Open mortgage is an innovative and revolutionary way of lending money for home purchases. It allows borrowers to customize their mortgage to fit their needs, giving them the flexibility and control to choose the best loan type, term, and interest rate. With Open mortgage, borrowers have access to a wide range of options, allowing them to make an informed decision and save money. This article will explore the advantages of Open mortgage, and explain how it can benefit potential home buyers.

Overview of Open Mortgage: What It Is & How It Works

Open mortgage is a unique type of loan that allows borrowers to have access to their home equity without having to go through the process of refinancing. It is the perfect solution for homeowners who want to tap into their home equity but don’t want to go through the hassle of refinancing. With an open mortgage, borrowers can access their home equity by simply making a lump sum payment or taking out a line of credit. This makes it easy for borrowers to access their funds quickly and easily, making it a great option for people who need a financial boost but don’t want to go through the process of refinancing. With an open mortgage, borrowers can also customize their loan to fit their budget and lifestyle. This allows them to choose the right loan terms and interest rate that will work best for them. Open mortgages are a great way to access your home equity without having to go through the hassle of refinancing.

Benefits of an Open Mortgage

![]()

An open mortgage is a great choice for those looking for flexibility in their mortgage payments. With an open mortgage, you have the option to make extra payments towards your principal balance whenever you can, without penalty. This is great for those who expect to receive a large sum at some point in the future, such as a bonus, inheritance, or tax refund, as they can use that money to pay off their mortgage debt faster. Not only does this save you money in interest over the life of the loan, but you can also pay it off at any time without incurring any expensive early-payment fees. Additionally, you can also opt to increase your regular payments to pay off your loan faster and save more money. With an open mortgage, you have the freedom and flexibility to make your payments how and when you want.

Tips for Choosing an Open Mortgage

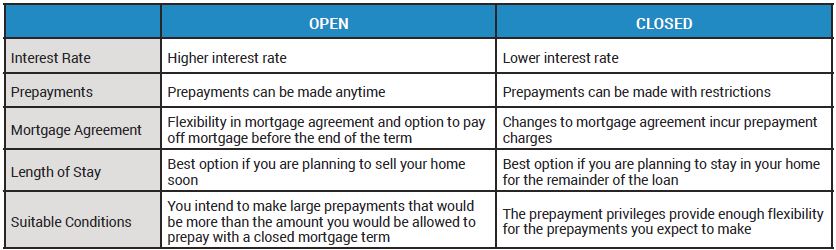

When choosing an Open Mortgage, it’s important to consider your long-term financial goals. An Open Mortgage offers greater flexibility than a traditional mortgage, allowing you to make lump sum payments or pay off the principal amount of the loan at any time without incurring a penalty. However, it also comes with higher interest rates and the potential for higher overall costs over the life of the loan. Take some time to weigh the pros and cons of an Open Mortgage before making a decision. It’s also a good idea to compare different lenders and their Open Mortgage offerings to make sure you’re getting the best deal. Doing your research and being informed about the different types of mortgages can help you make the best decision for your financial future.

How to Make the Most of an Open Mortgage

If you’re considering an open mortgage, you should know how to make the most of it. An open mortgage lets you pay off your principal at any time without penalty, meaning you can save on interest if you’re able to pay down your loan quickly. Start by crunching the numbers and setting a budget for yourself. Look at your current financial situation and figure out how much you can afford to pay each month. This will help you determine whether it’s more cost effective to pay down the loan quickly or to just make regular payments. Once you know how much you’re comfortable spending, you can look into different payment plans that fit within your budget. You can also consider refinancing your loan with another lender in order to get a lower interest rate. Finally, make sure you have an emergency fund in place in case you need to dip into it to make payments. With a little planning and financial savvy, you can make the most of an open mortgage and save yourself some cash in the long run.

Risks Involved with Open Mortgages

Open mortgages can be a great way to make some extra cash, but they come with some risks that you should be aware of before making any decisions. One of the biggest risks of open mortgages is that you may be subject to higher interest rates. Since you’re not locked into a fixed rate, your mortgage can fluctuate with the market, which can mean higher payments if the rates go up. Additionally, if you want to pay off your mortgage early, you could face a penalty for doing so. Furthermore, open mortgages typically have shorter terms than closed mortgages, so you may end up paying more interest in the long run. To avoid these risks, it’s important to understand the terms of your open mortgage and to shop around for the best rate.