Discover the ins and outs of a conventional loan in this comprehensive guide that delves into its pros and cons, helping you make an informed decision. As a popular mortgage option, conventional loans offer an array of benefits, including flexible terms and potentially lower interest rates. However, they also come with their own set of drawbacks, such as stricter qualification requirements. Unravel the complexities of this financing option and determine if it’s the right fit for your home-buying journey by exploring the advantages and disadvantages of conventional loans in this must-read article.

Lower interest rates: Conventional loans typically have lower interest rates than government-backed loans, such as FHA or VA loans

Lower interest rates are a significant advantage of conventional loans over government-backed options like FHA or VA loans. Since these loans are not insured by the government, lenders often offer more competitive rates to attract borrowers, ultimately leading to lower monthly payments and reduced overall borrowing costs. Borrowers with good credit scores and stable financial histories can particularly benefit from these lower rates, making a conventional loan a more attractive option for those who qualify. In today’s competitive housing market, securing a loan with a lower interest rate could be the key to affording your dream home and ensuring long-term financial stability.

This can result in significant savings over the life of the loan.

Opting for a conventional loan can lead to substantial savings throughout the loan’s lifespan, making it a financially attractive choice for many homebuyers. With lower interest rates and reduced private mortgage insurance (PMI) costs, borrowers can save thousands of dollars over the life of their mortgage. Additionally, the flexibility of conventional loan terms allows borrowers to customize their repayment plan, potentially shortening the loan duration and further increasing savings. By carefully considering the benefits of a conventional loan, homebuyers can make an informed decision that suits their financial situation and long-term goals, ultimately leading to a more cost-effective and rewarding homeownership experience.

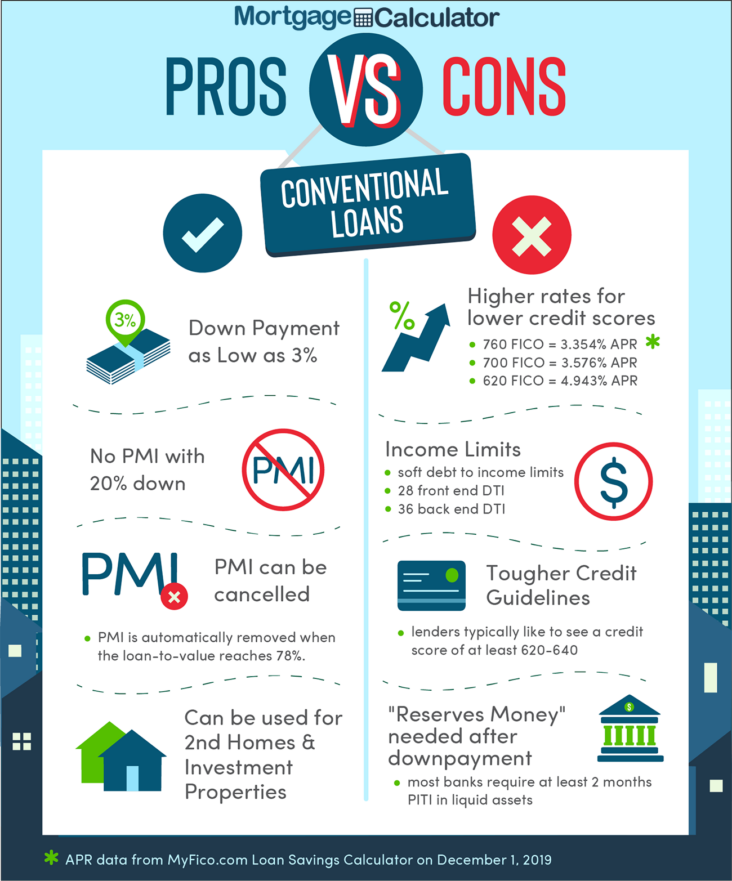

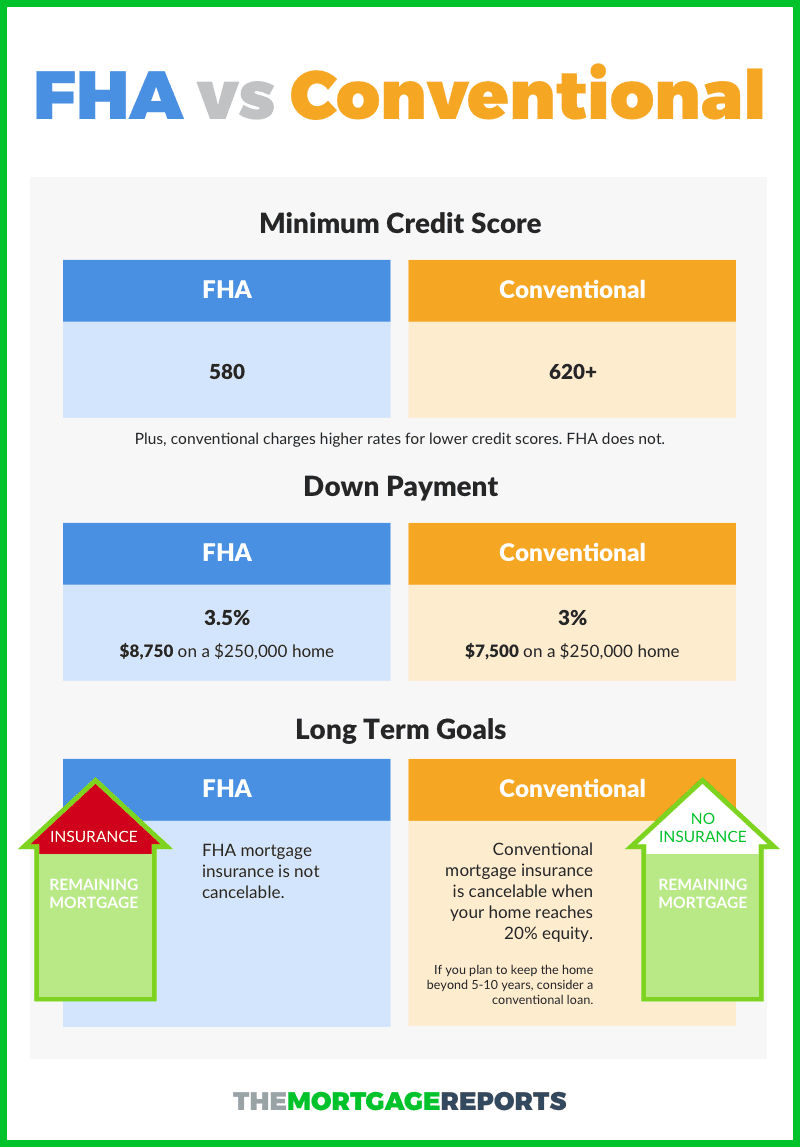

No mortgage insurance requirement: If you are able to put down at least 20% of the purchase price, you will not be required to pay private mortgage insurance (PMI), which can save you thousands of dollars over the life of the loan.

One of the most significant advantages of a conventional loan is the potential to avoid paying private mortgage insurance (PMI) if you can make a 20% down payment. This considerable saving can result in thousands of dollars kept in your pocket throughout the loan’s duration. PMI is typically required by lenders when borrowers put down less than 20% to protect the lender in case of default. By eliminating the need for PMI, a conventional loan with a substantial down payment can be a more cost-effective option for homebuyers, allowing them to potentially secure more favorable terms and save money in the long run.

Flexible loan terms: Conventional loans offer a variety of loan terms, ranging from 10 to 30 years, allowing you to choose a repayment schedule that best fits your financial situation.

One of the most significant advantages of conventional loans is the flexibility they offer in terms of loan terms. With options ranging from 10 to 30 years, borrowers can select a repayment schedule that aligns with their financial goals and capabilities. This adaptability not only helps in managing monthly payments but also in potentially saving thousands of dollars in interest over the life of the loan. Furthermore, the versatility of conventional loan terms makes them an attractive option for borrowers with varying financial profiles, including first-time homebuyers, seasoned investors, or those looking to refinance their existing mortgage. This wide range of choices ensures that borrowers can find a loan term that best suits their individual needs and long-term financial strategies.

Higher loan limits: Conventional loans typically have higher loan limits than government-backed loans

Higher loan limits are a significant advantage of conventional loans, as they allow homebuyers to borrow more money compared to government-backed loans. This makes them a great option for those looking to purchase a more expensive home or invest in a high-value property. The Federal Housing Finance Agency (FHFA) sets the loan limits for conventional mortgages, which are subject to annual adjustments. As of 2021, the conforming loan limit for a single-family home is $548,250 in most areas, with higher limits in more expensive markets. This flexibility in loan amounts enables borrowers to secure financing that best suits their needs and budget, ultimately expanding their options in the real estate market.