Are you thinking of taking out an interest-only mortgage, or have you already got one? Then this article is for you! Here, we will provide you with a full guide to understanding interest-only mortgages, including their benefits, drawbacks, and how they work. We will also provide you with some tips to help you make the right decision for your financial future. Read on to learn everything you need to know about interest-only mortgages.

What is an Interest-Only Mortgage?

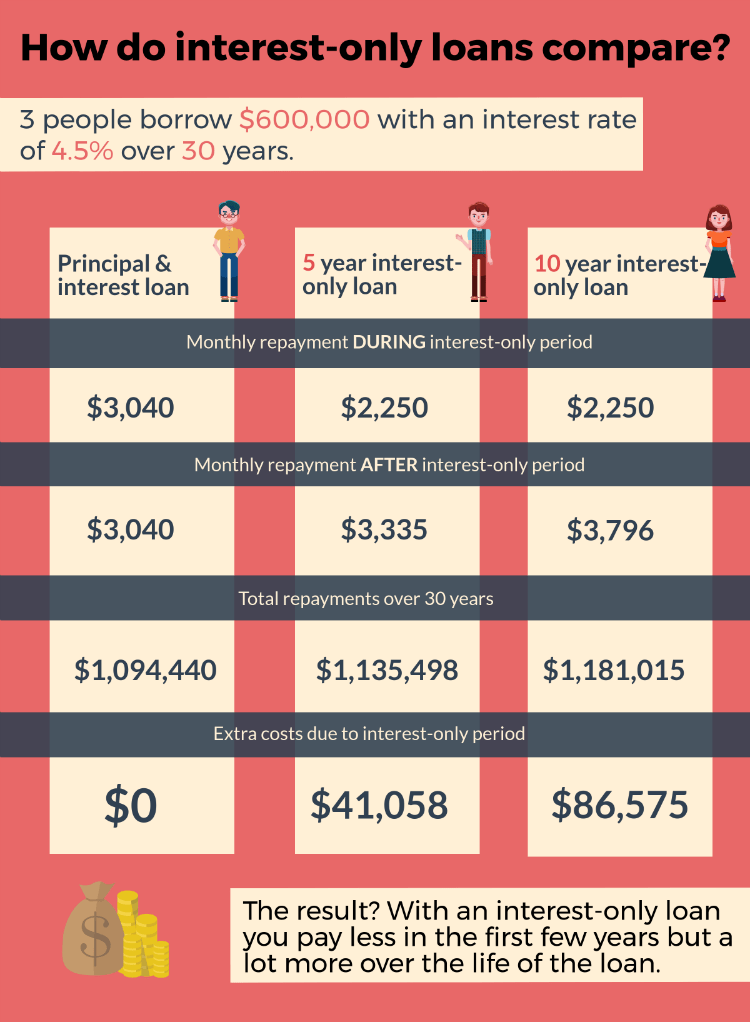

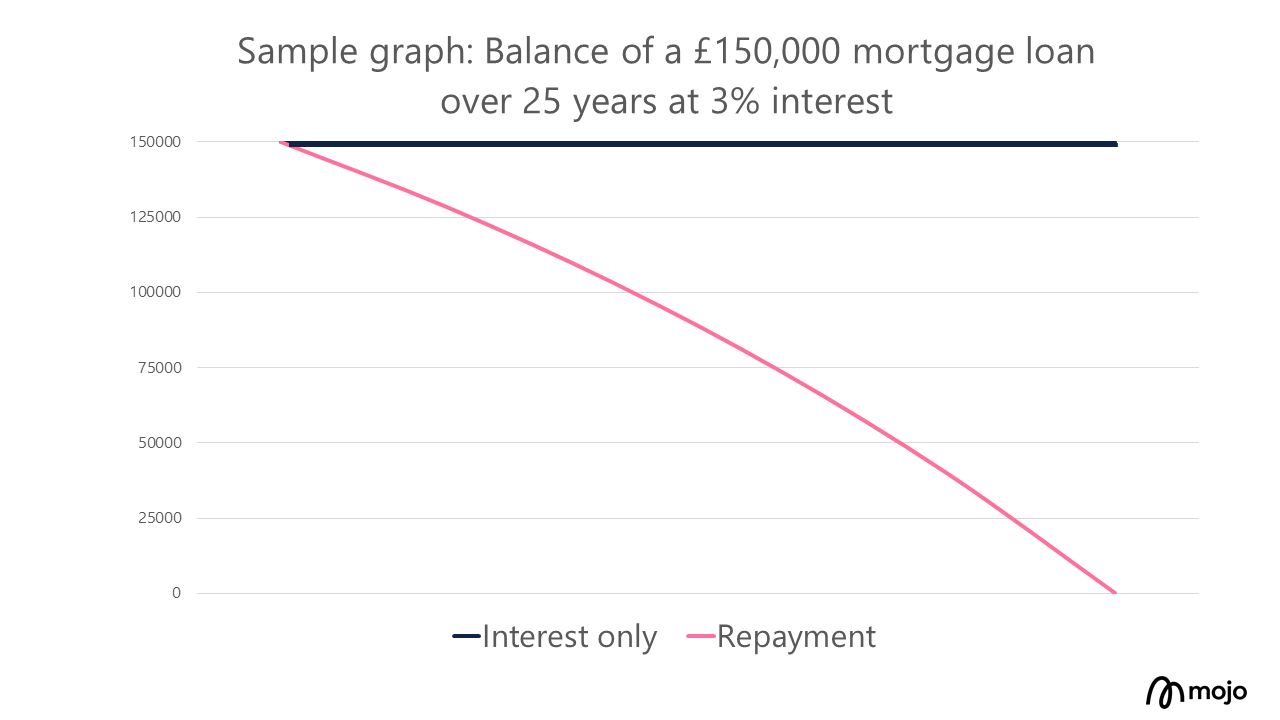

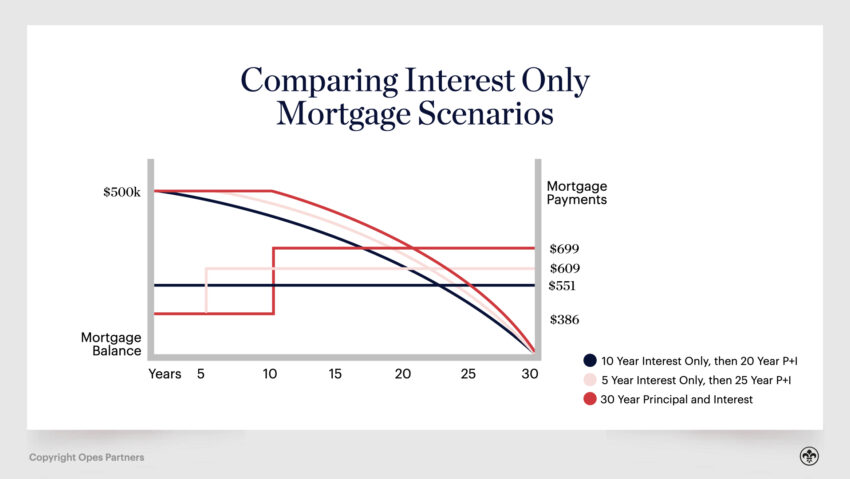

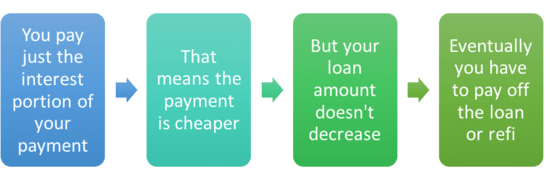

An interest-only mortgage is a loan that only requires borrowers to pay the interest that is due on the loan each month. This means that the borrower does not have to make any payments towards the principal balance of the loan. Instead, they just have to make the interest payments. This type of mortgage can be a great way to save money on monthly payments and can be beneficial for those who have a limited budget or are trying to save for a major purchase. With an interest-only mortgage, borrowers can also get a lower interest rate, which can help them reduce their overall loan costs. It’s important to remember, however, that interest-only mortgages come with some risks, so it’s important to make sure that you understand the terms and conditions before signing on the dotted line.

Advantages and Disadvantages of an Interest-Only Mortgage

Interest-only mortgages are a popular option for those looking to purchase a home on a budget. The biggest advantage of an interest-only mortgage is that you can make smaller monthly payments. This means that you can get into a home quicker and with a lower down payment. The downside is that you only pay the interest for the first few years, and then you’ll have to start paying the principal. This means that the total cost of the loan will be higher in the long run. Additionally, you could end up owing more than the value of the home if the housing market drops. It’s important to understand all of the risks and rewards of an interest-only mortgage before making a decision.

Qualifying for an Interest-Only Mortgage

If you’re looking to get an interest-only mortgage, you’ll want to make sure you meet the qualifications. Generally, lenders want to see that you have good credit, a strong employment history, and enough income to cover the loan payments. Additionally, you’ll need to have a large enough down payment to qualify for an interest-only mortgage; most lenders require at least 20 percent. It’s also important to have a solid plan for how you will pay off the loan after the interest-only period ends. If you can demonstrate that you have a good handle on your finances and a plan for repayment, you should have a good chance at qualifying for an interest-only mortgage.

Repayment Strategies for an Interest-Only Mortgage

If you’re looking for a way to make your interest-only mortgage work for you, there are a few repayment strategies you can try. The first is to make extra payments when possible. This can help you pay down the principal faster and will reduce the amount of interest you owe. Additionally, consider refinancing your mortgage to a lower rate or to a shorter loan term. This will help you save money in the long run and save you time in paying off your loan. Finally, if you have the financial means, consider making a lump sum payment to reduce the amount of interest you owe. All of these strategies can help you make the most of your interest-only mortgage, ensuring you get the best deal possible.

Tips for Avoiding Plagiarism when Writing about an Interest-Only Mortgage

When writing about an interest-only mortgage, it’s important to keep in mind the dangers of plagiarism. Plagiarism is taking someone else’s work and passing it off as your own, and it can have serious consequences. To avoid plagiarism when writing about an interest-only mortgage, make sure to always cite any sources you use, make sure to use your own words to explain the concept, and make sure to do your own research. Writing about an interest-only mortgage can be a tricky task, but by following these tips you can make sure that your content is original and free of plagiarism.