Are you considering buying a home, but don’t know what a mortgage payment is or how it works? You’re not alone! A mortgage payment is a regular payment made to a lender to pay off a home loan. It’s an important part of the home buying process and understanding how it works is an essential step in the journey to becoming a homeowner. In this article, we’ll explain what a mortgage payment is, how it works, and provide helpful tips to make sure you’re financially prepared. Get ready to become an expert on mortgage payments!

What is the Definition of a Mortgage Payment?

A mortgage payment is a monthly payment made by a borrower to a lender for the repayment of a mortgage loan. The payment typically includes principal and interest, as well as other fees such as homeowners insurance and property taxes. Mortgage payments are typically due on the first of the month, though some lenders may offer different payment dates, such as the 15th or the last day of the month. The amount of the mortgage payment is determined by the size of the loan, the interest rate, and the loan term. Borrowers can choose to make extra payments on their mortgages or pay them off early if they wish. Making extra payments can help borrowers save on interest over the life of the loan, while paying off the loan early can help them save thousands in interest payments.

Explaining the Components of a Mortgage Payment

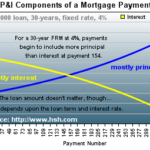

A mortgage payment is an essential part of the home ownership process. It is the amount the borrower pays each month to their lender in order to pay off their loan. Mortgage payments can vary depending on the type of mortgage, the loan amount, the interest rate, and other factors. The components of a mortgage payment include principal, interest, homeowners insurance, property taxes, and private mortgage insurance (PMI). Principal is the amount borrowed from the lender. This amount does not change over the life of the loan unless additional funds are borrowed. Interest is the fee that the borrower pays to the lender for borrowing the funds. This amount will vary depending on the type of loan and the interest rate. Homeowners insurance is the insurance policy that the borrower must purchase to protect their home from unforeseen circumstances such as fire or theft. Property taxes are taxes assessed by the local government that the borrower must pay. Private mortgage insurance is an additional cost required by some lenders to insure the loan if the borrower fails to make payments. Understanding the components of a mortgage payment is essential for anyone who is looking to purchase a home. Knowing the different components and how they impact your mortgage payment will help you make smarter decisions and find the best loan for your needs.

What Factors Determine the Amount of a Mortgage Payment?

Mortgage payments are determined by several factors, including mortgage loan amount, interest rate, loan term, and other factors. The amount of the mortgage loan is the amount of money borrowed, and the interest rate is the cost of borrowing that money. The loan term is the amount of time that the mortgage loan is in effect. When considering all of these factors together, the amount of a mortgage payment can vary greatly. The mortgage loan amount affects the amount of a mortgage payment, as the larger the loan amount, the higher the payment. The interest rate can also have a large effect on the payment, as a higher rate will result in a higher payment. The loan term also affects the payment, as a longer term means lower payments, but higher total interest paid. Other factors such as taxes, insurance, and PMI can also affect the amount of the payment. It is important to carefully consider all of these factors and their impact on the amount of a mortgage payment when determining how much to borrow. A good mortgage lender can help explain the different factors and how they affect the amount of the payment. It is important to understand how the payment is calculated in order to make the best financial decision and choose the right loan.

How to Make Mortgage Payments Easier

Making mortgage payments easier is an important part of managing your finances. There are several ways to reduce the amount of money you have to pay each month and make it easier to keep up with your payments. The first step is to determine how much you can realistically afford to pay each month. This means taking a close look at your budget and factoring in any income you have, as well as any expenses that you have. Once you have a good idea of what you can afford, you can start to look for ways to reduce your monthly payments. One way to make mortgage payments easier is by refinancing your loan. Refinancing your loan can help you lower your interest rate and get a lower monthly payment. This can save you money in the long run as you pay less interest over the life of the loan. Another option is to get a loan modification. Loan modifications can help you extend the length of the loan, reducing your monthly payments. The last way to make mortgage payments easier is by setting up automatic payments. Automating your payments can help you stay on top of them and make it easier to keep up with your payments. It can also help you avoid late fees and other penalties. Making mortgage payments

The Benefits of Making Regular Mortgage Payments

Making regular mortgage payments is one of the best ways to build equity and establish a positive credit rating. Paying your mortgage on time each month is a key factor in establishing a good credit score. By paying your mortgage on time, you are building trust with lenders and creditors that you are a responsible borrower. This will help you when you apply for a loan or credit card in the future. Additionally, making regular payments on your mortgage will help you build equity in your home. As you make payments, you are increasing the amount of ownership you have in the home. This equity can be used for investments, such as making improvements to the home or purchasing additional real estate. Making regular payments on your mortgage is an important aspect of financial planning, and can help you build wealth and reach your financial goals.