Are you looking to purchase a home but are unsure of what a mortgage insurance premium (MIP) is? This article will provide an overview of what a MIP is and how it affects your mortgage. MIP is a form of insurance that protects lenders from losses that can occur if the borrower defaults on their loan. In addition, this article will explain how the cost of MIP is calculated, and how you can save money by paying an upfront MIP or by paying an annual MIP. Finally, this article will discuss the advantages of having MIP and the steps you can take to ensure you get the best deal on your mortgage. Read on to learn more about the ins and outs of MIP.

What is Mortgage Insurance Premium (MIP) and How Does it Work?

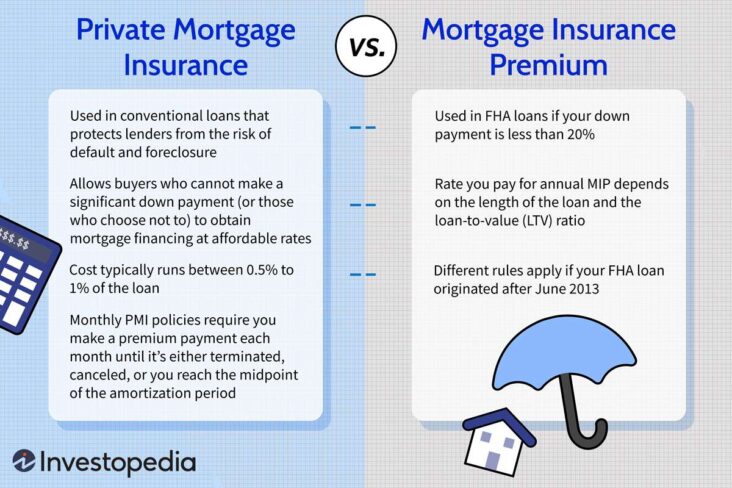

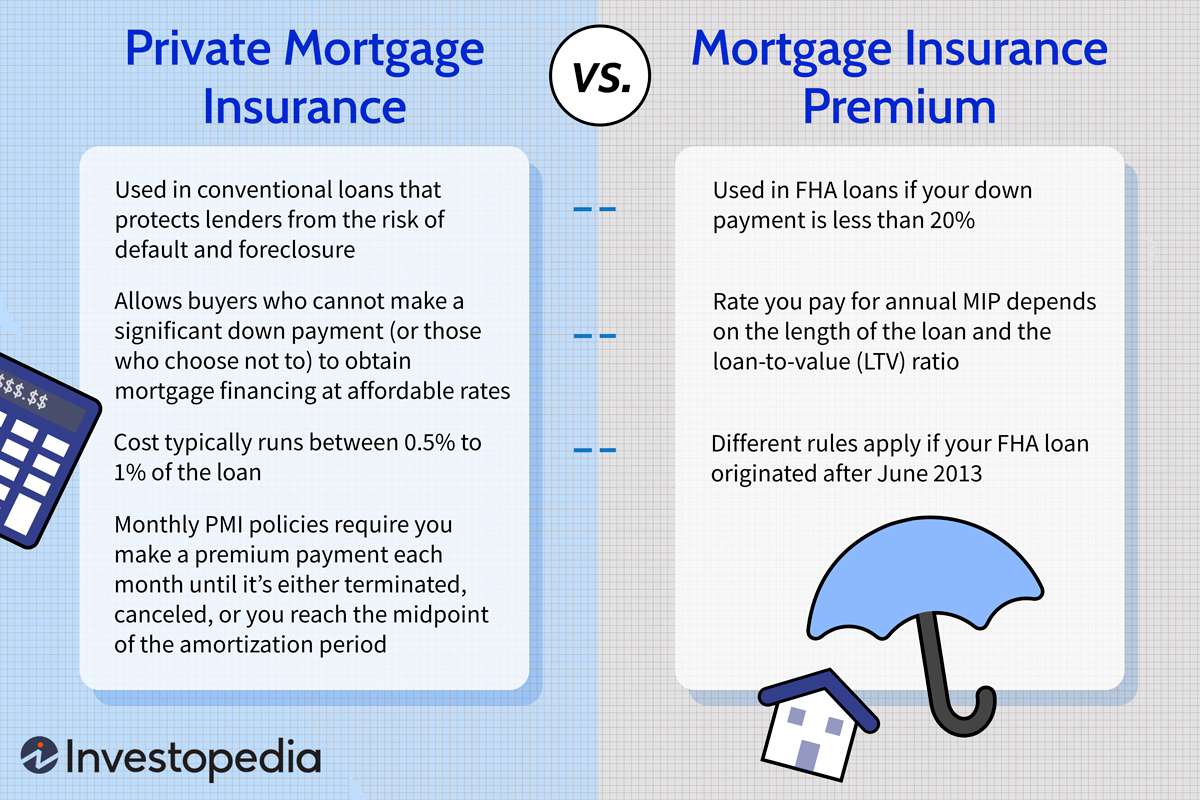

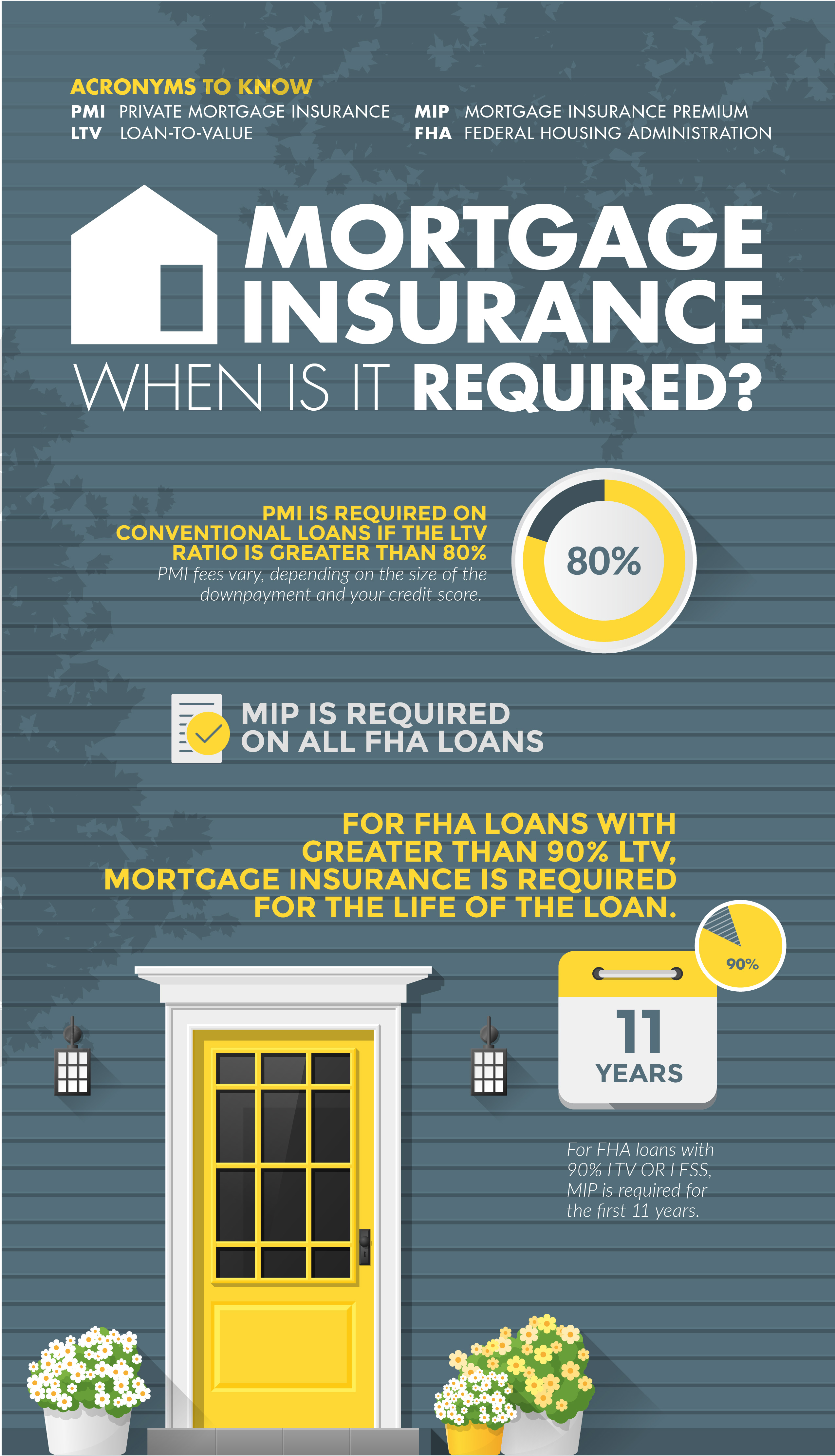

Mortgage Insurance Premium (MIP) is an insurance policy that is paid by homeowners to protect lenders from losses in the event of a mortgage default. This insurance is typically required when a borrower puts less than 20% down on a home loan. It is an additional cost that is added to the borrower’s monthly payment and is usually paid for up to 11 years or until the loan-to-value ratio (LTV) reaches 78%. MIP works by protecting the lender from losses if the borrower defaults on the loan. The premium is calculated as a percentage of the loan amount and is typically paid monthly. The amount of the premium is based on the loan-to-value (LTV) ratio and the borrower’s credit score. For example, borrowers with a higher credit score and lower LTV ratio will typically pay a lower MIP premium than those with a lower credit score and higher LTV ratio. The MIP premium is typically paid for up to 11 years or until the LTV ratio reaches 78%. Once the loan-to-value ratio reaches 78%, the MIP is no longer required and can be cancelled. Cancelling the MIP can significantly lower the borrower’s monthly payment but

What Are the Benefits of Paying Mortgage Insurance Premium?

Mortgage insurance premium (MIP) is a way for borrowers to protect their lenders from default. This type of insurance is typically required for borrowers who are putting less than 20% down when purchasing a home. Paying MIP can be beneficial for both lenders and borrowers in several ways. Benefits for Lenders: Since MIP protects the lender from a borrower defaulting, lenders will often be more willing to provide mortgages to those who are putting less than 20% down. This will allow more borrowers to become homeowners, which can provide beneficial economic growth for the local community. Benefits for Borrowers: Since MIP can protect the lender from default, it also offers some protection to borrowers. In the event of a borrower default, the lender will have insurance to cover the amount they are owed. This can help provide peace of mind to borrowers that their properties will remain theirs even if they experience financial hardship. In addition to the benefits of MIP, borrowers may also qualify for lower interest rates when they pay their MIP. Lower interest rates can help borrowers save money in the long run, making it easier to pay off their mortgages. Overall, paying MIP can be beneficial for both lenders

How Much Does Mortgage Insurance Premium Cost?

Mortgage Insurance Premium (MIP) is an upfront cost that borrowers must pay in order to secure their mortgage loan. The cost of MIP varies depending on the size and type of loan, as well as the borrower’s down payment. Generally speaking, the larger the loan, the higher the MIP cost. For example, a loan with a small down payment of less than 5% will typically require a higher MIP than a loan with a larger down payment. Additionally, FHA loans require a higher MIP cost than conventional loans. The cost of MIP will also differ based on the length of the loan. Generally speaking, the longer the loan term, the higher the MIP cost, although this will vary between lenders. Additionally, the cost of MIP can also vary based on the borrower’s credit score, as lenders will charge higher MIP rates for borrowers with lower credit scores. Overall, the cost of MIP can vary greatly depending on the loan type, down payment, credit score, and other factors. It is important for borrowers to understand the cost of mortgage insurance premiums as this may affect their overall budget for the loan. Additionally, it is important for borrowers to shop around and compare

How is Mortgage Insurance Premium Calculated?

Mortgage Insurance Premium (MIP) is calculated based on the loan amount, loan type, loan-to-value ratio, and term of the loan. The MIP rate is determined by the Federal Housing Administration (FHA) and is based on the loan-to-value ratio, the term of the loan, and the loan amount. The loan-to-value ratio is the amount of the loan compared to the value of the home. The term is the length of the loan and the amount of the loan determines the premium rate that is charged. The MIP rate is typically an annual premium payment and is based on the loan amount. The MIP rate is lower for loans with a higher loan-to-value ratio and longer terms, and is higher for loans with a lower loan-to-value ratio and shorter terms. To determine the MIP rate, the Federal Housing Administration will consider the loan amount, loan type, loan-to-value ratio, and term of the loan. Understanding these factors can help you determine the MIP rate that is most appropriate for your loan.

What Are the Alternatives to Paying Mortgage Insurance Premium?

Paying a mortgage insurance premium (MIP) can be an expensive cost, so it’s important to understand the alternatives. One alternative to paying MIP is to take out a second loan to cover the cost. This loan can be secured by your home and can provide the necessary funds to cover the MIP, allowing you to avoid having to pay for it out of pocket. Another option is to look into private mortgage insurance (PMI). This type of insurance is purchased directly from a private insurance company and can be used to cover the cost of the MIP. Another alternative is to make a higher down payment on the loan. By putting down more money upfront, the lender may waive the MIP requirement. Finally, you may want to consider an FHA-insured loan. These loans are backed by the Federal Housing Administration and typically require a lower down payment, which may result in a lower MIP. All of these alternatives can help you save money and avoid having to pay a mortgage insurance premium.