An interest-only mortgage is a type of home loan that allows you to pay only the interest portion of your monthly payments. This type of mortgage could be a great way to save money over the life of the loan. It’s important to understand the pros and cons of an interest-only mortgage before committing to it, so that you can make an informed decision about whether or not it’s the right choice for your financial needs. Learn more about what an interest-only mortgage is and how it works to determine if it’s the right fit for you.

Understanding Interest-Only Mortgages: What They Are and How They Work

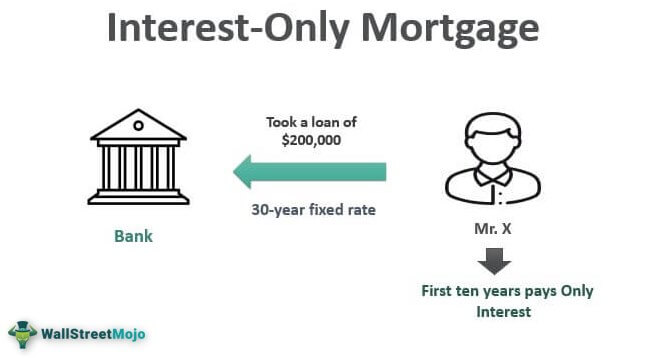

Understanding Interest-Only Mortgages is key to knowing if they are the right home loan option for you. An Interest-Only Mortgage is a loan where you only pay the interest on the loan for a certain period of time. This means that your monthly payments are lower than a normal mortgage, allowing you to save money each month. However, at the end of the interest-only period, you will need to start making principal and interest payments, which can be significantly higher than the interest-only payment. It’s important to understand how this type of loan works so you can determine if it’s a good fit for your financial situation. Make sure to speak with a qualified mortgage lender to discuss your options and determine if an Interest-Only Mortgage is right for you.

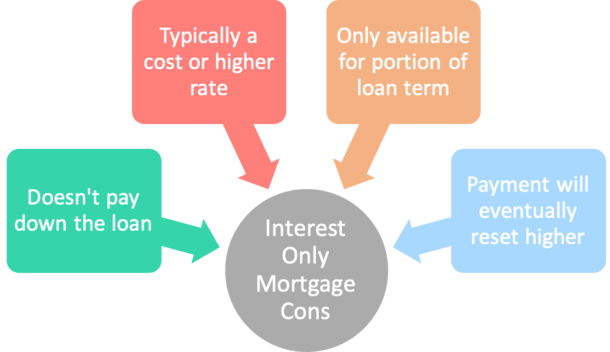

Advantages and Disadvantages of Interest-Only Mortgages

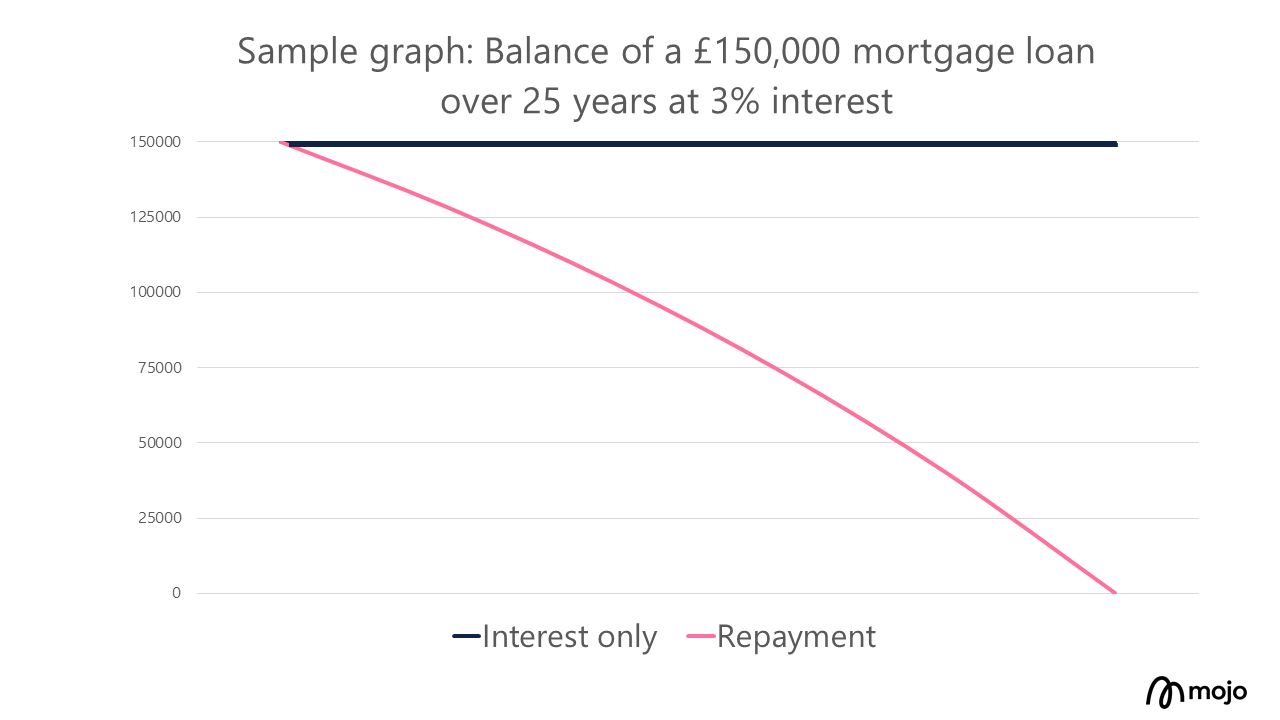

The advantages and disadvantages of interest-only mortgages have been debated for years. Interest-only mortgages offer many advantages like lower monthly payments, flexibility with payments and the ability to invest the difference between the interest-only payment and the amount of the loan. However, there are also disadvantages associated with this type of loan. The biggest disadvantage is that, since you are only paying the interest on your loan, you are not paying down the principal and your loan balance will remain the same or go up over time. This means you will end up paying more in interest over the life of the loan. Additionally, it’s important to remember that you will still owe the full loan amount at the end of the interest-only period. This means that you could end up owing more than the original amount you borrowed if you don’t refinance or make arrangements to pay off the balance. It’s important to weigh the pros and cons carefully before taking out an interest-only loan.

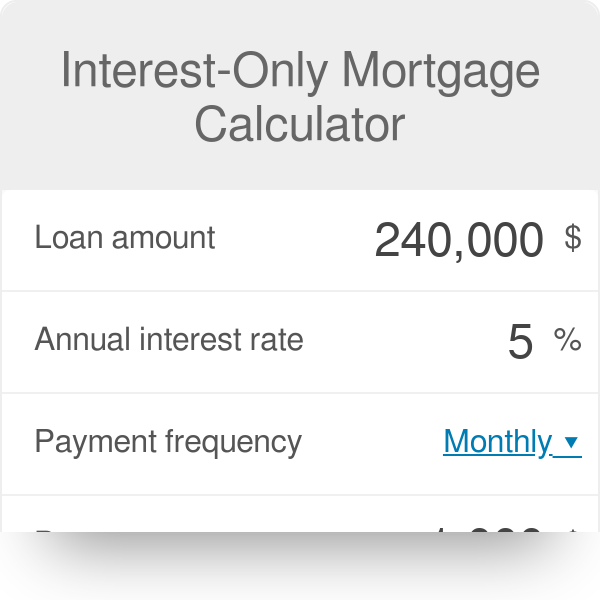

How to Calculate Interest-Only Mortgage Payments

Interest-only mortgage payments can be a great way to reduce your monthly payments and save money if used responsibly. Calculating your payments is quite simple and the formula used is similar to a regular mortgage. To calculate your monthly interest-only payment, you need to know the loan amount, the loan term, and the interest rate. First, you need to multiply the loan amount by the interest rate. Then, divide that number by 12, to get your monthly interest-only payment. For example, if you have a loan amount of $200,000, with an interest rate of 4%, your monthly interest-only payment would be $666.67. When you use an interest-only mortgage, it’s important to make sure you can afford the payments and that you have a plan in place to pay off the entire loan amount when the loan term ends.

Qualifying for an Interest-Only Mortgage

If you’re looking to qualify for an interest-only mortgage, you’ll need to meet certain criteria. First, you must have good credit and enough income to be able to make the loan payments. You’ll also need to show that you have a plan for how you’ll pay off the loan when the interest-only period is over. You may also need to provide evidence of your assets and liabilities, as well as proof of other sources of income. Finally, the lender may require an appraisal of the property you’re looking to purchase before they will approve your loan. By meeting all the requirements, you can increase your chances of being approved for an interest-only mortgage.

Tips for Choosing an Interest-Only Mortgage

When it comes to choosing an interest-only mortgage, it’s important to keep a few tips in mind. First and foremost, do your homework. Research different lenders and compare interest rates, terms, and fees for each potential mortgage. Make sure you understand the differences between interest-only mortgages and regular mortgages, and decide which one is best for you. Additionally, make sure you have a clear plan for how you’ll make the payments once the interest-only period ends. Finally, look for other potential fees and costs associated with the mortgage, such as closing costs or pre-payment penalties. Taking these steps can help you find the right interest-only mortgage for your financial situation.