the loan. Mortgage amortization can also help you pay off your loan faster. When you make your payments, some of the money goes towards the principal, so you’re paying down the loan faster. This can help you get out of debt quicker and save you money in the long run. Overall, mortgage amortization is an

Calculating Mortgage Amortization

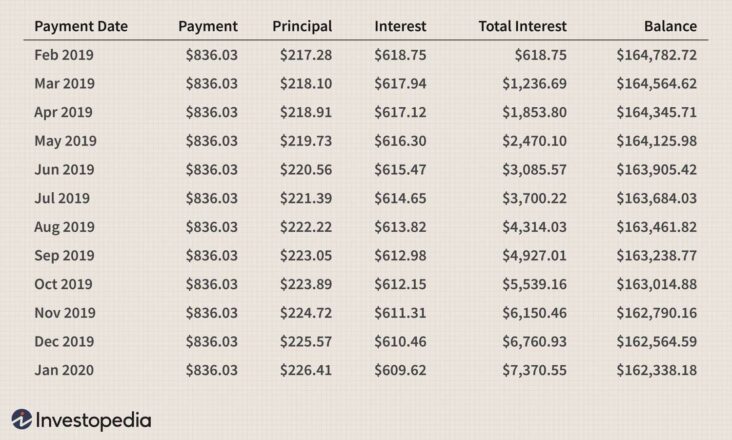

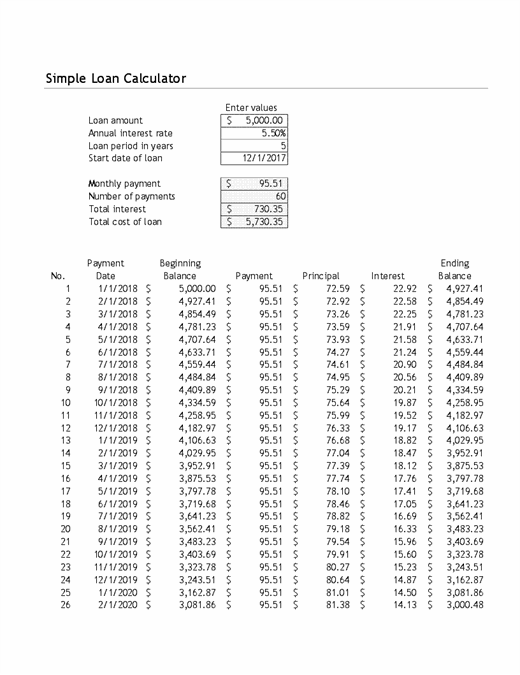

Calculating mortgage amortization is an important part of understanding how your mortgage works. This process involves breaking down your loan into its individual payments, so you can easily track how much you are paying each month. Amortization is determined by the amount of your loan, your loan’s interest rate, and the length of the loan. The amortization schedule is a breakdown of how your monthly payments are allocated to the principal and interest. The principal is the amount that you originally borrowed, and the interest is the cost of borrowing the money. As you make your payments each month, the amount that goes towards the principal increases, while the interest amount decreases, until the loan is paid in full. In addition to understanding how much you will be paying each month on your mortgage, the amortization schedule allows you to see the total cost of the loan. This includes the principal amount borrowed, plus the interest paid over the life of the loan. It is important to be aware of the total cost of the loan, as this will help you determine how much you can afford, and how long it will take to pay off the loan. Knowing this information can help you make the best financial decision possible when it comes to your mortgage.

Common Mistakes to Avoid with Mortgage Amortization

Making mistakes when it comes to mortgage amortization can be costly. One of the most common mistakes to avoid is not factoring in taxes and insurance when calculating your mortgage payments. It is important to remember that taxes and insurance are both separate from the loan payments. This can cause you to end up with a much bigger payment than you anticipated. Another mistake to avoid is not considering all of your options. There are different repayment plans available, such as accelerated payments, bi-weekly payments, and fixed payments. Taking the time to research your options can help you decide on the best plan for your financial situation. Finally, it’s important to stay up to date on your mortgage payments. Missing payments can lead to late fees and even foreclosure, so it’s important to make sure you make all of your payments on time. By avoiding these common mistakes, you can ensure that you have the best experience possible with your mortgage amortization.