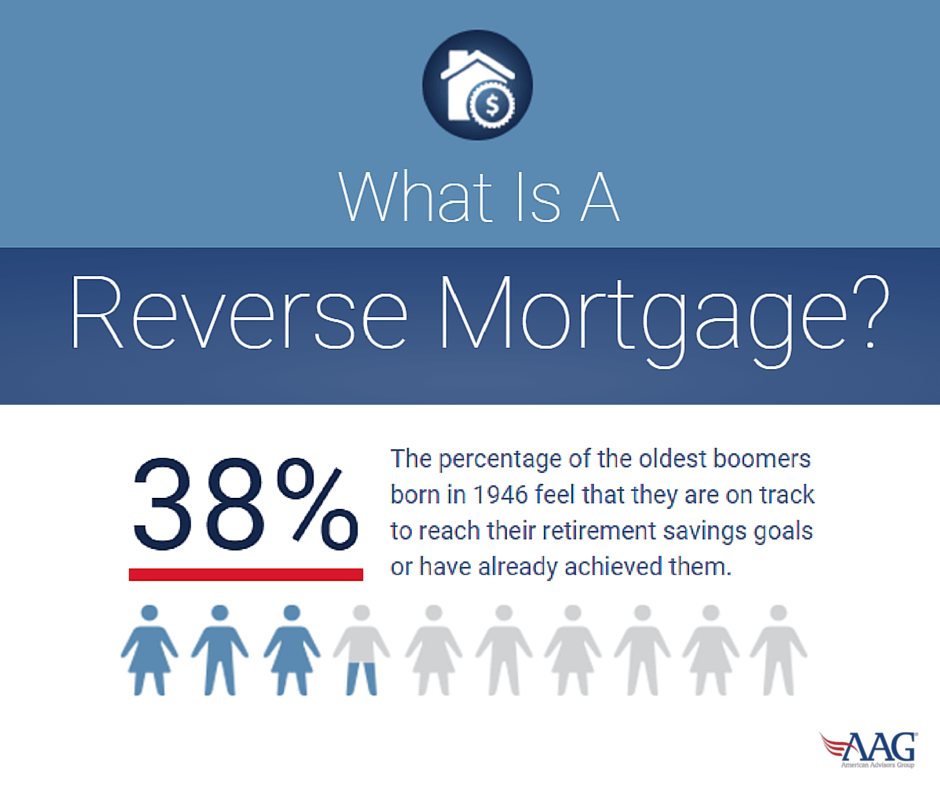

Reverse mortgages are a unique financial product that can help retirees access the equity they have built up in their homes. They enable older homeowners to borrow money against the value of their home that can be used for any purpose, without having to make monthly payments or sell their home. Reverse mortgages are a great way for retired homeowners to supplement their retirement income and make their retirement years more comfortable and secure.

Overview of Reverse Mortgages

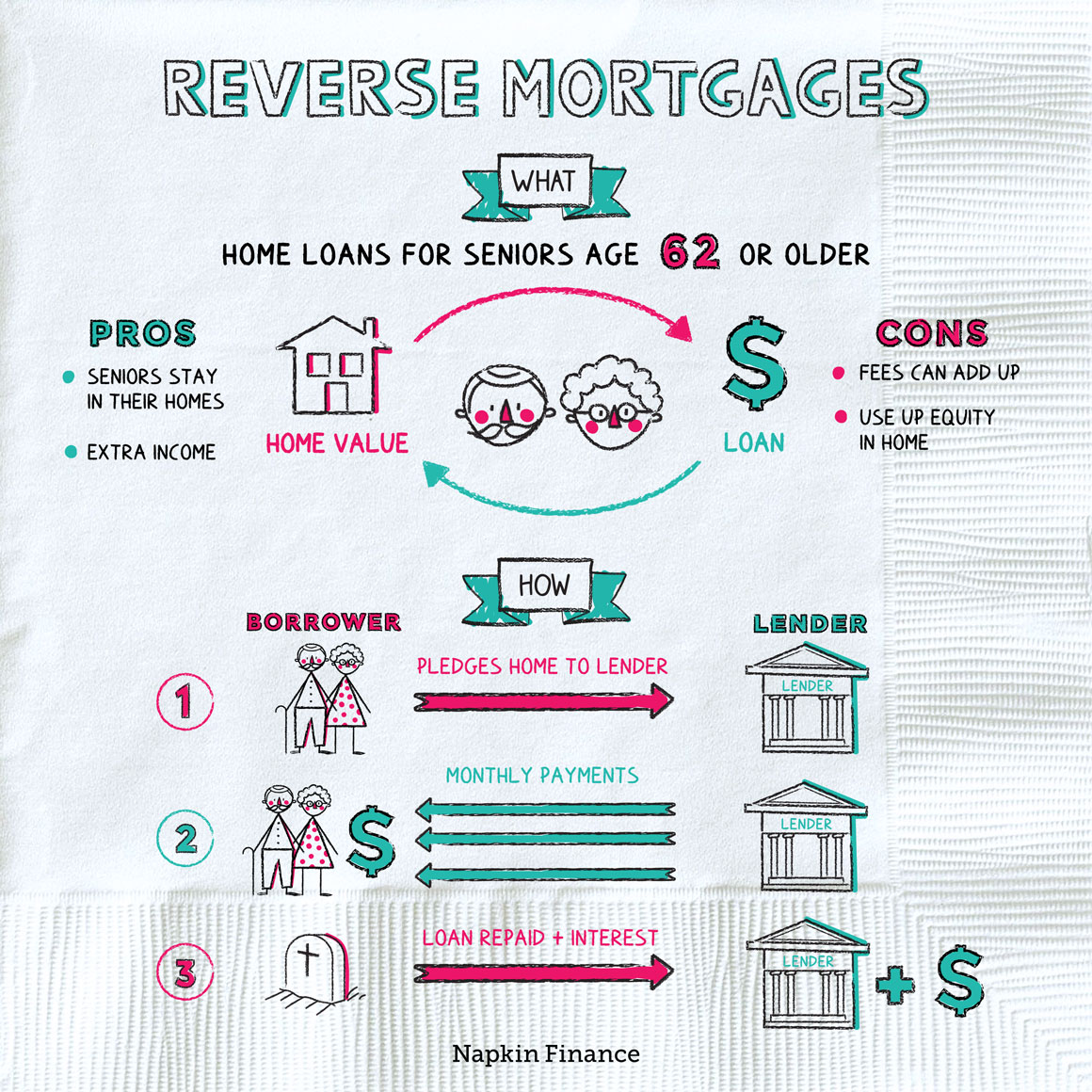

Reverse mortgages are an amazing option for those over the age of 62 who are looking to access some of the equity they have built up in their home. It allows you to convert that home equity into cash without having to sell or move out of your home. You can receive these funds in a lump sum or in monthly payments, depending on your needs and goals. Reverse mortgages are a special type of loan that does not require you to make monthly payments for repayment. Instead, the loan is repaid when the house is sold or when the borrower passes away. This makes it a great option for retirees who want to access the equity in their home without having to worry about making regular payments. Plus, it can be a great way to supplement your income in retirement.

Benefits of Reverse Mortgages

Reverse mortgages come with a lot of benefits, making them a great option for people who need to supplement their retirement savings. One of the best benefits of a reverse mortgage is the fact that you don’t have to make any monthly payments. Instead, the loan is repaid when the homeowner moves or passes away. This means you can use the money from the reverse mortgage to make any improvements or investments you need without worrying about making payments. Another great benefit of a reverse mortgage is the fact that it allows you to access the equity in your home without having to sell it. This can be especially beneficial for those who are close to retirement and don’t want to move. Finally, reverse mortgages can also offer tax advantages and can help you maximize Social Security and other retirement benefits. With all these benefits, it’s easy to see why reverse mortgages are becoming increasingly popular among retirees.

Qualifying for a Reverse Mortgage

Qualifying for a reverse mortgage is not as hard as you may think. To qualify, you must be at least 62 years old, own your home outright (or have a low enough mortgage balance that can be paid off with the proceeds from the reverse mortgage), and live in the home as your primary residence. You will also need to meet with a HUD-approved counselor to go over the ins and outs of a reverse mortgage and make sure it is the right decision for you. The counselor will also meet with your family members or other interested parties to ensure that everyone is on the same page with the decision. Once you are approved, you will receive a reverse mortgage, which is a loan that allows you to access the equity in your home.

Types of Reverse Mortgages

There are 3 main types of reverse mortgages: Home Equity Conversion Mortgages (HECMs), Single-Purpose Reverse Mortgages, and Proprietary Reverse Mortgages. Home Equity Conversion Mortgages are the most commonly used type of reverse mortgage. These are federally insured and allow borrowers to receive a lump sum, set monthly payments, or a line of credit based on their home equity. Single-Purpose Reverse Mortgages are offered by some state and local government agencies, as well as non-profits, and are only used for a specific purpose. For example, they may be used to pay off debts or to make home repairs. Proprietary Reverse Mortgages are private loans that are backed by the companies that develop them. These are usually more expensive than other types of reverse mortgages, but they may have more flexible terms. No matter which type of reverse mortgage you choose, it’s important to make sure you understand all the terms and conditions before signing any paperwork.

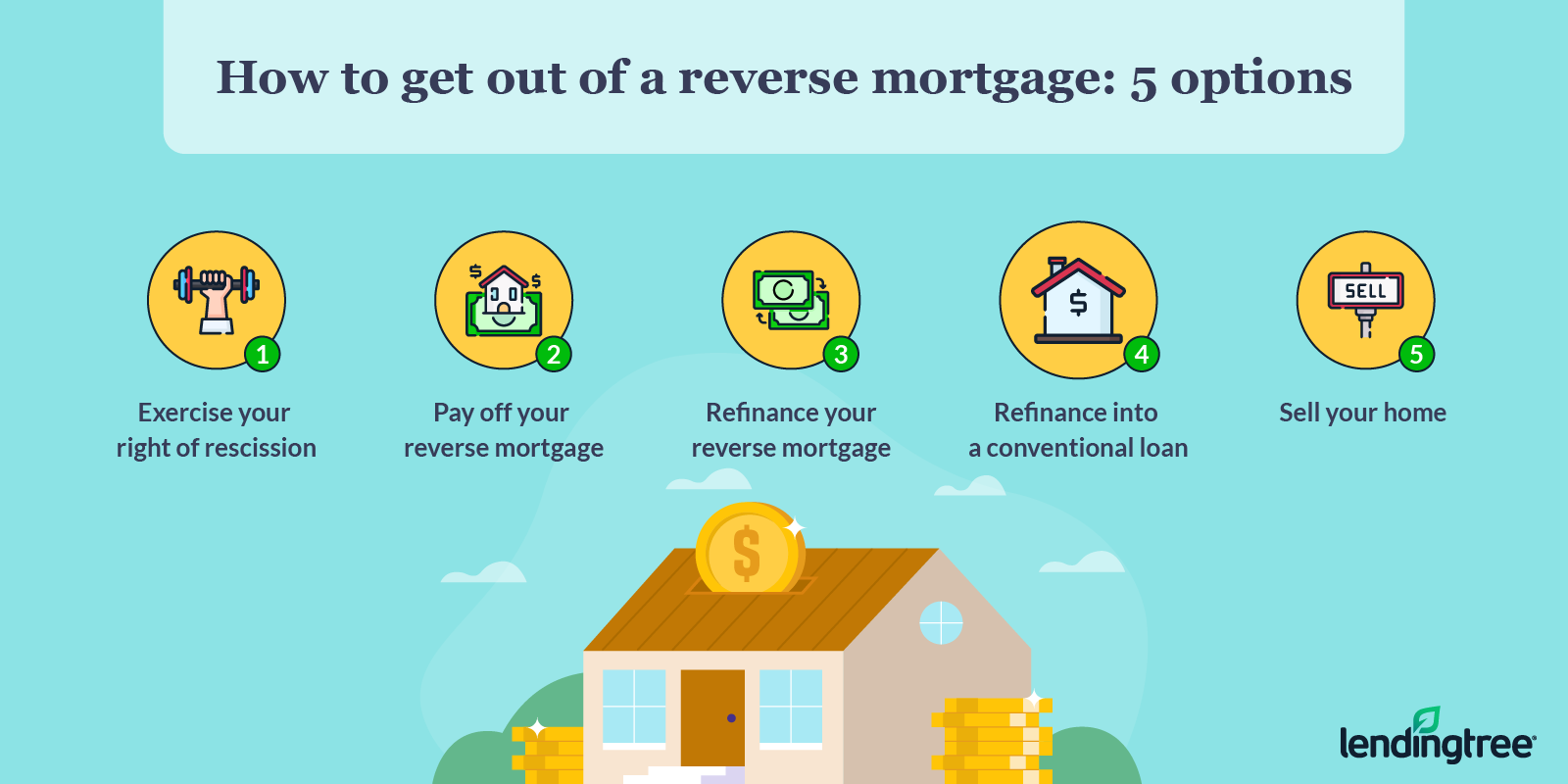

Risks and Drawbacks of Reverse Mortgages

Reverse mortgages are a great way to make sure that you can stay in your home and continue to enjoy your golden years without having to worry about financial issues. However, there are some risks and drawbacks associated with this type of loan that are worth considering before making a decision. For starters, the interest rates on reverse mortgages are usually higher than those on traditional mortgage loans, so it may be more difficult to pay off the loan. Additionally, if the homeowner does not pay off the loan, the home may be sold to pay for it, which can be a major setback for those relying on the home for retirement income. Finally, loan fees can be another downside, as they can add up quickly. It’s important to carefully weigh the risks and drawbacks of a reverse mortgage before signing on the dotted line.