Are you considering stepping into the world of luxury real estate? If so, a jumbo loan might be the key to unlocking the doors to your dream home. However, before diving headfirst into this high-value financing option, it’s essential to weigh the pros and cons of jumbo loans. In this comprehensive guide, we’ll explore the advantages and disadvantages of these larger-than-life mortgages, helping you make an informed decision and secure the best possible terms for your financial future. So, let’s embark on this journey to upscale homeownership together and discover the ins and outs of jumbo loans!

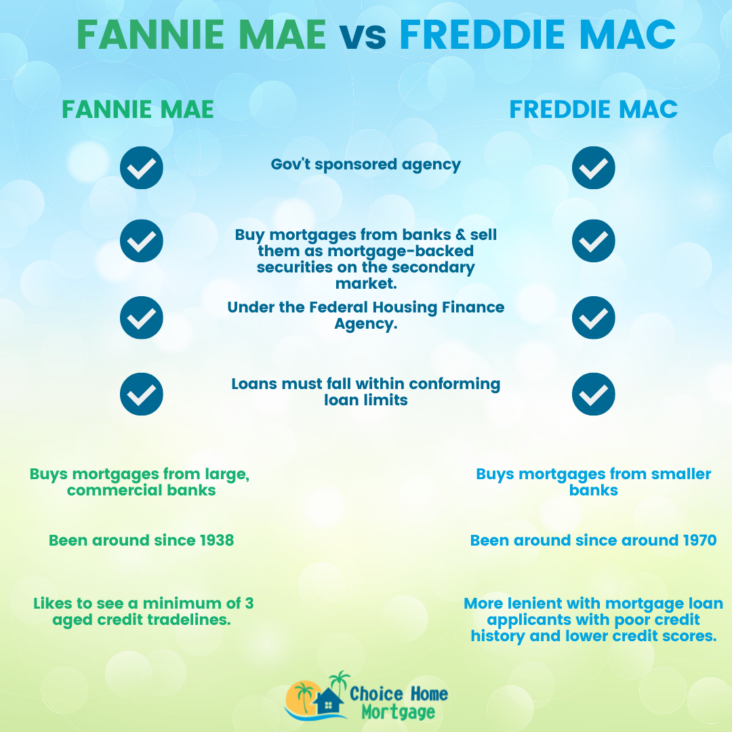

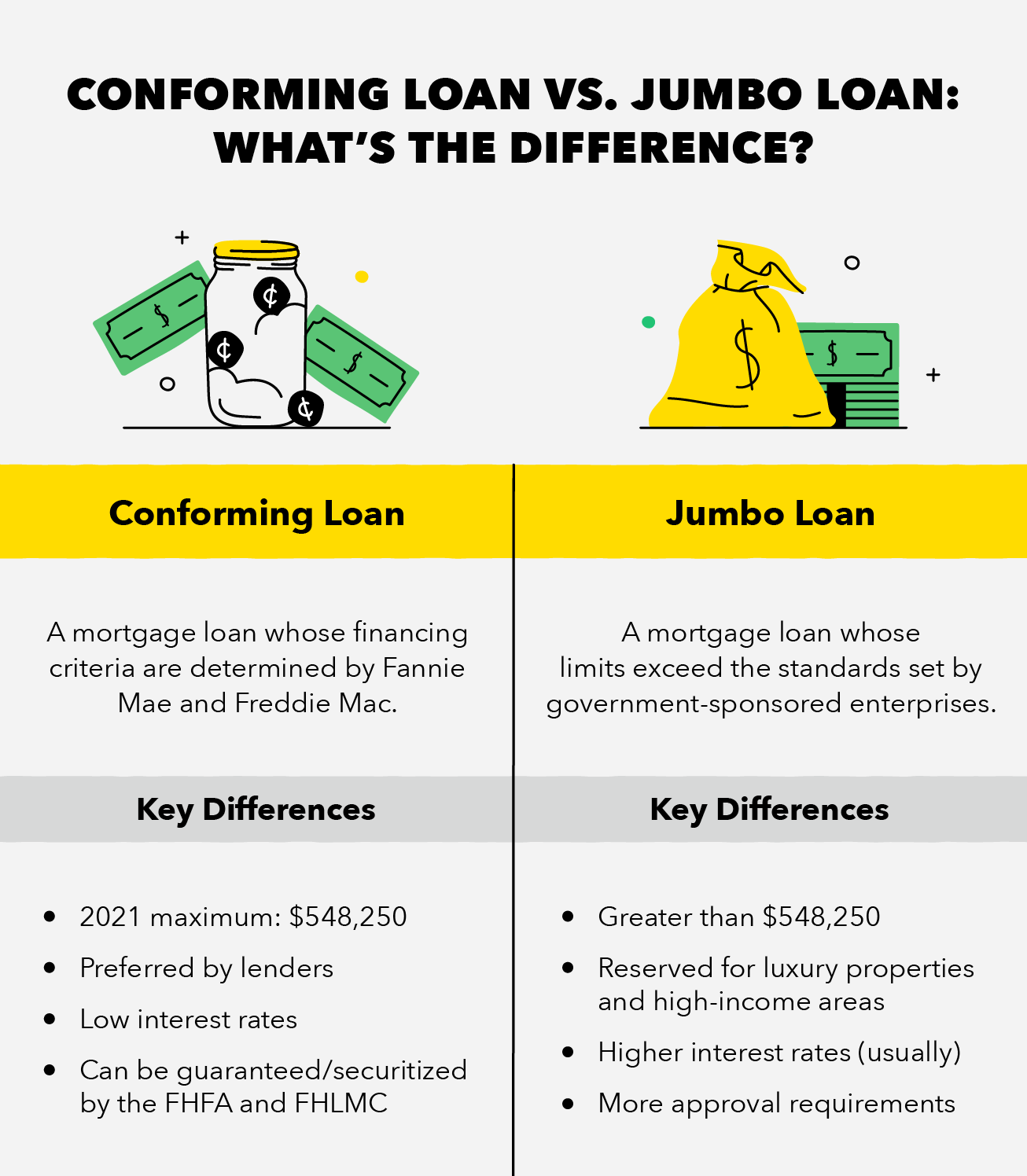

Higher loan limits: Jumbo loans allow borrowers to access financing for more expensive homes that exceed the conforming loan limits set by Fannie Mae and Freddie Mac

Higher loan limits are a significant advantage of jumbo loans, as they enable borrowers to secure financing for luxury homes that surpass the conforming loan boundaries established by Fannie Mae and Freddie Mac. With this increased borrowing capacity, individuals can invest in their dream property without being restricted by the conventional loan threshold. This flexibility is particularly beneficial in high-cost real estate markets, where home prices often exceed standard lending limits. However, it’s essential to note that obtaining a jumbo loan typically requires a more stringent approval process, including higher credit scores and lower debt-to-income ratios. By offering greater purchasing power, jumbo loans contribute to an expanded range of housing opportunities for qualified borrowers.

This can be particularly beneficial in high-cost areas where housing prices are consistently above the conforming loan limits.

A jumbo loan can be a game-changer for potential homeowners in high-cost areas, where housing prices often exceed conforming loan limits. These non-conforming loans grant borrowers the ability to finance a more expensive property without the restrictions imposed by conventional loans. By providing a larger sum, jumbo loans enable homebuyers to secure their dream homes in competitive markets, where prices are constantly on the rise. Additionally, lenders may offer more flexible terms and lower interest rates for well-qualified borrowers. However, it’s essential to carefully weigh the pros and cons and consider the potentially higher down payments, stricter eligibility requirements, and the risk of a higher loan balance before opting for a jumbo loan.

Competitive interest rates: While jumbo loans historically had higher interest rates than conforming loans, in recent years, interest rates for jumbo loans have become more competitive and, in some cases, may be lower than conforming loan rates

Competitive interest rates have become a significant advantage of jumbo loans in recent times. Historically, these loans were associated with higher interest rates compared to conforming loans. However, the current market scenario has witnessed a shift, with jumbo loans now offering interest rates that are not only competitive but, in certain instances, even lower than conforming loan rates. This is a major selling point for borrowers seeking larger mortgages, as a favorable interest rate can lead to significant savings over the loan’s duration. As a result, jumbo loans have become an increasingly popular option for homebuyers and refinancers alike.

This can result in significant savings for borrowers over the life of the loan.

One of the key benefits of a jumbo loan is the potential for significant savings over the life of the loan. Since jumbo loans typically come with lower interest rates compared to conventional loans, borrowers can potentially save thousands of dollars in interest payments. This can be especially advantageous for borrowers who plan to stay in their homes for an extended period, as the savings can accumulate over time. By opting for a jumbo loan, homebuyers can secure a larger loan amount without the added burden of higher interest rates, making it an attractive option for those looking to finance a high-priced property.

Flexibility in terms and options: Jumbo loans often come with various term options and loan structures, allowing borrowers to choose the best fit

Jumbo loans offer remarkable flexibility in terms and options, catering to the unique needs of borrowers seeking larger loan amounts. With a variety of term lengths and adjustable or fixed-rate loan structures, jumbo loans empower borrowers to select the ideal financing solution for their high-value property purchases. This tailor-made approach ensures that borrowers can secure a loan that aligns with their financial goals and long-term plans. By carefully evaluating the available options, borrowers can make well-informed decisions and maximize the benefits of a jumbo loan. Ultimately, this flexibility contributes to the overall appeal and popularity of jumbo loans among high-net-worth individuals and savvy real estate investors.