Are you considering buying a home but don’t have a large down payment saved up? Private mortgage insurance, or PMI, could be an option worth exploring. PMI is a type of insurance that protects lenders from losses due to borrower default, and it can help make homeownership more accessible by reducing the amount of money you need to put down up front. In this article, we’ll explore what PMI is, when and why it might be required, and how you can minimize the cost of PMI.

What Does PMI Cover?

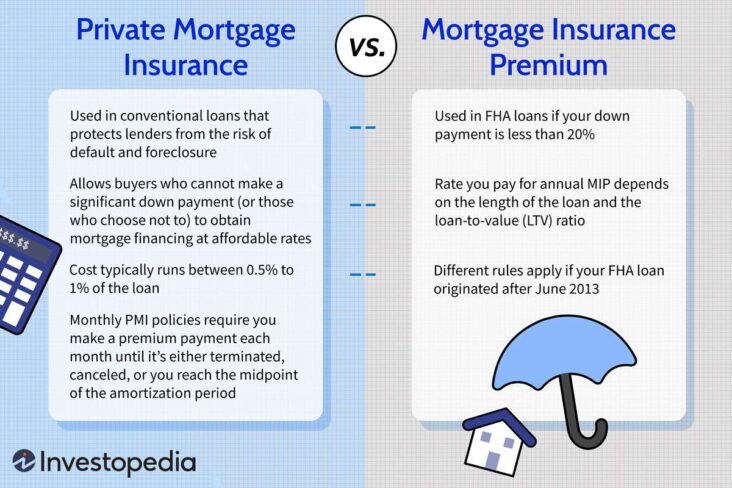

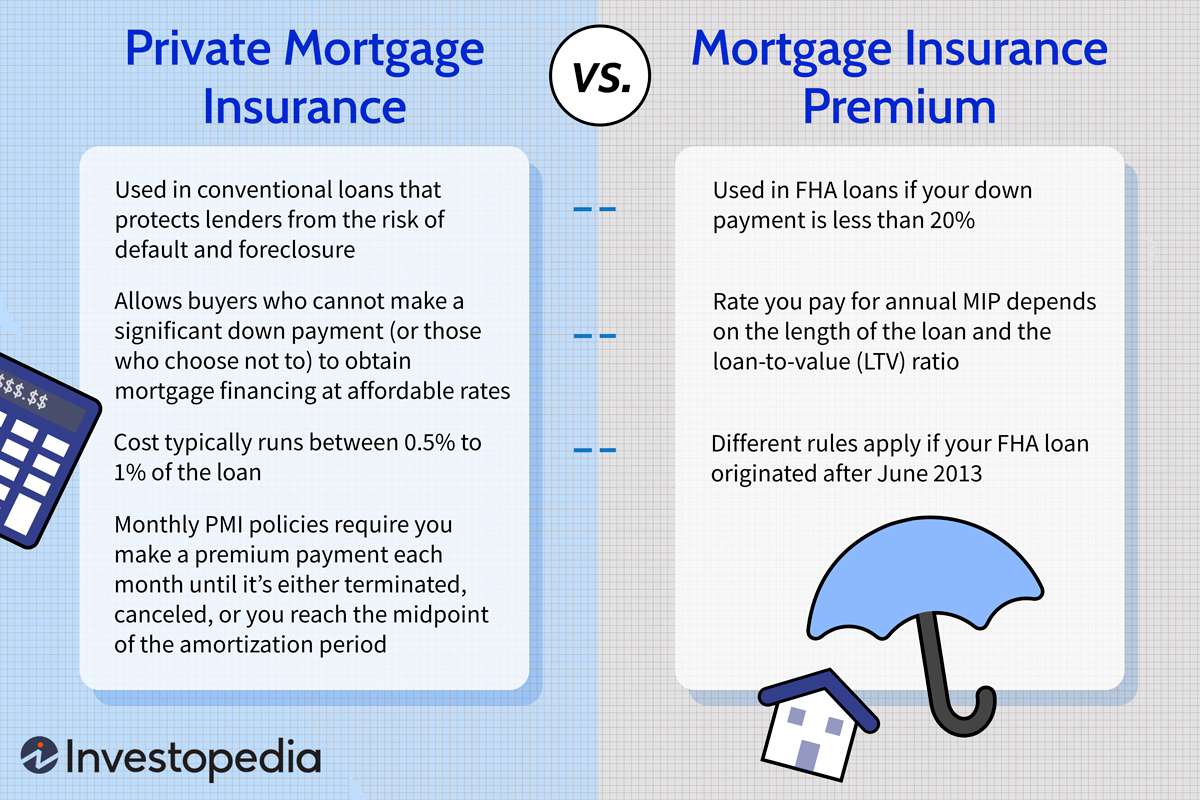

Private Mortgage Insurance (PMI) is a type of insurance that covers lenders against potential losses that may arise from a mortgage loan. PMI can help protect lenders if a borrower defaults on a loan and is unable to repay the loan. It can also provide additional security for lenders in the event of a foreclosure or short sale.PMI covers a variety of different aspects of the loan, including the cost of the loan, the interest rate, and the amount of money that the borrower can borrow. It also covers the cost of repairs and renovations to the property, as well as legal fees associated with foreclosure proceedings. PMI can also help protect lenders in the event of a borrower’s death, disability, or bankruptcy. In some cases, PMI may even cover the cost of rental income from the property.PMI is typically paid for by the borrower as part of their monthly mortgage payment. The amount of PMI depends on the loan amount, the type of loan, and the borrower’s credit score. It is important to understand the terms of your loan and PMI coverage before signing a loan agreement. It is also important to talk to your lender about any additional coverage you may need.

Advantages of PMI

PMI can be beneficial for those that are unable to make a 20% down payment on a home. PMI allows for a lower down payment, which can make it easier to purchase a home. PMI also protects the lender in the event of borrower default, which can make it easier for lenders to approve lower down payments. Additionally, PMI can also help those who are unable to save the large down payments required by other loan products, such as FHA loans. This can be especially beneficial for those who are first-time home buyers or who don’t have the funds available to make a large down payment.PMI can also provide peace of mind for those with a lower down payment. PMI provides coverage that can cover the cost of any losses the lender may experience if the borrower defaults on the loan. This not only protects the lender, but it also helps to reduce the risk of default for the borrower, since they know that their lender is protected in the event of a default. Additionally, PMI can be cancelled once the borrower reaches a certain loan-to-value ratio, which can result in significant savings for the borrower.

How to Avoid Paying PMI

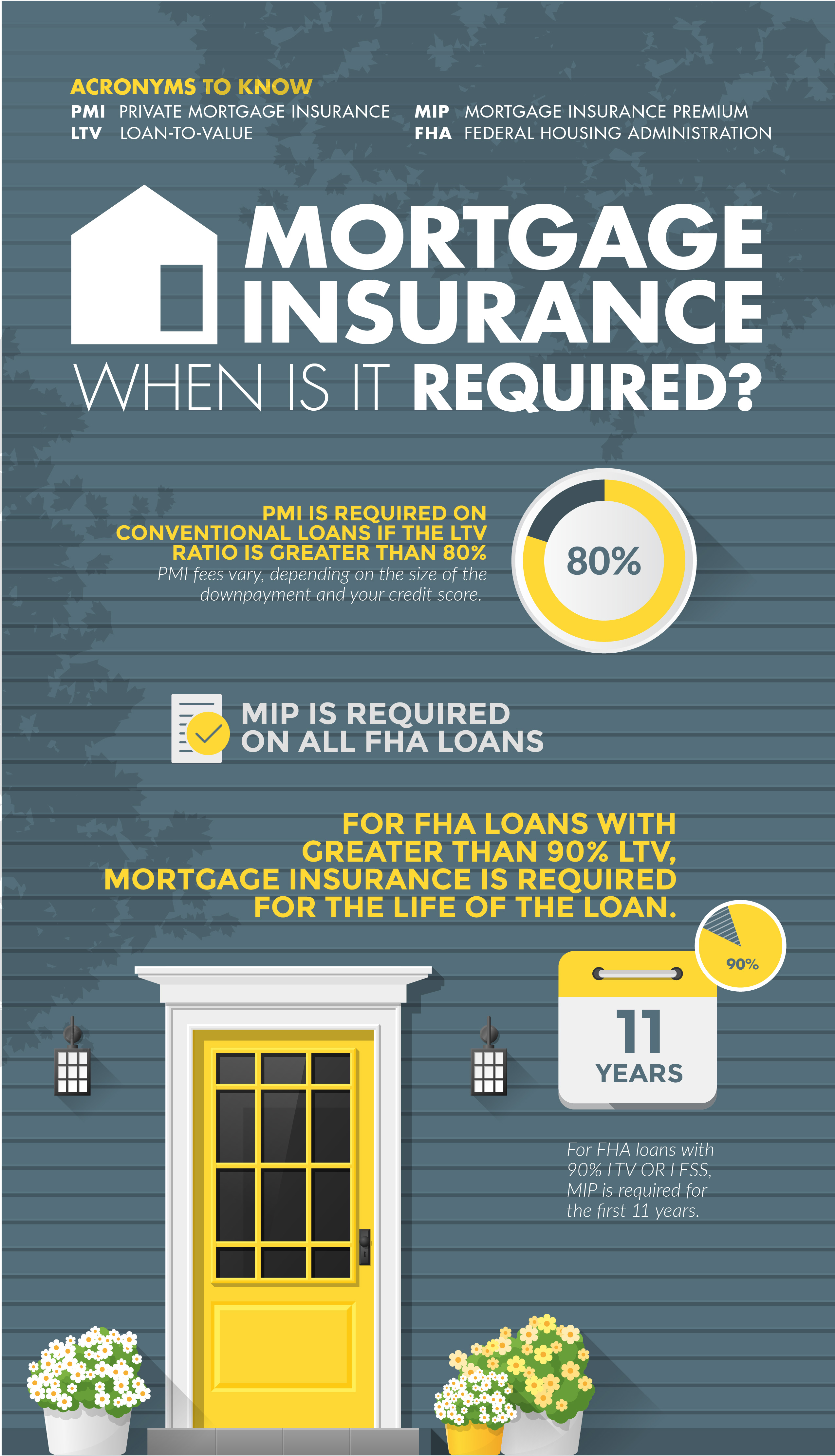

One way to avoid paying private mortgage insurance (PMI) is by making a larger down payment. Generally, lenders require PMI when the borrower has a loan-to-value ratio (LTV) of more than 80%. LTV is the loan amount divided by the home’s appraised value. By putting more money down, you can reduce your LTV and avoid paying PMI. Additionally, if you have a good credit score, you may be able to negotiate with the lender to waive PMI. Some lenders also offer other alternatives such as piggyback loans, where the borrower takes out a second mortgage to cover part of the down payment, and interest-only loans, where the borrower pays only interest for the first few years of the loan. Another option is to choose a lender that does not require PMI. This can be more difficult to find, but doing your research and shopping around can help you find a lender that offers such a loan.

How Much Does PMI Cost?

PMI can be costly and vary depending on your loan amount and credit score. Generally, it can range from 0.5% to 1% of the total loan amount annually. For example, if you take out a loan of $150,000, then the PMI cost could be between $750 and $1,500 per year. Your credit score also plays a role in how much you pay for PMI. If you have a higher credit score, then you may be eligible for a lower PMI cost. On the other hand, if your credit score is lower, then you may have to pay a higher PMI cost to compensate for the greater risk of default. It’s important to remember that PMI can add significantly to your total loan amount. Therefore, if you’re able to, it’s best to avoid PMI altogether by putting down at least 20% of the loan amount. Doing so will help you save on PMI costs and may even help you get a better interest rate on your loan.

How to Calculate PMI Premiums

When it comes to calculating Private Mortgage Insurance premiums, there are a few key factors to consider. First, you’ll need to know the amount of the loan, the loan-to-value ratio, and the borrower’s credit score. The loan amount will determine the premium rate, which is based on the loan-to-value ratio. This ratio is calculated by dividing the loan amount by the appraised value of the property. For example, if you have a loan of $200,000 and the appraised value of the home is $225,000, then the loan-to-value ratio is 0.89. The credit score of the borrower is also a factor in determining the premium rate, as borrowers with higher credit scores will typically receive lower rates. Once all of these factors are considered, the lender can then calculate the total premium rate for the loan.