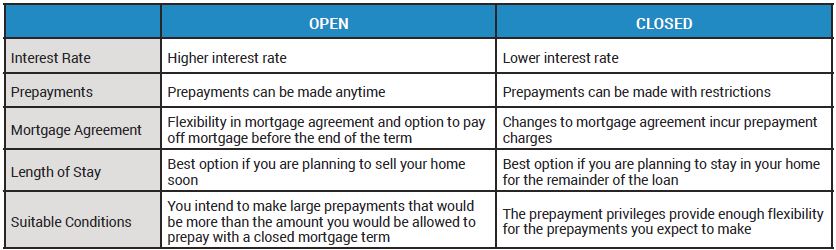

Are you considering purchasing a home with a closed mortgage? A closed mortgage is a type of loan that provides fixed interest rates for a set period of time. With this type of loan, you’re not able to make payments that are larger than the minimum amount, and you’re not able to pay off the loan in full before the end of the contract. Read on to learn more about what a closed mortgage is, and how it could benefit you.

What is a closed mortgage and why is it important?

A closed mortgage is a mortgage loan that cannot be paid out or renegotiated until its term is up. This type of loan is important because it allows borrowers to lock in their interest rate for the entire length of the loan. With a closed mortgage, the borrower won’t have to worry about their interest rate rising as the market changes, meaning they can have peace of mind knowing that their payments will stay the same. Additionally, closed mortgages can provide more flexibility in terms of repayment, offering a variety of payment options for the borrower that may not be available with other types of loans. Ultimately, a closed mortgage is a great option for those looking for a secure, long-term loan.

The Benefits of a Closed Mortgage

A closed mortgage is a great way to secure a low-interest rate on your home loan. It also gives you the peace of mind that comes with a locked-in rate, which means you don’t have to worry about the possibility of your payments increasing during the term of your mortgage. With a closed mortgage, you can also take advantage of prepayment privileges, allowing you to make extra payments or lump sum payments to pay off your mortgage faster and save on interest. Another great benefit of a closed mortgage is that you can choose the term of your loan, giving you more control over how long you will make payments. All of these benefits make a closed mortgage an attractive option for many home buyers.

What You Should Know Before You Get a Closed Mortgage

If you’re considering a closed mortgage, you should know that there are a few things to consider before you make the decision. First, you should understand that with a closed mortgage, you won’t be able to make additional payments or increase the frequency of your payments, so you’ll be locked in to the original terms of your loan. Additionally, if you choose to break your mortgage early, there could be a significant penalty that you’ll be required to pay. Finally, there may be restrictions on how much you can borrow against your home with a closed mortgage, so it’s important to make sure you understand exactly what you’re signing up for before you commit. With a closed mortgage, you can enjoy the security of a fixed rate and term, but it’s important to make sure you understand the details before you make any decisions.

How to Choose the Right Closed Mortgage

Choosing the right closed mortgage is an important decision that could affect you for years to come. To make sure you get the right mortgage for your needs, it’s important to consider a few key factors. First, consider your budget and how much you can afford to pay each month. If you’re on a tight budget, a closed mortgage with a lower interest rate may be better for you. Additionally, consider the length of time you plan to stay in the home. If you plan to stay for the long haul, a closed mortgage can give you peace of mind that comes with fixed payments for the entire term. Ultimately, it’s important to weigh your options carefully and make sure you choose the right mortgage for your situation.

What to Do if You Want to Get Out of a Closed Mortgage

If you’re stuck in a closed mortgage, don’t worry – there are options for getting out. Depending on your situation, you may be able to refinance or transfer your mortgage to another lender. Refinancing can be a great way to lower your interest rate, freeing up money for other things. Transferring your mortgage to another lender can often be done with little or no penalty and you may even be able to negotiate a lower interest rate. If you don’t want to go through the hassle of refinancing or transferring, you may be able to break your mortgage by paying a penalty. Breaking your mortgage is usually more expensive than the other options, but it can be worth it if you need to get out of your closed mortgage quickly.