An adjustable-rate mortgage, or ARM, is a unique type of home loan that can offer great flexibility and potential savings. An ARM can be a great option for those who may need to move or refinance in the near future, or for those who are looking to take advantage of a lower initial interest rate. By understanding the basics of an adjustable-rate mortgage and its features, you can make an informed decision when it comes to choosing the best home loan for your needs.

Understanding How Adjustable-Rate Mortgages Work

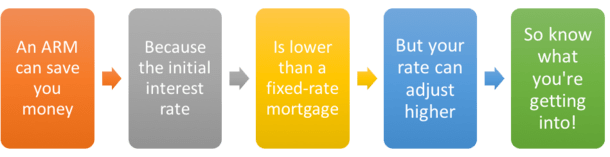

An adjustable-rate mortgage (ARM) is a type of loan that has a variable interest rate that can change over time. With an ARM, your interest rate will fluctuate depending on several factors, including the market conditions. This type of loan is a great option for those who are looking to save on interest payments, as it can offer a lower rate than a regular fixed-rate mortgage. It is important to understand how adjustable-rate mortgages work before taking one out, as the interest rate can fluctuate, resulting in higher payments over time. Knowing how an ARM works and researching the current market conditions can help you determine if an adjustable-rate mortgage is the right choice for you.

Examining the Advantages and Disadvantages of ARMs

Adjustable-rate mortgages (ARMs) can be a great option for those looking to save money on their home loan. On the plus side, ARMs often have lower initial rates and lower monthly payments, making them an attractive option for those who don’t want to break the bank on their mortgage. On the other hand, ARMs can be a bit of a gamble since the rates can change over time, meaning that your payments could go up. It’s important to weigh the pros and cons of ARMs before making a decision, and to understand that an ARM could end up costing you more in the long run. So, before you dive in and get an ARM, make sure you do your research and figure out if it’s the right choice for you.

Deciding if an ARM Is Right for You

When deciding if an ARM is right for you, it’s important to take into account how long you plan to be in your home, how comfortable you are with taking on risk and how flexible you want your monthly payments to be. If you plan to move within the next few years, an ARM can save you money in the long run. With an ARM, you’ll have a fixed interest rate for a set period of time, and then the rate can adjust based on the current market rate. If you’re comfortable with taking on risk, an ARM may be the right choice for you because you’ll take advantage of low initial rates and have the potential to save money over time. On the other hand, if you need more stability with your mortgage payments, an ARM may not be the best option. So before you decide if an ARM is right for you, it’s important to do your research and consider your own financial situation.

Factors That Impact ARM Interest Rates

When it comes to an adjustable-rate mortgage (ARM), there are several factors that can have a huge impact on the interest rate. The most important factor is the index rate, which is a benchmark rate used to adjust the mortgage rate. Other factors that can affect the ARM interest rate include the mortgage term, margin, and the initial interest rate. The margin represents the lender’s profit, while the initial interest rate is the rate used to start the mortgage. Additionally, mortgage terms can range from 5 to 30 years, and the longer the mortgage term, the higher the interest rate.

Tips for Navigating the ARM Process Successfully

Getting an adjustable-rate mortgage (ARM) can be a great way to save money on your monthly payments, but it’s important to be aware of the risks associated with this type of loan. To ensure a successful ARM process, here are a few tips to keep in mind. First, you should always read the terms and conditions of the loan carefully and ask questions if there is anything you don’t understand. Second, make sure to compare different ARM loan offers from different lenders to find the best rate. Third, pay attention to the margin, index rate, and caps associated with the ARM loan, as these can significantly impact the interest rate of the loan. Finally, be sure to plan for the possibility of rising interest rates by setting aside extra money each month to cover any increases. Following these tips can help you navigate the ARM process successfully and save money in the long run.