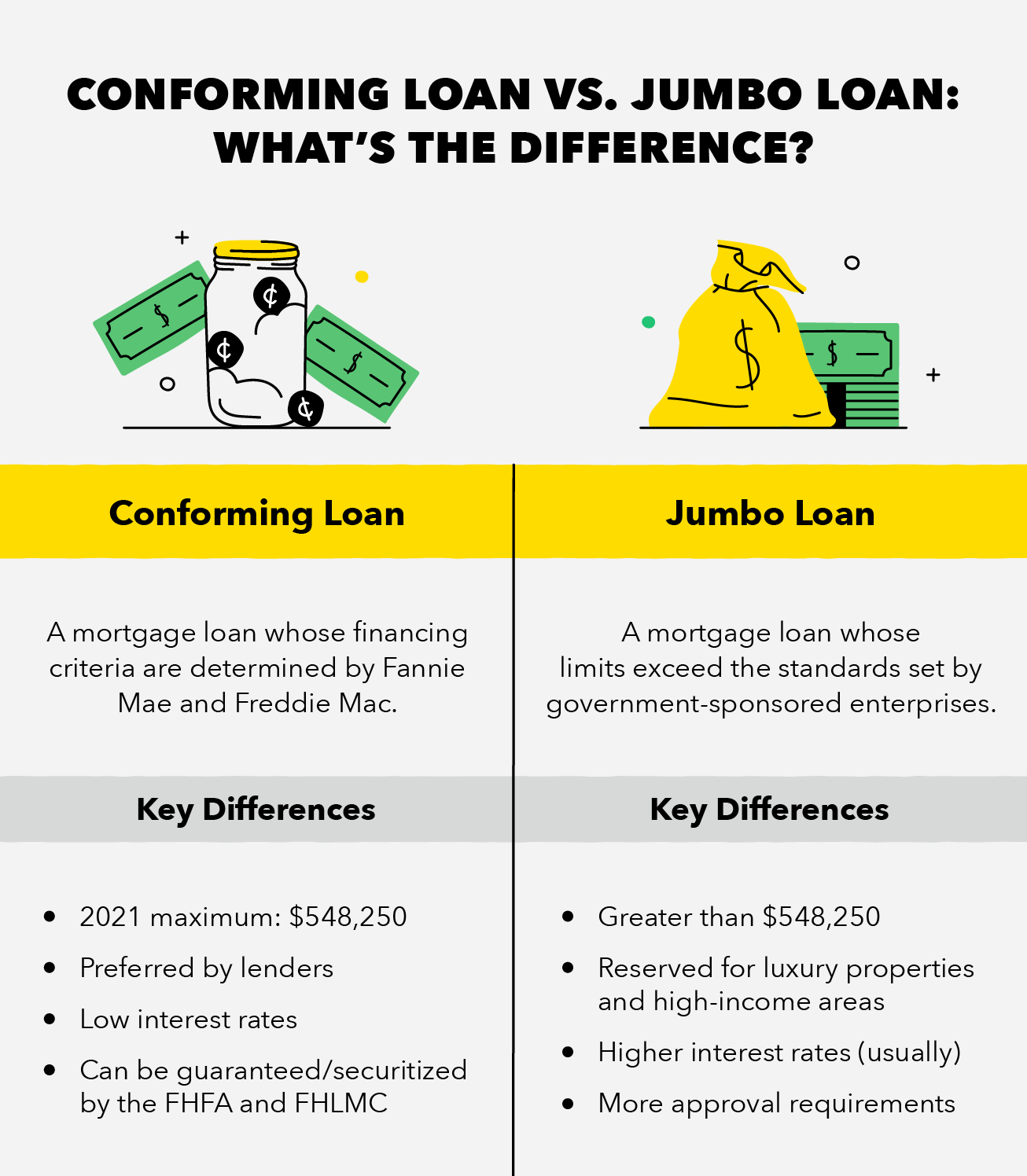

Are you looking for a large loan to finance your dream home? A Jumbo mortgage may be just what you need! A Jumbo mortgage is a type of mortgage loan that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). This means that borrowers can borrow more money than conventional mortgages, allowing them to finance expensive homes, investment properties, and more. If you’re interested in learning more about Jumbo mortgages, keep reading to find out their benefits, drawbacks, and more.

What Qualifies as a Jumbo Mortgage?

If you’re looking to buy a home that’s above the conforming loan limit, a jumbo mortgage could be the right choice for you. A jumbo mortgage is a loan that exceeds the conforming loan limit, which is set by the Federal Housing Finance Agency. To qualify for a jumbo mortgage, you’ll need to have a higher credit score, a larger down payment and a higher debt-to-income ratio. Additionally, lenders may require you to have more liquid assets as well as more reserves, which are funds that can cover your mortgage payments in the event of an emergency. Lastly, you’ll need to be able to document your income and assets. With all these requirements, it’s important to do your research and shop around to find the best jumbo mortgage that fits your needs.

Benefits of a Jumbo Mortgage

If you’re looking for a loan that exceeds the limits of traditional conforming mortgages, a jumbo mortgage might be for you. Jumbo mortgages offer several benefits including lower interest rates, more loan options and lower closing costs. These benefits can help you secure a larger loan amount. With a jumbo mortgage, you can finance a luxury home, vacation home, or investment property. Jumbo mortgages also offer more flexibility with less stringent requirements, allowing you to qualify for a loan even if you have a lower credit score or higher debt-to-income ratio. Jumbo mortgages are also known for having more competitive interest rates than traditional conforming mortgages, so you can save money over the life of your loan. With a jumbo mortgage, you can get the most out of your home buying experience and enjoy the benefits of owning a larger property.

Understanding the Risks of a Jumbo Mortgage

When it comes to jumbo mortgages, it’s important to understand the potential risks involved with taking on such a large loan. A jumbo mortgage can put you in a precarious situation if you don’t understand the risks and how it may affect you financially in the long run. One risk is that you may not be able to make payments on your loan if the market conditions change drastically. Additionally, if you don’t have enough money saved up to pay the interest on the loan, you could end up owing more than you borrowed. Taking on a jumbo mortgage is a big responsibility and requires careful consideration. Make sure you understand what risks you’re taking on before committing to a jumbo mortgage.

How to Qualify for a Jumbo Mortgage

Qualifying for a jumbo mortgage can be a bit more challenging than qualifying for a standard loan. The requirements for a jumbo mortgage vary from lender to lender, but typically you’ll need to have a strong credit score, a low debt-to-income ratio, a high down payment and a good amount of cash reserves. It’s also important to have a good employment history and a steady income. In addition, lenders typically want to see that you’ve been in the same job for a few years and that you have a reasonable debt-to-income ratio. When applying for a jumbo mortgage, lenders will also take a close look at your assets and liabilities to make sure you can handle the loan. If you have a good credit score, ample cash reserves, a low debt-to-income ratio and a solid employment history, you should have no problem qualifying for a jumbo mortgage.

The Best Jumbo Mortgage Lenders

If you’re looking for the best jumbo mortgage lenders, you’ve come to the right place. With so many lenders out there, it can be hard to narrow down your options. But if you’re looking for big loan amounts and great rates, jumbo mortgage lenders are the way to go. From big banks to online lenders, these lenders offer some of the best rates and services on the market. So if you’re looking for a jumbo mortgage, you won’t want to miss out on these great deals. Whether you’re a first-time homebuyer or a veteran, you’ll find the perfect lender to meet your needs. Don’t wait another minute – check out the top jumbo mortgage lenders today and get the best deal for your homebuying needs.