A mortgage is an integral part of home ownership, but how do mortgage rates work? Understanding the factors that affect mortgage rates, like the state of the economy, the type of loan you choose, and your credit score, can help you get the best deal on your home loan. Whether you’re a first-time homebuyer or an experienced homeowner, this article will provide you with the information you need to make informed decisions about your mortgage.

Overview of Mortgage Rates: What You Need to Know

Mortgage rates are an important factor to consider when shopping for a home. The rate you are offered is determined by a variety of factors, including your credit score, the amount of your loan and the size of your down payment. Mortgage rates can fluctuate over time, as the market for mortgage-backed securities changes. To get the best rate, it’s important to shop around and compare offers from multiple lenders. You should also consider the different types of mortgage products available, such as fixed-rate, adjustable-rate and jumbo loans, and determine which one is best for your financial situation. Knowing your options and understanding how mortgage rates work will help you make an informed decision and find the best deal for your needs.

Factors That Impact Mortgage Rates

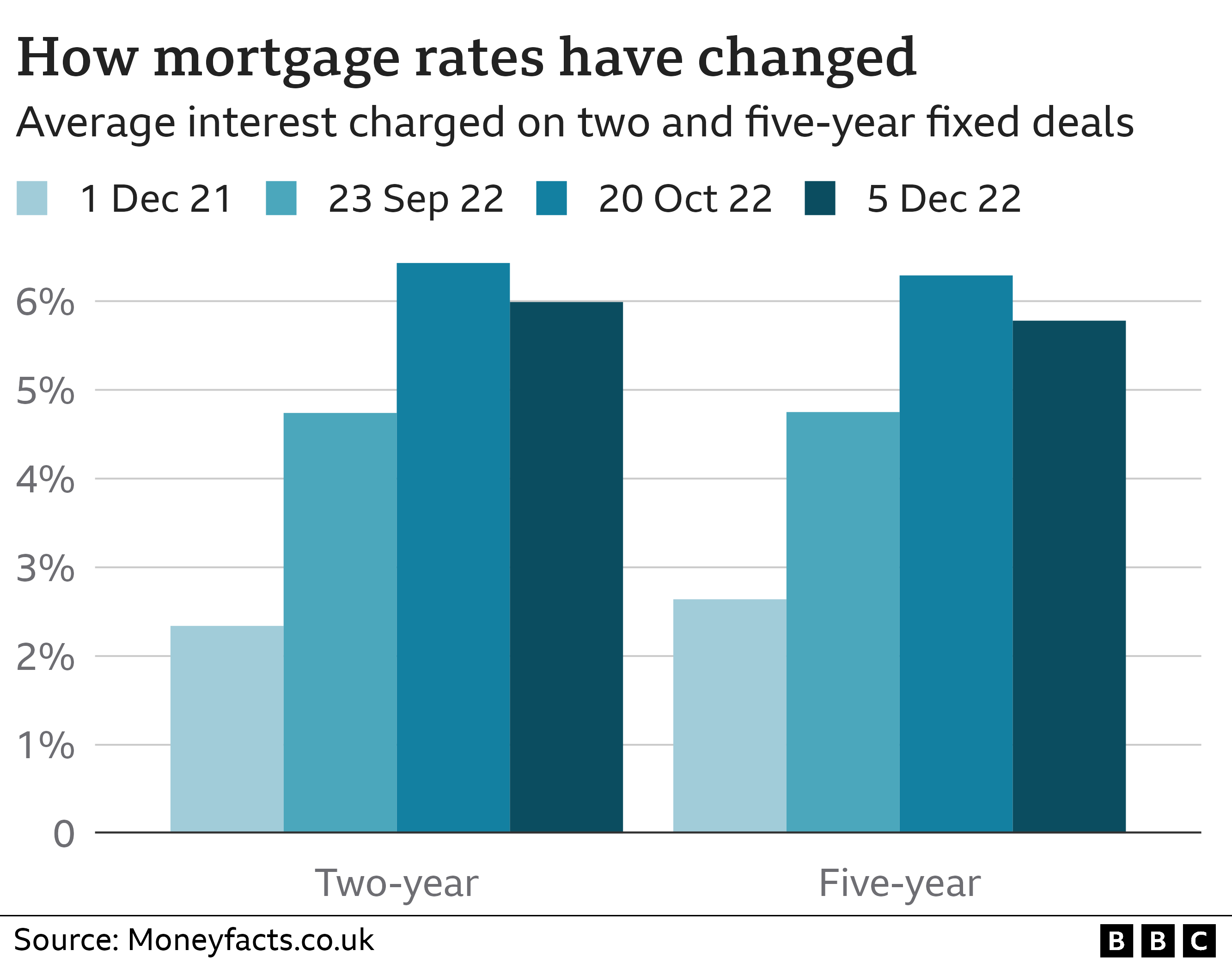

Mortgage rates are an important consideration when it comes to home buying or refinancing. It is important to understand the factors that impact mortgage rates so that you can make an informed decision when shopping around for the best terms. The most influential factor impacting mortgage rates is the health of the economy. When the economy is doing well, mortgage rates tend to be lower. This is because lenders are more likely to offer lower rates to borrowers when the economy is strong. On the other hand, when the economy is weak, lenders are more likely to increase their rates to protect themselves from potential losses. In addition to the economy, mortgage rates are also affected by the availability of funds. When there is a large amount of money available, lenders are more likely to offer lower mortgage rates in order to attract more borrowers. Conversely, when funds are scarce, lenders are more likely to increase their rates in order to protect themselves from potential losses. Mortgage rates can also be impacted by the type of loan that you are looking for. For instance, adjustable-rate mortgages tend to have lower rates than fixed-rate mortgages. This is because the interest rate on an adjustable-rate mortgage can change over time, which can make it a risk

How to Compare Mortgage Rates

Comparing mortgage rates can be a tedious and time-consuming task, but it is essential to finding the best rate for you. To compare rates, start by researching the different types of loans available to you and determine which type fits your financial needs. Then, you can research different lenders and compare the interest rates, fees, and other factors associated with each loan. Additionally, you should also consider the loan term, your credit score, and any other factors that could influence the rate you receive. Finally, compare the total cost of the loan and determine which one offers the most value. By doing your research and taking the time to compare mortgage rates, you can save a considerable amount of money in the long run.

How to Choose the Best Mortgage Rate for You

Choosing the best mortgage rate for you can be a complex process. It is important to compare several different mortgage rates, as well as the terms and conditions associated with each loan. When comparing mortgage rates, you should pay close attention to the interest rate, the length of the loan, any additional fees associated with the loan, and the lender’s reputation. Additionally, you should consider the type of loan you are applying for and the loan-to-value ratio of your home. Knowing these factors can help you negotiate the best mortgage rate for your situation. It is also important to consider if you will be able to keep up with the payments over the life of the loan. Before signing your loan agreement, make sure to read all of the fine print, including any prepayment penalties that may apply. Taking the time to do your research and compare different mortgage rates can save you money in the long run.

Strategies for Finding the Lowest Mortgage Rate

Having the lowest mortgage rate possible could save you thousands of dollars on your mortgage payments over the life of your loan. There are several strategies that you can use to help you find the lowest rate available. First, shop around with several different lenders before committing to a loan. Different lenders may offer different interest rates and terms, so it’s important to compare them all. It’s also important to make sure that you have a good credit score so you can get the best possible interest rate. Additionally, you should aim to make a larger down payment since lower down payments tend to have higher interest rates. Finally, consider asking for points on your mortgage loan. This could help you get a lower interest rate, but it will cost you more upfront. By following these strategies, you can help ensure that you get the lowest mortgage rate possible.