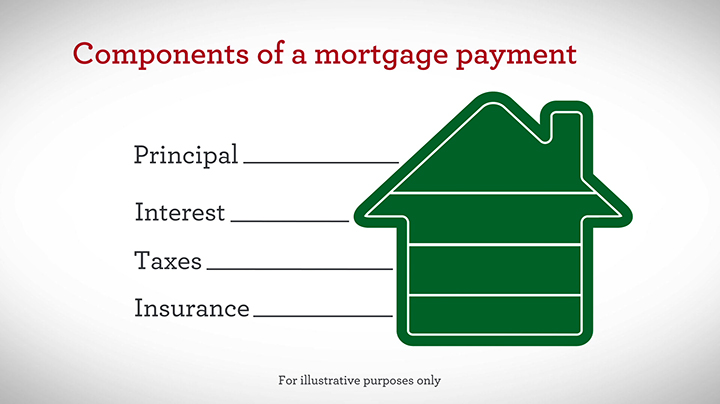

A mortgage principal is an essential part of understanding how a mortgage works. It’s the amount of money that you borrow, plus interest, when you take out a mortgage loan. Knowing the amount of your mortgage principal can help you make decisions about your home loan, such as how much you should pay each month, and how long it will take to pay off the loan. In this article, we’ll look at what a mortgage principal is and how it affects your monthly payments and total loan amount.

How Mortgage Principal Affects Your Monthly Mortgage Payment

The amount of mortgage principal you carry affects your monthly mortgage payment in a few ways. First, the more principal you owe, the higher your monthly payments will be. This is because the higher the principal, the higher the interest rate and the more interest you will pay each month. The second way your principal affects your monthly payments is that the amount of principal you owe will determine the amount of interest you pay each month. The more principal you owe, the more interest you pay each month. Lastly, the amount of principal you owe will determine the length of your mortgage. The more principal you owe, the longer your loan term and the more years you will have to make payments.It’s important to understand how mortgage principal affects your monthly mortgage payment so that you can make informed decisions when taking out a mortgage loan. Knowing how much principal you owe and how it affects your monthly payment can help you make the right decision and keep your finances in order. Making sure you have a clear understanding of how mortgage principal affects your monthly payment will help you save money and keep your finances in check.

Understanding Mortgage Principal to Help You Make the Right Decisions

Mortgage principal is the amount of money you owe on your loan, and it is typically the amount of money that you borrowed when you took out the loan. To understand how mortgage principal works and how it affects your finances, it is important to understand the underlying concepts of interest rates, loan terms, and amortization. Interest rates are the fees that you pay to borrow money, and they are typically expressed as a percentage of the loan amount. Loan terms refer to the length of time you have to pay back the loan, and amortization is how a loan is structured over time. Your mortgage principal will be affected by all of these factors, so understanding these concepts can help you make smart decisions when it comes to your mortgage. Additionally, it is important to consider how changes in interest rates and loan terms can affect your mortgage principal and how that can affect your overall financial picture. Understanding how mortgage principal works is a key to making informed decisions that can save you money over the long term.

Different Types of Mortgage Principal

The different types of mortgage principal can vary depending on the type of mortgage loan. Conventional mortgage loans are the most common type of mortgage loan and are not backed by the federal government. These loans typically have a fixed interest rate and a fixed monthly payment for the life of the loan. Adjustable-rate mortgages, or ARMs, have an interest rate that can change over time. This type of loan offers more flexibility than a conventional loan, but it also carries more risk. Government-backed mortgages, such as those insured by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), offer more relaxed eligibility requirements and lower down payments than conventional loans. These types of loans are beneficial for borrowers who may not qualify for conventional loans due to their credit score or lack of down payment funds. Reverse mortgages are a unique type of loan that allows homeowners to access their home equity without having to make monthly payments. The homeowner must be at least 62 years of age and must use the home as their primary residence. The loan becomes due when the homeowner passes away, moves out of the home, or fails to pay taxes and insurance. No matter which type of mortgage principal you choose, it is important

Knowing When to Adjust Mortgage Principal

Adjusting the mortgage principal is an important decision for homeowners. Knowing when to adjust the mortgage principal can make a big difference in the long-term success of a homeowner’s financial plan. Making adjustments to the mortgage principal can help homeowners save money on interest payments and build equity faster. The best time to adjust the mortgage principal is when a homeowner has extra money and wants to reduce their principal balance. This can be done by making extra principal payments or refinancing the mortgage. Extra principal payments can help reduce the total amount of interest paid over the life of the loan. Refinancing the mortgage can also help lower the amount of interest paid, as well as possibly lower the monthly payments. Homeowners should carefully consider their financial situation before making any adjustments to the mortgage principal. They should also speak with a qualified mortgage professional to ensure they are making the best decision for their individual situation. Adjusting the mortgage principal can be a great way to save money and build equity faster, but homeowners should take the time to make sure they are making the right decision for their long-term financial success.

Exploring the Benefits of a Lower Mortgage Principal

Exploring the many benefits of a lower mortgage principal can help homeowners maximize their savings and build wealth. Having a lower principal amount can mean a lower monthly payment and fewer interest payments over the life of the loan. This can allow homeowners to keep more of their hard-earned money in their pocket. Additionally, it can also lead to faster loan repayment, allowing homeowners to become debt free more quickly, and free up their income for other investments or savings goals. A lower principal can also lead to significant savings over time, as homeowners will pay less interest over the life of the loan. Lower mortgage principal payments can also be beneficial for homeowners who are trying to refinance, as a lower principal can mean a better interest rate and more affordable loan terms. Ultimately, a lower mortgage principal can be an excellent way to save money and build wealth.