Are you looking to purchase a new home and curious about mortgage rates? Mortgage rates are an important factor when it comes to deciding if you can afford the home of your dreams. Knowing what mortgage rates are and how they work can help you make an informed decision on whether or not you can afford a home. In this article, we’ll explore what mortgage rates are and how they can affect your decision.

Factors that Affect Mortgage Rates

Mortgage rates are an integral part of the home-buying process, and understanding the factors that affect them is essential for any homebuyer. Mortgage rates are based on a variety of factors, including economic indicators, government policies, and the type of loan you select. One of the most important factors that affects mortgage rates is the state of the housing market. When the housing market is strong, lenders are more likely to offer higher rates to attract more customers. On the other hand, when the housing market is weak, lenders are less likely to offer higher rates, as they don’t want to attract too many customers. The Federal Reserve’s policies are also influential when it comes to mortgage rates. The Federal Reserve is responsible for setting the federal funds rate, which is the rate that banks use to lend money to each other. When the Federal Reserve lowers the federal funds rate, it usually leads to lower mortgage rates. Finally, the type of loan you select will also affect your mortgage rate. For example, fixed-rate mortgages typically offer lower rates than adjustable-rate mortgages, which can give you more stability and predictability. However, adjustable-rate mortgages may offer a lower initial rate, so

How to Determine the Current Mortgage Rate

When it comes to determining the current mortgage rate, there are a few different factors that can influence the rate you may receive. The first factor is the type of loan you’re looking to get – whether it’s a fixed rate or an adjustable rate mortgage (ARM). The type of loan you choose will determine the rate you receive, as fixed rate loans typically have lower rates than ARMs. Additionally, the amount of your down payment, the credit score of the borrower, and the current market conditions can all affect the mortgage rate you’re offered. Knowing these factors can help you understand how the current mortgage rate is determined and can help you make an informed decision when it comes to selecting a loan. Talk to your lender to understand all the factors at play and to get a better idea of the rate you may qualify for.

Types of Mortgages and Rates

There are a variety of mortgage types available to prospective home buyers, each of which can offer different terms, interest rates, and benefits. Fixed-rate mortgages are the most common type of mortgage, and are a good option for those looking for a consistent payment each month. These mortgages provide the same interest rate for the life of the loan, allowing for budgeting and long-term planning. Adjustable-rate mortgages, also known as ARM loans, offer more flexibility in terms of interest rate and payment, as the rate can vary over the life of the loan. This type of loan is best for those who plan to stay in their home for a short period of time.Mortgage rates can vary significantly based on the type of loan and the lender, so it is important to compare rates from various lenders before making a decision. Generally, the best mortgage rates are available to those with good credit scores, a low debt-to-income ratio, and a large down payment. Additionally, government-backed loans, such as FHA and VA loans, often have lower rates than conventional loans. Shopping around and comparing rates can help you get the best deal on your mortgage.

How to Secure the Best Mortgage Rate

When it comes to securing the best mortgage rate, it is important to know what factors will affect your rate. Your credit score is one of the most important factors that lenders consider when deciding your mortgage rate. A higher credit score can give you access to lower interest rates and better loan terms. Additionally, the amount of your down payment will also affect your mortgage rate. A larger down payment can give you additional leverage when negotiating with lenders. It is also important to shop around when looking for the best mortgage rate, as lenders may offer different rates and terms. Lastly, the type of loan you choose can also have an impact on your mortgage rate. Different loan types may have varying interest rates and eligibility requirements. By understanding what factors will affect your rate and shopping around for the best option, you can be sure to secure the best mortgage rate possible.

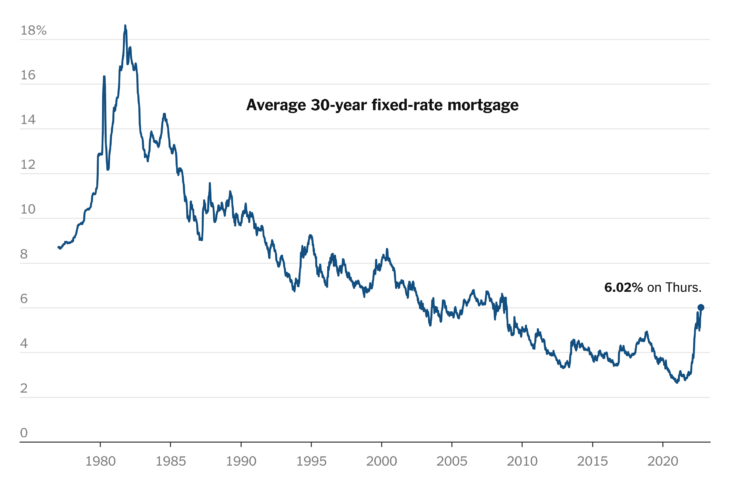

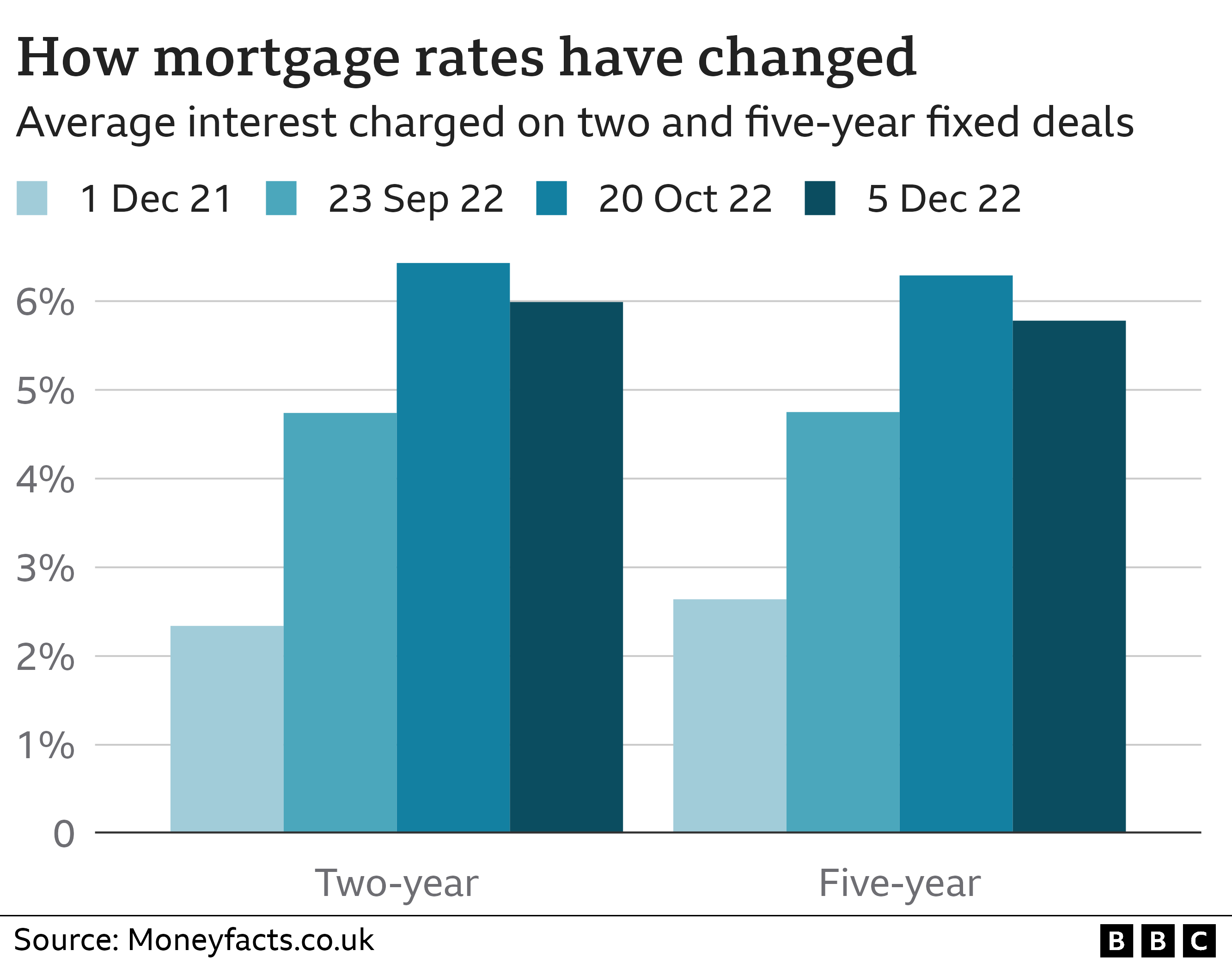

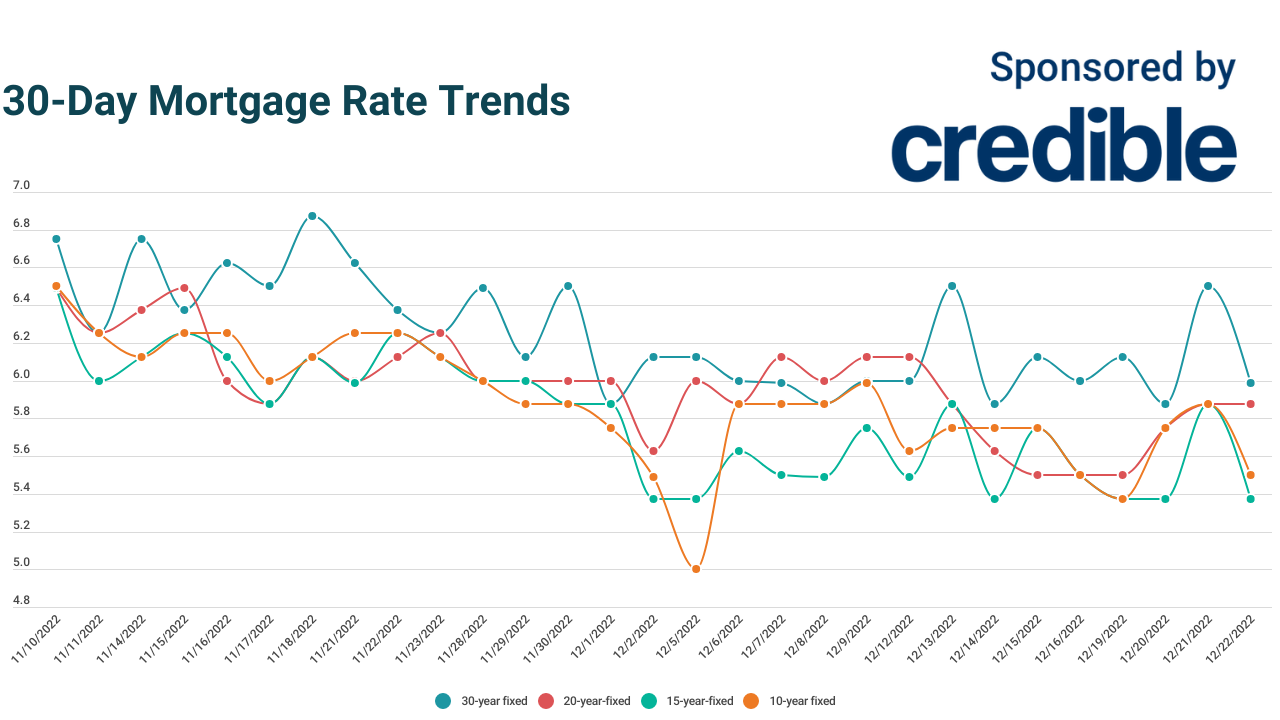

How Mortgage Rates Have Changed Over Time

Mortgage rates have changed drastically over the years, as economic trends and other factors have caused them to fluctuate. In the 1950s, mortgage rates began to rise gradually, as the Federal Reserve started to increase the federal funds rate. Over the following decades, mortgage rates would move up and down, depending on the state of the economy and the Federal Reserve’s policies. In the early 2000s, the Federal Reserve initiated a policy of lowering interest rates, which caused mortgage rates to fall drastically. This period of low mortgage rates lasted until the 2008 financial crisis, when the Federal Reserve increased the federal funds rate in an effort to stabilize the economy. In the wake of the crisis, mortgage rates began to rise and eventually reached a peak of over 5% in 2018. Since then, mortgage rates have declined again as the Federal Reserve has lowered interest rates in an attempt to stimulate the economy. Currently, mortgage rates are much lower than they were in 2018, with the average rate for a 30-year fixed mortgage hovering around 3%. It is important for potential homebuyers to stay up-to-date on current mortgage rates and economic trends in order to make the best decision when it comes to purchasing a home.