When it comes to buying a home, one of the most important factors to consider is mortgage interest. A mortgage interest is the amount of interest charged by a lender on a home loan, usually expressed as a percentage of the total loan amount. Knowing what mortgage interest is and how it is calculated will help you determine how much you need to budget for when it comes to purchasing a home. This article will explain what mortgage interest is and how it is calculated, so you can make the best decision for your financial future.

Definition of Mortgage Interest

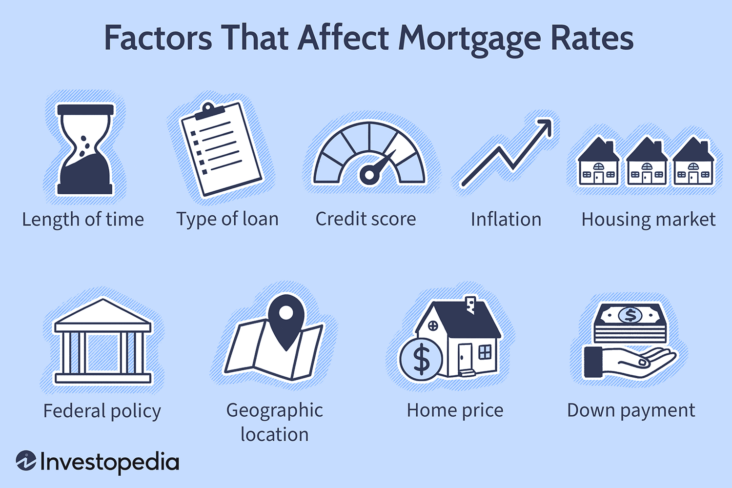

Mortgage interest is the interest charged on a mortgage loan, which is a type of loan that is secured by real estate. In most cases, a mortgage loan is paid over a period of time that is known as the mortgage term. During this time, the borrower will make monthly payments that include principal and interest. The interest portion of the payment is what is known as the mortgage interest. The interest rate on the loan will determine the amount of interest that is paid on the loan.Mortgage interest is usually paid to the lender as part of the monthly payment. The interest rate on the loan will determine the amount of the monthly payment. The interest rate is determined by a variety of factors, including the current market rate, the borrower’s credit score, and the loan-to-value ratio. The interest rate can also vary based on the type of loan, such as a fixed-rate mortgage or an adjustable-rate mortgage.Mortgage interest is usually tax-deductible, which can help reduce the overall cost of the loan. It is important to understand the tax implications of taking out a mortgage loan, as this can help you determine the best course of action for your financial situation. Additionally, it is important to understand

Types of Mortgage Interests

Mortgage interest is the money charged by a lender when a borrower takes out a loan to purchase a home. Mortgage interest is usually expressed as a percentage of the loan amount and can vary depending on the type of loan. The higher the interest rate, the more money the borrower has to pay in the form of interest. There are several types of mortgage interests available, including fixed rate mortgages, adjustable rate mortgages, and hybrid mortgages. Fixed rate mortgages have an interest rate that remains the same throughout the life of the loan. This type of mortgage interest is ideal for those who want a predictable monthly payment amount. It also provides stability for those who are looking for long-term financial security. Adjustable rate mortgages have an interest rate that can fluctuate based on market conditions. This type of mortgage interest has a lower initial cost but can be more expensive over time. Hybrid mortgages combine elements of both fixed and adjustable rate mortgages. This type of mortgage interest offers a combination of stability and potential for savings depending on market conditions. No matter which type of mortgage interest you choose, it is important to understand the terms and conditions of your loan agreement. Be sure to research all of your options and compare interest rates, fees, and other terms before signing

Calculating Mortgage Interest

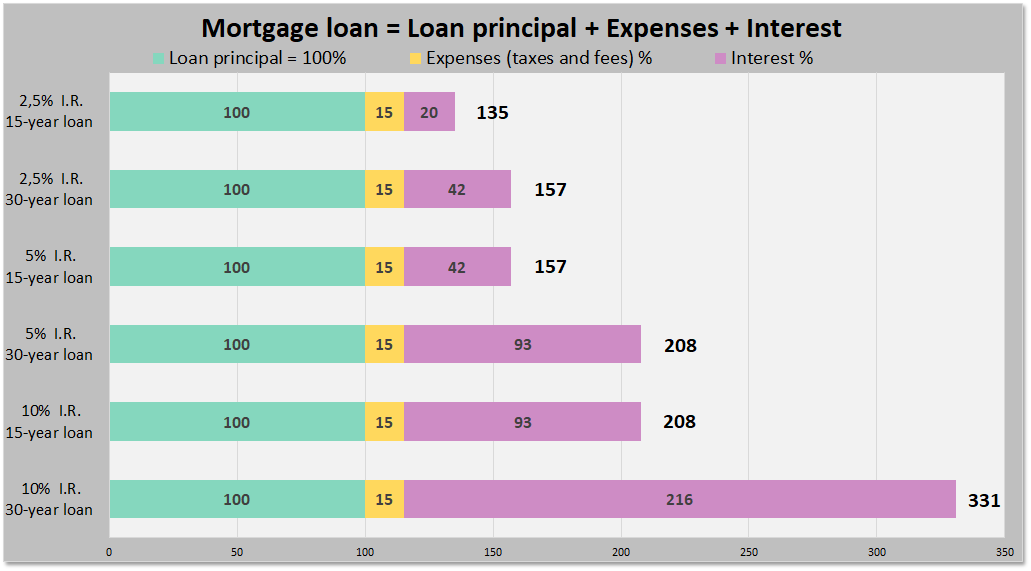

Calculating mortgage interest is an important step when calculating the total cost of a mortgage. Interest is calculated as a percentage of the principal balance, which is the original amount of money borrowed. In most cases, the interest rate is fixed, meaning it won’t change during the term of the loan, but some loans have variable rates which can fluctuate over the course of the loan. The amount of interest paid on a mortgage is typically determined by the amount of the loan, the interest rate, and the length of the loan. Interest is typically compounded monthly, meaning each month’s interest is calculated on the principal balance plus any interest that has been added from previous months. On a monthly basis, the amount of interest paid is equal to the principal balance multiplied by the annual interest rate divided by 12. This amount is then added to the principal balance for the following month. In most cases, mortgage lenders will provide an amortization schedule that breaks down the principal and interest payments over the life of the loan. This schedule will show how much of each payment goes towards principal and how much will be applied towards interest. It’s important to understand how much of each payment is being applied to principal, as this will determine the

Benefits of Mortgage Interest

Mortgage interest can be a great benefit to homeowners, and there are several advantages to taking advantage of them. Mortgage interest can help homeowners save money on their monthly mortgage payments, as they are usually lower than they would be with a traditional loan. Furthermore, homeowners who take advantage of mortgage interest can often receive tax deductions and other financial benefits. Additionally, mortgage interest can help homeowners build equity in their home, which can be used to borrow money for home improvements, college tuition, and more. Finally, mortgage interest can be used to help homeowners pay off their mortgage faster and reduce their overall debt. Therefore, taking advantage of mortgage interest can be a great way for homeowners to save money and build equity in their home.

Tips for Maximizing Mortgage Interest Savings

When it comes to maximizing your mortgage interest savings, there are a few tips you can use to ensure you get the most out of your home loan. First, shop around and compare different loan offers to find the best interest rate and terms for your needs. It’s also important to keep an eye on market trends and current interest rates to see if you can take advantage of any lower rates. Additionally, you can consider opting for a shorter loan term so you can pay off your loan quicker and save on interest. Finally, you can also consider making extra payments or larger payments towards the principal of your loan to reduce the amount of interest you’re paying. By following these tips, you can maximize your interest savings and save on your mortgage in the long run.