Are you looking to save money, lower your monthly payments, or tap into your home’s equity? Our Top 10 Mortgage Refinancing Tips for a Better Rate is here to guide you to the best possible refinancing deal! With today’s low interest rates, now is the perfect time to explore your refinancing options. In this article, we’ll share expert advice, industry secrets, and proven strategies to help you navigate the refinancing process and secure a lower rate on your mortgage. So, let’s dive in and start saving you money today!

Research current mortgage rate trends.

Stay ahead of the game by researching current mortgage rate trends. Knowledge is power, especially when negotiating better rates for your refinance. Familiarize yourself with the latest market fluctuations, and use that information to snag the best deal possible. With a little research, you’ll be one step closer to a more affordable mortgage.

Improve credit score before applying.

Boosting your credit score is crucial for snagging the best refinancing rates. Before applying, review your credit report for errors, pay off outstanding debts, and consistently make timely payments. A higher credit score not only increases your chances of approval but can also save you thousands in interest over time.

Shop around for competitive offers.

Don’t just settle for the first mortgage refinancing offer you come across. Make sure to do your homework and explore various lenders to find the most competitive rates and terms. Comparing multiple options will not only help you save money, but also ensure you snag the best deal for your financial situation.

Negotiate better terms with lenders.

Don’t be shy when it comes to negotiating better terms with lenders. Put your research and communication skills to work, and show them you mean business. Prove you’re a low-risk borrower by showcasing your improved credit score, steady income, and financial responsibility. Remember, lenders want your business, so don’t settle for less than the best deal possible.

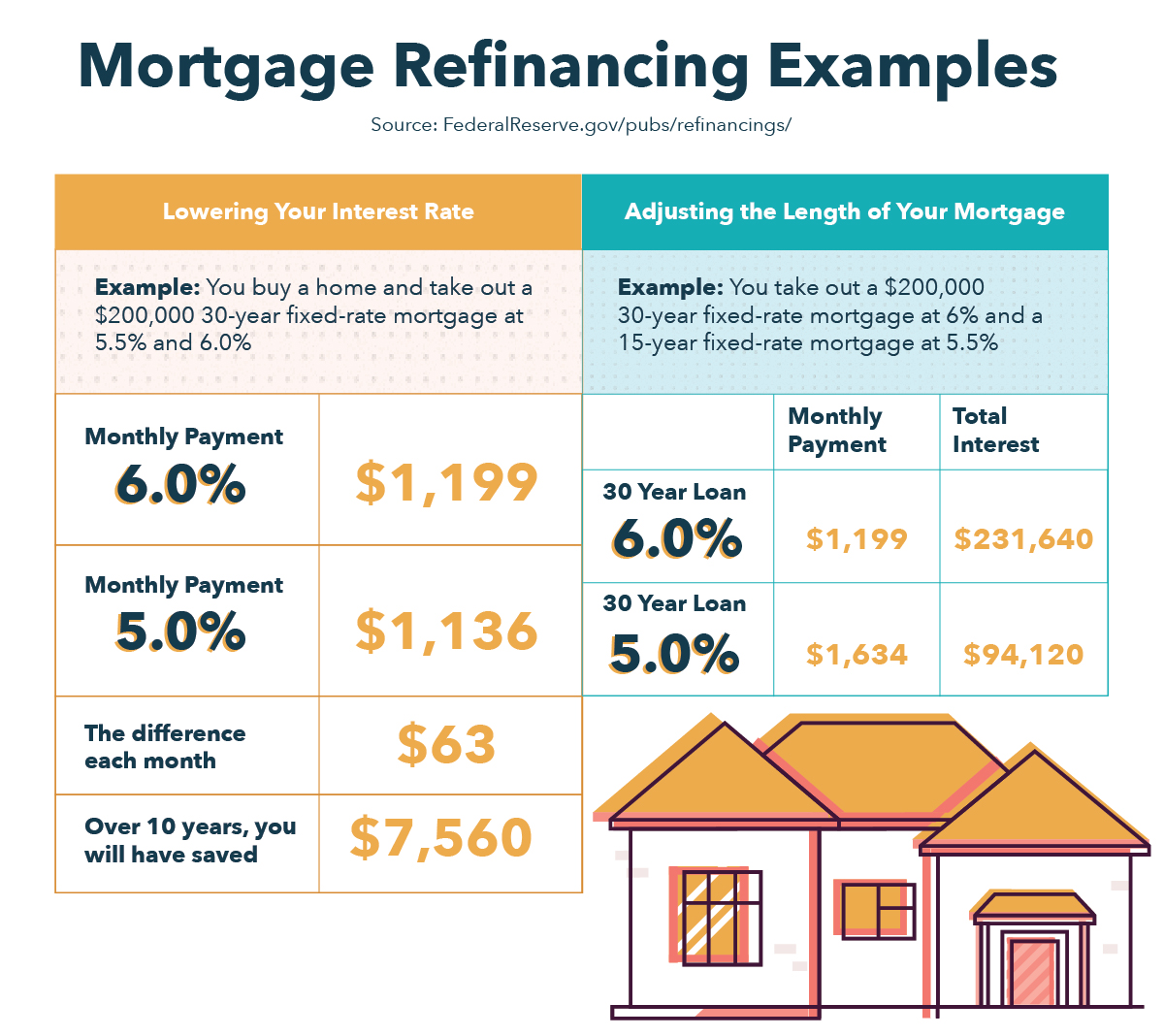

Consider shorter loan repayment period.

Switching to a shorter loan repayment period can significantly reduce your interest rate and save you money in the long run. While this may increase your monthly payments, it will help you pay off your mortgage faster and build equity more quickly. Explore various repayment options and secure a better rate for a financially stable future.

Evaluate closing costs and fees.

Don’t let hidden costs sneak up on you! Always evaluate closing costs and fees when refinancing your mortgage. By comparing lenders and negotiating, you can save a significant amount of money. Remember, a lower interest rate doesn’t always mean a better deal – stay savvy and weigh all the factors.