Are you considering purchasing a home but worried about the risks? Then a government-insured mortgage might be the perfect solution for you! A government-insured mortgage is a type of mortgage that is guaranteed by the Federal Housing Administration (FHA) or the Department of Veteran Affairs (VA) and can help you find an affordable loan with lower interest rates and more favorable terms than a traditional loan. This article will provide you with all the information you need to know about government-insured mortgages and will help you decide if it’s the right option for you.

Understanding Government-insured Mortgages

If you’re looking to buy a home and don’t have a lot of cash saved up for a down payment, a government-insured mortgage could be a great option for you. Government-insured mortgages are designed to help people purchase homes who don’t have a large amount of money saved up. These mortgages are backed by the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA) and the Department of Agriculture (USDA). With a government-insured mortgage, you can get a loan with a low down payment, often as low as 3.5%. You’ll also likely get a lower interest rate than you would with a conventional loan, making it easier to afford your monthly payments. Additionally, government-insured mortgages often have more flexible qualification requirements, making it easier to qualify for a loan. All in all, government-insured mortgages are great options for those who want to buy a home but don’t have a lot of cash saved up.

Benefits of Government-insured Mortgages

If you’re looking for a mortgage, you should definitely consider a government-insured mortgage. Government-insured mortgages have a number of benefits that make them an attractive option for first-time home buyers. Government-insured mortgages are often more affordable than traditional mortgages, as they often have lower down payment requirements and lower interest rates. Additionally, government-insured mortgages are often more flexible than traditional mortgages, allowing for more lenient credit requirements. Finally, government-insured mortgages are often backed by the government, meaning that in the event of a default, the government will cover the remaining balance owed on the loan. All these benefits make government-insured mortgages a great option for those who are trying to get into the housing market.

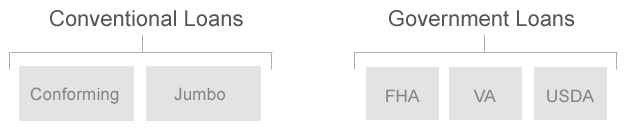

Types of Government-insured Mortgages

When it comes to buying a home, a government-insured mortgage can be a great way to go. These types of mortgages are backed by the government, so they come with lower interest rates and other perks. There are several types of government-insured mortgages available, each with their own set of benefits. FHA loans are popular among first-time homebuyers, as they require a lower down payment and offer competitive interest rates. VA loans are another option for veterans and active duty service members, offering competitive interest rates and no down payment. USDA loans are ideal for low-income buyers, as they provide 100% financing and don’t require a down payment. No matter what kind of mortgage you’re looking for, there’s a government-insured option that can help make your dream of homeownership a reality.

Qualifying for a Government-insured Mortgage

If you’re looking to get a mortgage, it may be worth considering a government-insured mortgage. These mortgages are backed by the government, which means they often come with better rates and more flexible terms than traditional mortgages. To qualify for a government-insured mortgage, you’ll typically need to meet certain requirements such as having a good credit score, a steady job, and a stable income. Additionally, you’ll have to provide documentation of your income, assets, and other financial information. The government-insured mortgage also typically requires a down payment, so make sure you have enough saved up before you apply. Finally, it’s important to shop around and compare rates from different lenders to make sure you get the best deal possible. A government-insured mortgage can be an excellent way to get into a new home, so make sure you look into all the options available to you.

Mistakes to Avoid When Applying for a Government-insured Mortgage

When you’re applying for a government-insured mortgage, there are a few mistakes to avoid. First, don’t apply for a mortgage that you can’t realistically afford. Make sure you are able to make the payments on the loan without stretching your finances too thin. Second, don’t be late on any payments. Late payments can have a negative impact on your credit score, which will affect your ability to get approved for a government-insured mortgage. Third, make sure the loan terms you are agreeing to are favorable. Government-insured mortgages usually have lower interest rates and closing costs, so make sure you’re getting a good deal. Lastly, don’t forget to shop around and compare offers to make sure you’re getting the best deal possible on your government-insured mortgage. Avoiding these mistakes when applying for a government-insured mortgage can help you secure a great deal and save you money in the long run.