Are you considering a USDA loan for your dream home? Look no further! In this comprehensive article, we’ll explore the numerous pros and cons of USDA loans, a lesser-known yet highly advantageous mortgage option. Designed to promote homeownership in rural areas, these government-backed loans boast impressive benefits like zero down payments and competitive interest rates. However, they also come with their share of drawbacks, such as income limitations and property restrictions. Delve into the world of USDA loans with us and make an informed decision that could potentially save you thousands on your home buying journey. Don’t miss out on this essential guide!

No down payment required: USDA loans provide 100% financing, which means that the borrowers do not need to have a down payment

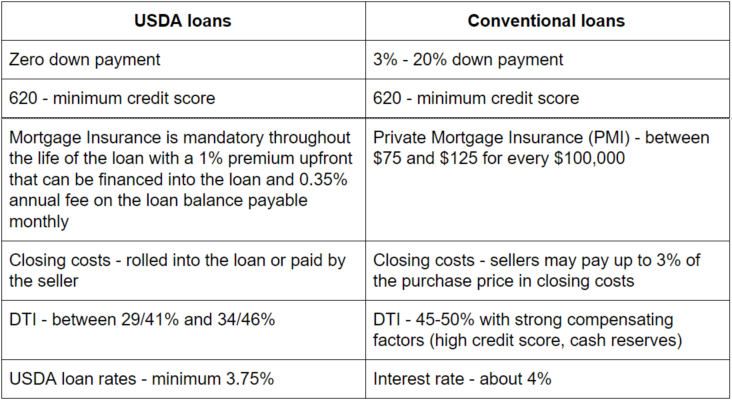

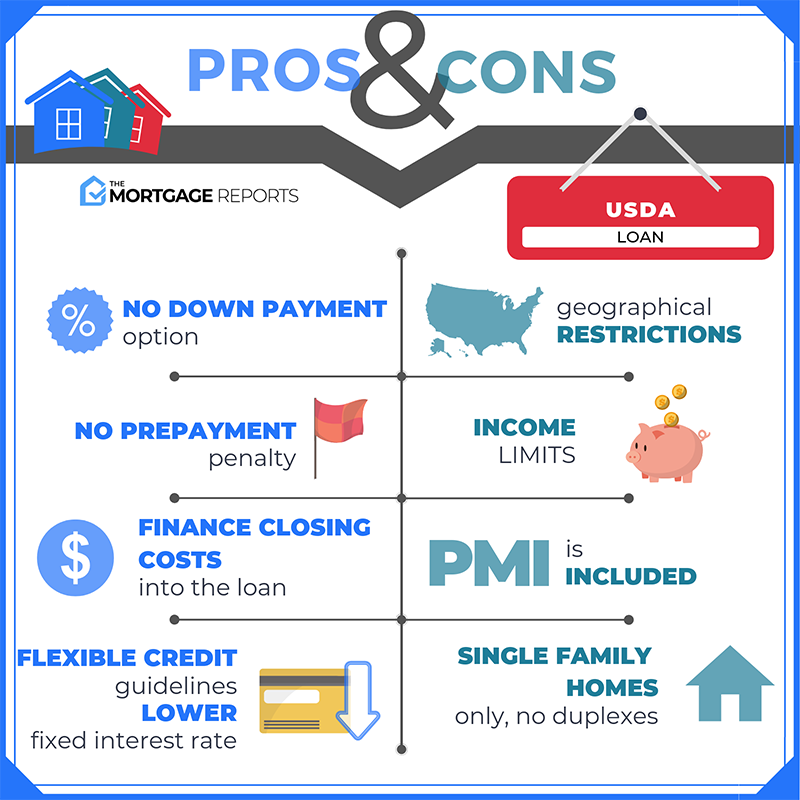

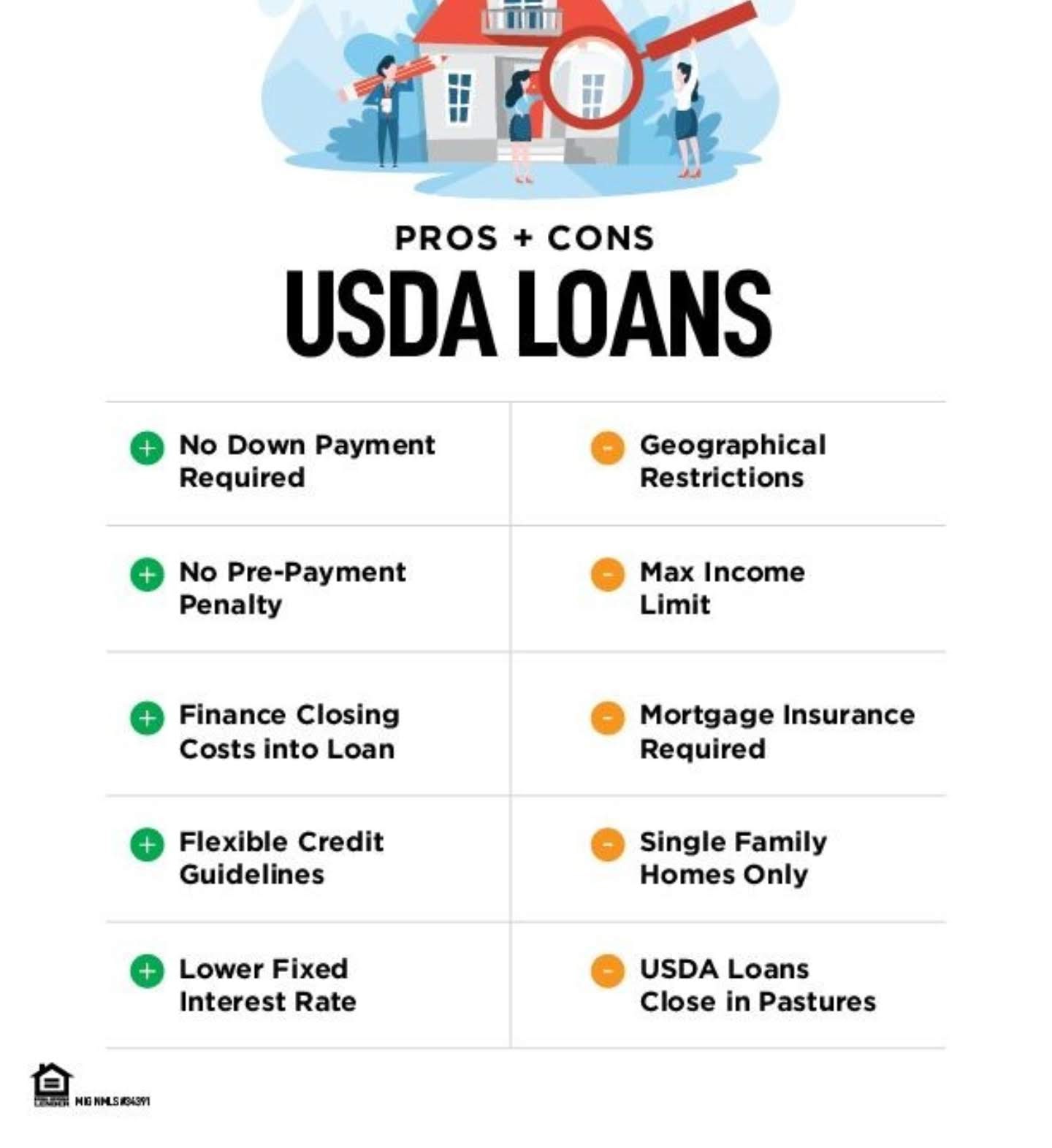

One of the most significant advantages of a USDA loan is that it offers 100% financing, eliminating the need for a down payment. This is a game-changer for many potential homebuyers who may struggle to save up for a substantial down payment amidst rising housing prices and other financial obligations. With a USDA loan, qualified borrowers can finance the entire purchase price of their dream home in eligible rural areas, making homeownership more attainable for those with limited savings. This no-down-payment feature is a unique benefit that sets USDA loans apart from conventional loans, which typically require a down payment of 3-20%, and even FHA loans that mandate a 3.5% minimum down payment.

This can be a significant advantage for first-time homebuyers or those with limited savings.

A USDA loan can be a game-changer for first-time homebuyers or those with limited savings, as it provides 100% financing and eliminates the need for a hefty down payment. This opens up homeownership opportunities for individuals who may have been previously deterred by high upfront costs. Moreover, USDA loans typically offer competitive interest rates and more relaxed credit requirements compared to conventional loans. By reducing the financial barriers to homeownership, USDA loans empower a broader range of buyers to invest in their dream home and build long-term equity, ultimately promoting financial stability and fostering thriving communities.

Flexible credit requirements: USDA loans have more lenient credit requirements compared to conventional loans

Flexible credit requirements are a key advantage of USDA loans, as they offer an accessible mortgage solution for potential homebuyers with imperfect credit histories. The minimum credit score requirement for a USDA loan is typically 640, but in some cases, borrowers with lower scores may still be approved. This leniency allows a wider range of individuals to qualify for a mortgage, making homeownership a reality for those who may have experienced financial setbacks in the past. Furthermore, USDA loans take into account non-traditional credit sources, such as rental and utility payment history, which can be beneficial for first-time homebuyers who haven’t yet built a strong credit profile. Overall, the flexible credit requirements of USDA loans provide a more inclusive path toward homeownership.

Borrowers with lower credit scores may still qualify for a USDA loan, making it easier for more people to become homeowners.

The USDA loan program offers a unique opportunity for borrowers with less-than-perfect credit scores to secure financing for their dream home. This flexible mortgage option is designed to help more individuals achieve homeownership, even with lower credit ratings. By offering lenient credit score requirements, the USDA loan program opens the door for potential homebuyers, who may have been turned down by traditional lenders. This inclusive approach promotes economic growth in rural areas and empowers a broader range of individuals to become proud homeowners. However, it is essential to understand that while the USDA loan program may be more forgiving, maintaining a good credit score is still vital for ensuring favorable loan terms and interest rates.

Competitive interest rates: USDA loans typically have lower interest rates compared to conventional loans

Competitive interest rates are a significant benefit of USDA loans, as they generally offer lower rates compared to conventional loans. With lower interest rates, borrowers can save a substantial amount of money over the life of their mortgage, making homeownership more affordable for eligible rural and suburban homebuyers. The USDA’s backing of these loans reduces the risk for lenders, which in turn allows them to pass on the savings to borrowers in the form of reduced interest rates. This competitive advantage makes USDA loans an attractive option for those who qualify, providing an opportunity to secure financing with more favorable terms than traditional mortgage options.

This can result in lower monthly mortgage payments and overall savings over the life of the loan.

One of the most significant advantages of a USDA loan is the potential for lower monthly mortgage payments and substantial savings over the loan’s life. This is primarily due to the competitive interest rates and the lack of a down payment requirement, which reduces the initial costs and allows for more manageable monthly payments. Moreover, the USDA guarantee on the loan provides lenders with the confidence to offer attractive terms, ultimately benefiting the borrower. By choosing a USDA loan, homebuyers can enjoy increased financial flexibility and long-term affordability, making it an ideal option for those looking to purchase a home in eligible rural areas.

Use for various property types: USDA loans can be used to purchase a variety of property types, including

The USDA loan program offers numerous benefits for homebuyers looking to purchase various types of properties. One significant advantage is its flexibility in accommodating different property types, such as single-family homes, townhouses, condominiums, and even manufactured homes. This versatility provides potential homeowners with a wider range of options to consider when searching for their dream home. Furthermore, since USDA loans cater to rural and suburban areas, buyers can explore the beauty of countryside living, away from the hustle and bustle of crowded cities. Thus, USDA loans open doors to a diverse array of housing opportunities, making homeownership more accessible for many.