Discover the potential advantages and drawbacks of an Adjustable Rate Mortgage (ARM) in our comprehensive analysis of this popular home financing option. As you navigate the world of mortgage products, it’s crucial to weigh the pros and cons of an ARM to determine if it’s the right fit for your financial goals and lifestyle. Delve into the intricacies of interest rate fluctuations, monthly payment variations, and overall savings in our in-depth exploration of this dynamic loan option. Stay informed and make a confident decision by uncovering the most crucial factors to consider when choosing an ARM.

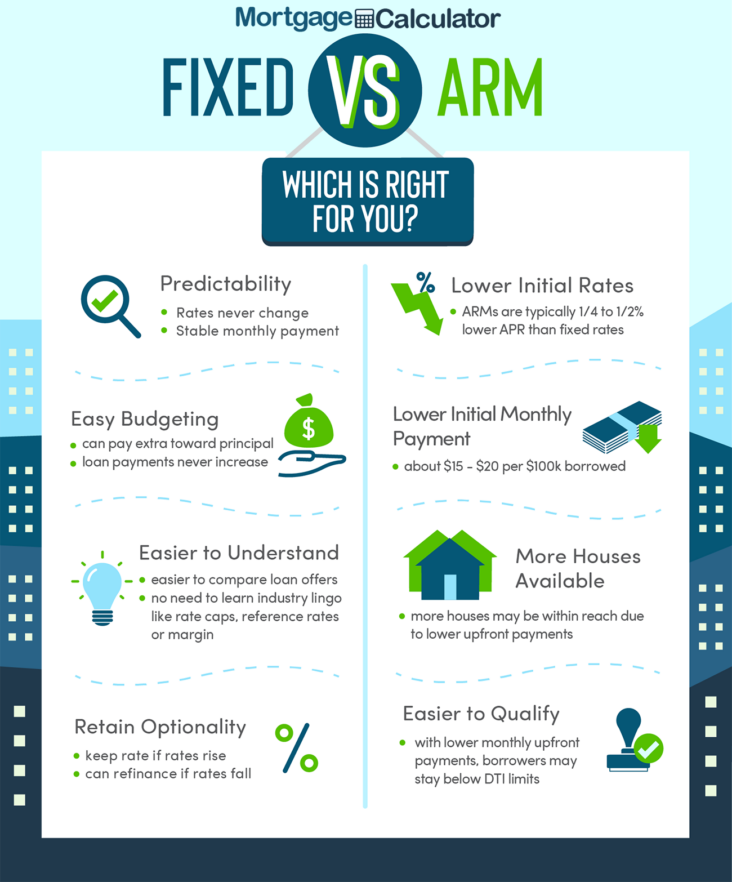

Lower initial interest rates: Adjustable-rate mortgages typically have lower initial interest rates compared to fixed-rate mortgages

One of the main advantages of an adjustable-rate mortgage (ARM) is the opportunity to benefit from lower initial interest rates. Generally, these rates are significantly lower than their fixed-rate counterparts, which makes ARMs an attractive option for many homebuyers. This cost-effective start allows borrowers to save on interest payments during the initial phase of their mortgage, often resulting in more manageable monthly payments. With lower interest rates, homebuyers may qualify for a larger loan amount and potentially afford a more desirable property. However, it’s essential to consider the potential rate fluctuations in the future and how they may impact your long-term financial health.

This can be beneficial for borrowers who plan to move or refinance their mortgage within a few years, as they can take advantage of the lower rates during the initial fixed-rate period.

One significant advantage of an Adjustable Rate Mortgage (ARM) is the opportunity for borrowers to capitalize on the lower interest rates during the initial fixed-rate period. This is especially beneficial for individuals who intend to relocate or refinance their mortgage within a few years. By opting for an ARM, these borrowers can potentially save a substantial amount on their monthly mortgage payments, making it a financially strategic decision. Furthermore, an ARM allows borrowers to build equity faster due to the reduced interest rate, paving the way for a smoother transition when the time comes to move or refinance their mortgage.

Lower monthly payments: Because of the lower initial interest rates, ARM borrowers can expect lower monthly payments during the fixed-rate period

Lower monthly payments are a significant advantage of Adjustable Rate Mortgages (ARMs) during the fixed-rate period, making them an attractive option for many homebuyers. The initial interest rates offered by ARMs tend to be lower than those of fixed-rate mortgages, resulting in reduced monthly expenditures for the borrower. This financial relief can enable homeowners to allocate funds towards other important expenses or investments, such as paying off debt, saving for emergencies, or making improvements to their property. However, it’s crucial for prospective ARM borrowers to carefully consider their long-term financial goals and potential rate fluctuations, as lower monthly payments may only be temporary if interest rates rise in the future.

This can help borrowers save money and potentially allocate those savings towards other financial goals or investments.

One of the most significant advantages of Adjustable Rate Mortgages (ARMs) is the potential for borrowers to save money on interest payments. With lower initial interest rates compared to fixed-rate mortgages, ARMs can provide short-term savings that can be allocated towards other financial goals or investments. This flexibility allows borrowers to capitalize on opportunities for wealth growth and diversification, ultimately improving their overall financial health. By strategically leveraging the savings from an ARM, individuals can enhance their financial portfolio, ensuring a more secure and prosperous future. However, it’s essential to carefully assess the potential risks and benefits before opting for an ARM, as the interest rates may increase over time.

Rate adjustments can be beneficial: If interest rates decrease over time, ARM borrowers may see their monthly payments decrease as well

Rate adjustments can be beneficial for Adjustable Rate Mortgage (ARM) borrowers, particularly when interest rates experience a downward trend. In such scenarios, monthly mortgage payments may decrease, resulting in significant savings for homeowners. This flexible nature of ARMs enables borrowers to capitalize on favorable market conditions, while potentially improving their financial stability and enhancing their purchasing power. However, it’s crucial for borrowers to closely monitor the interest rate environment and make informed decisions to reap the benefits of this mortgage option. Overall, ARMs can prove advantageous when navigated wisely, with rate adjustments playing a key role in their appeal.

This can lead to significant savings over the life of the loan, especially if the borrower does not

The potential for significant savings over the loan’s lifespan is one of the most attractive benefits of an adjustable-rate mortgage (ARM). These savings can be realized, particularly if the borrower does not plan on staying in the home for an extended period. By capitalizing on lower initial interest rates, homeowners can reduce their monthly mortgage payments, enabling them to allocate funds towards other financial goals or investments. However, it’s essential to carefully assess one’s long-term plans and consider the potential fluctuations in interest rates to make an informed decision about whether an ARM is the right choice for their unique situation.