Are you considering a home purchase, but not sure what type of loan is best for you? Conventional mortgages are a great option for many homebuyers, offering low down payments, competitive rates, and flexible terms. Read on to learn what a conventional mortgage is, who it’s best for, and how to qualify.

Overview Of A Conventional Mortgage

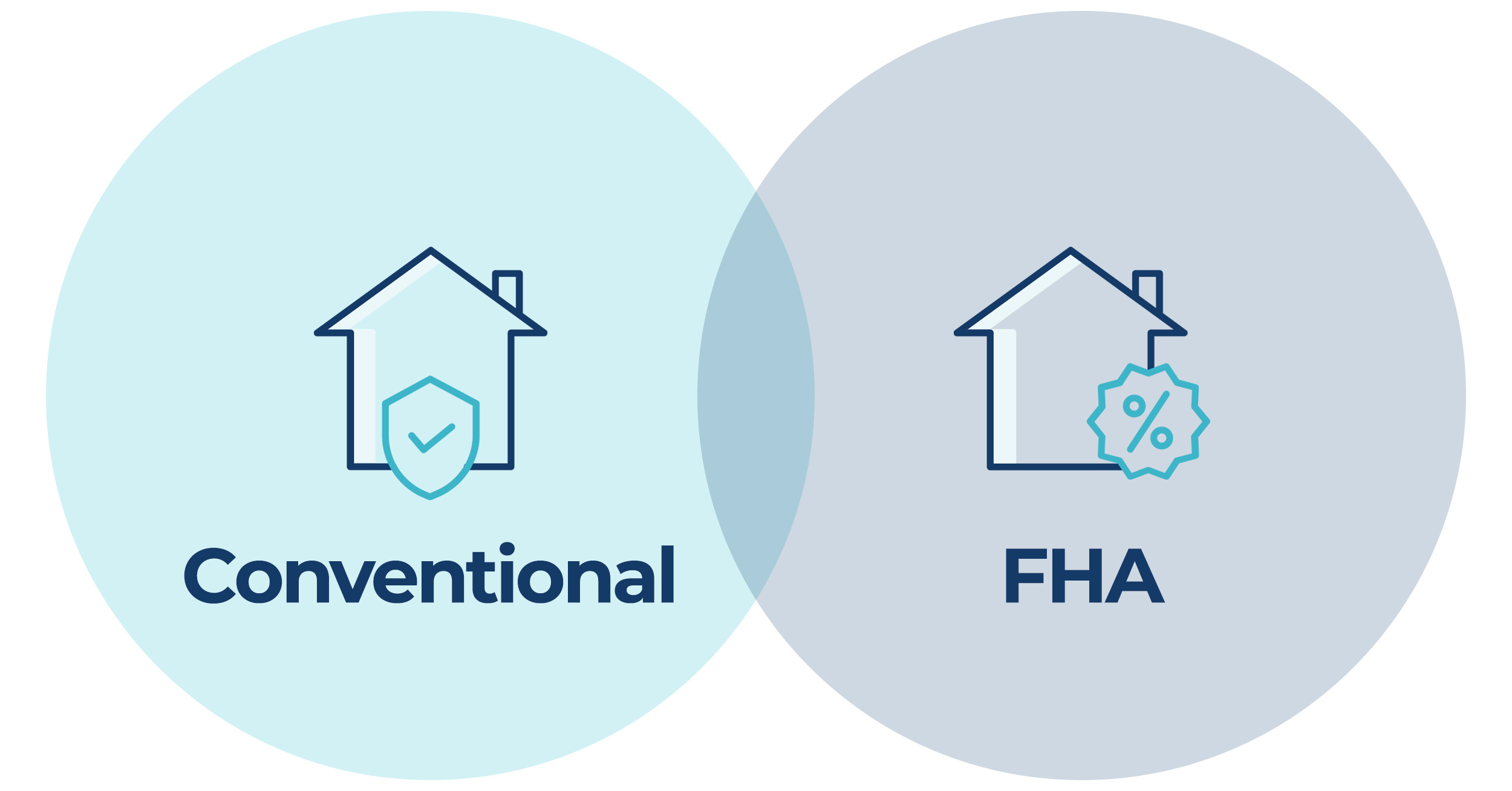

A conventional mortgage is a loan secured by a mortgage on a property. It is the most common type of loan used in the United States and is typically used to purchase a house, condo or other real estate. Conventional mortgages are offered by a variety of lenders, including banks, credit unions, and mortgage brokers. These loans typically require a higher credit score than other types of loans, as well as a larger down payment. With a conventional mortgage, you will pay private mortgage insurance (PMI) if you put down less than 20 percent of the purchase price. PMI protects the lender in the event that you default on the loan. The interest rate on a conventional mortgage is usually higher than other types of loans, but it can be a good option for those who have good credit and can afford to make a large down payment.

Eligibility Requirements For A Conventional Mortgage

If you’re looking to apply for a conventional mortgage, you should know that there are certain eligibility requirements that you’ll have to meet. First, you’ll need to have a good credit score, typically at least 620. You’ll also need to have a steady income and a steady job for at least the past two years. You’ll also need to show that you have a good debt-to-income ratio, meaning that your monthly debt payments are less than 43 percent of your monthly income. You’ll also need to make a down payment of at least 3 percent. Finally, you’ll need to show that you have enough money saved up to cover the closing costs associated with the loan. Meeting these requirements will put you in a good position to get approved for a conventional mortgage.

Benefits Of A Conventional Mortgage

When it comes to mortgages, a conventional mortgage is one of the best options out there. Not only are conventional mortgages more affordable, but they also offer a number of benefits that make them an attractive option for homebuyers. For starters, conventional mortgages often have lower interest rates than other types of mortgages, making them more affordable in the long run. Additionally, conventional mortgages typically don’t require a down payment, which can be a great relief for homebuyers who don’t have a lot of money saved for a down payment. Another benefit of a conventional mortgage is that the loan terms are often more flexible, allowing borrowers to adjust the terms to better suit their financial needs. Finally, with a conventional mortgage, borrowers can often get pre-approval, which can make the process of purchasing a home much easier. All in all, conventional mortgages are a great option for homebuyers who are looking for an affordable, flexible, and accessible loan.

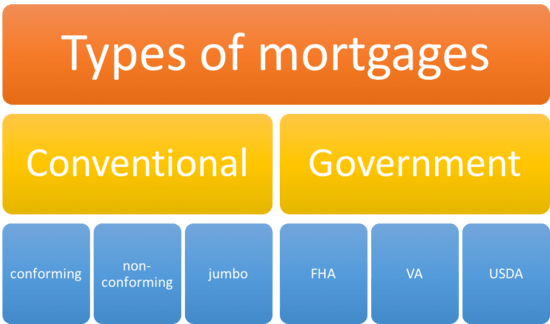

Different Types Of Conventional Mortgages

There are several different types of conventional mortgages available, so it’s important to make sure you understand the differences before making your final decision. Fixed-rate mortgages are the most common type of conventional loan. This type of loan has an interest rate that doesn’t change over the life of the loan, so you’ll always know exactly what your monthly payments will be. Adjustable-rate mortgages, or ARMs, are loans that have interest rates that can change over time. These loans typically have lower interest rates and initial payments than fixed-rate mortgages, but the rate can fluctuate and your payments can increase over time. Balloon loans are another type of conventional loan, which are typically used by people who plan to own their home for a short period of time. With a balloon loan, you pay a fixed amount each month for a certain number of years and then pay a lump sum for the balance of the loan. Finally, jumbo loans are mortgages that exceed the maximum loan limit for a given area. These loans usually require a higher down payment and higher credit score than other conventional loans, but they can be a great option for borrowers who need a larger loan amount.

How To Apply For A Conventional Mortgage

If you’re looking to purchase a home, a conventional mortgage is one of the most popular financing options. To apply for a conventional mortgage, you’ll need to meet certain eligibility requirements, such as having a good credit score, a steady employment history and a down payment. Once you know you meet the eligibility requirements, you’ll need to gather all the necessary paperwork needed to apply. This includes tax returns, pay stubs, proof of assets and debts, and any other financial documents. You’ll also need to find a qualified lender and provide them with all the required documents. Once your application has been approved, you’ll be required to pay closing costs, which typically range from 2-5% of the home’s purchase price. With a conventional mortgage, you’ll be able to enjoy the benefits of a fixed-rate mortgage, lower interest rates, and a flexible repayment plan.