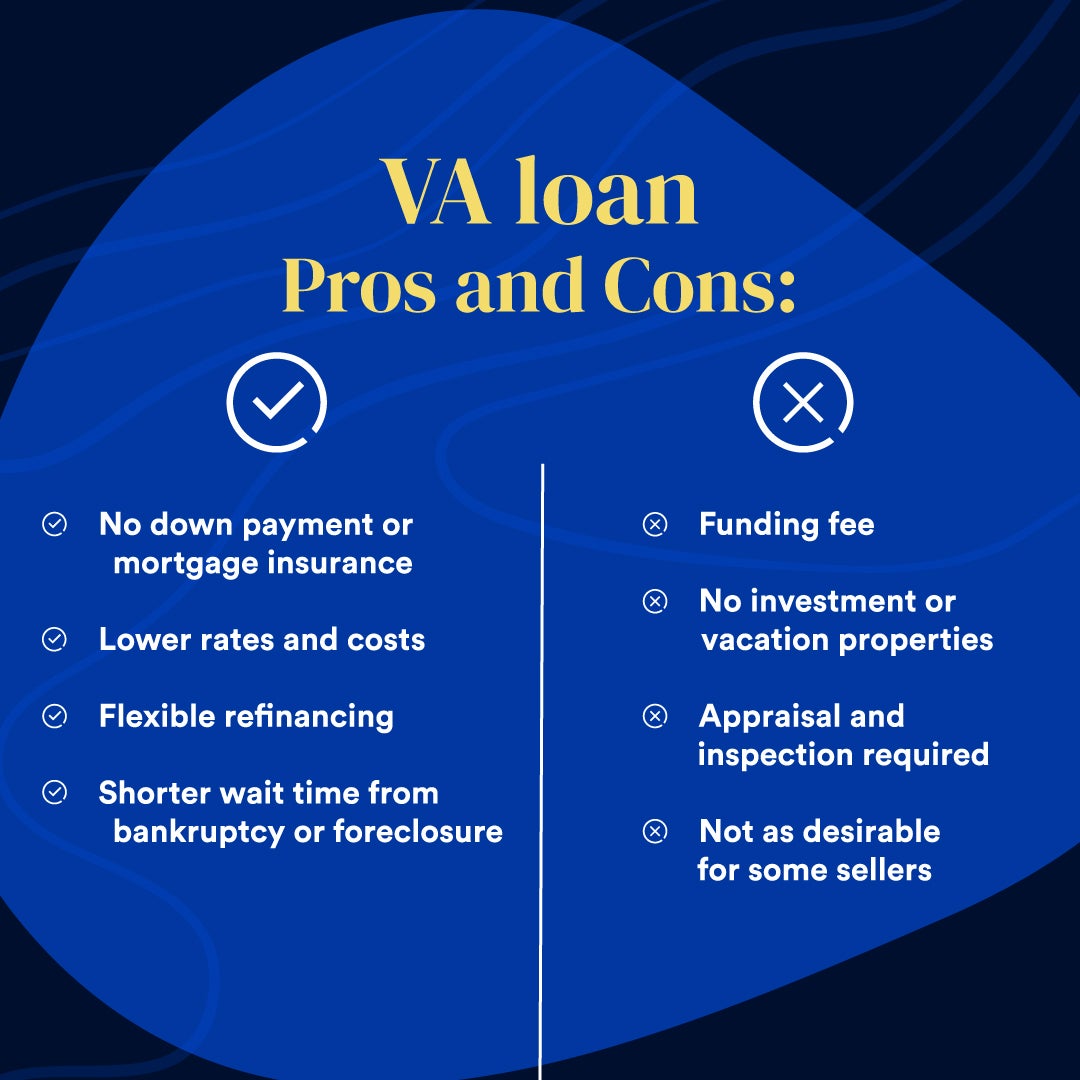

Are you a veteran, active-duty service member, or eligible surviving spouse considering homeownership? If so, a VA loan might be the perfect solution for you! This unique mortgage option, backed by the Department of Veterans Affairs, offers numerous advantages that can make your home-buying journey more accessible and affordable. However, like any financial decision, it’s essential to weigh the pros and cons to ensure it’s the right fit for your situation. In this comprehensive article, we’ll dive into the ins and outs of VA loans, exploring the benefits and drawbacks to help you make an informed decision when it comes to financing your dream home.

Low or no down payment: One of the most significant advantages of a VA loan is the ability to purchase a home with little or no down payment

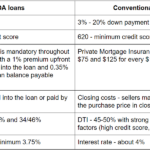

Low or No Down Payment: VA loans present a substantial financial benefit for eligible homebuyers, as they often require little to no down payment. This feature is particularly attractive for first-time homebuyers or those with limited savings, as it enables them to achieve their homeownership goals without the need for a large upfront investment. With conventional mortgage options, borrowers typically need to provide a 5% to 20% down payment, while VA loans can allow for a 0% down payment. This not only reduces the financial burden on borrowers but also expedites the home-buying process, allowing veterans and military families to settle into their new homes sooner.

Qualified veterans can finance up to 100% of the home’s value, making it easier for them to become homeowners.

One of the most significant advantages of a VA loan is the ability for qualified veterans to finance up to 100% of the home’s value, making homeownership more accessible for those who have served our country. This benefit eliminates the need for a down payment, which can be a significant financial hurdle for potential homebuyers. With a VA loan, veterans can secure a mortgage with no money down, allowing them to achieve the dream of homeownership without the burden of saving for a large upfront payment. Furthermore, this 100% financing option can provide veterans with more flexibility in choosing a home that fits their needs and budget, making it an attractive choice for those looking to invest in their future.

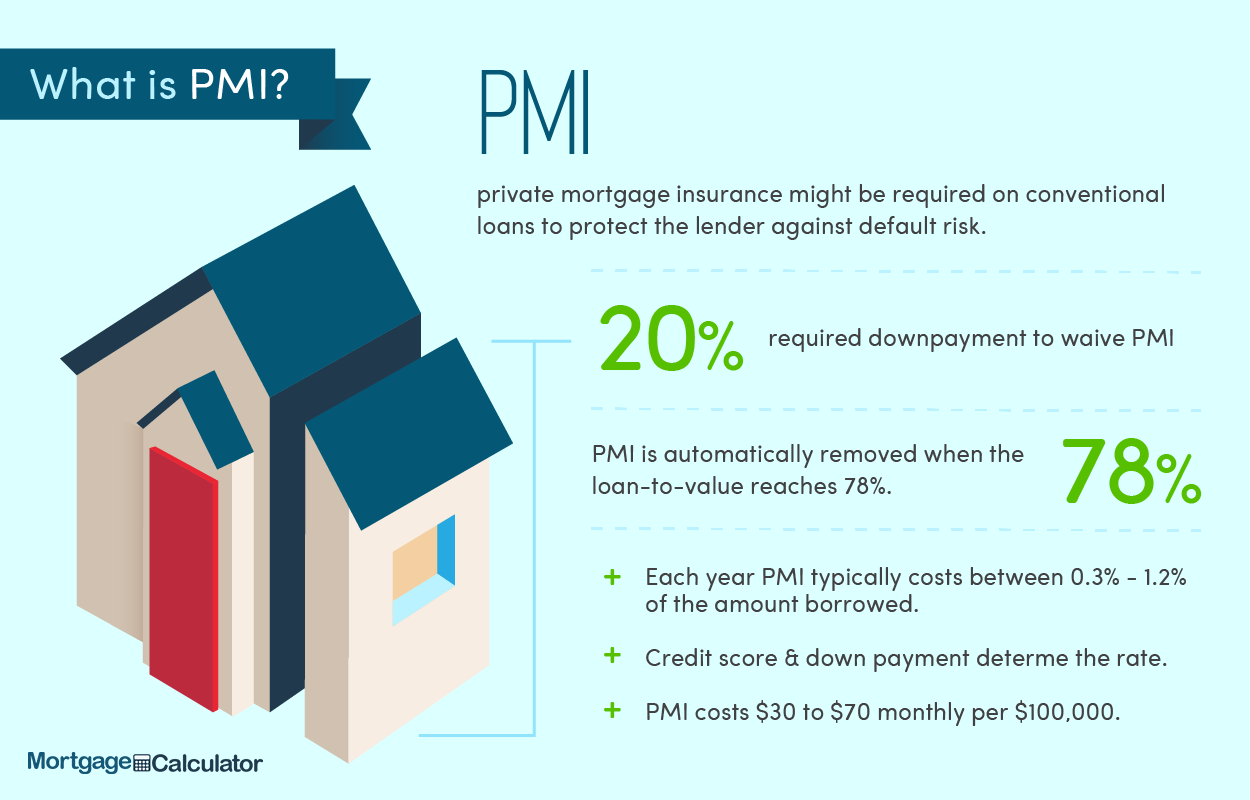

No private mortgage insurance (PMI): VA loans do not require borrowers to pay PMI, which is typically required for home loans with less than a 20% down payment

One significant advantage of a VA loan is the exemption from Private Mortgage Insurance (PMI), a substantial cost-saving benefit for eligible borrowers. Traditional home loans generally require PMI for down payments less than 20%, leading to higher monthly mortgage payments. However, with a VA loan, borrowers can enjoy 100% financing without the added burden of PMI. This benefit not only reduces the upfront costs associated with purchasing a home but also leads to lower monthly payments for veterans and active-duty service members. By eliminating PMI from the equation, VA loans provide a more affordable and accessible path to homeownership for those who have served our country.

PMI can be a substantial monthly expense, so not having to pay it can save veterans thousands of dollars over the life of their loan.

The absence of Private Mortgage Insurance (PMI) is a noteworthy advantage of VA loans, as it can lead to significant savings for veterans. Typically, borrowers who cannot afford a 20% down payment on a conventional loan are required to pay PMI, which protects the lender in case of default. This additional cost can amount to hundreds of dollars per month, adding up to thousands over the life of a loan. With a VA loan, however, no PMI is required, regardless of the down payment amount. This means that veterans can enjoy lower monthly payments and increased long-term affordability, making homeownership a more attainable goal for those who have served our country.

Competitive interest rates: VA loans generally have lower interest rates compared to conventional loans

Competitive interest rates are one of the major advantages of opting for a VA loan. Generally, these loans offer lower interest rates compared to conventional loans, making them a more affordable option for eligible borrowers. The reduced interest rates can potentially save veterans and active-duty service members thousands of dollars over the life of the loan. This financial benefit is a direct result of the VA guarantee, which minimizes the risk for lenders and allows them to offer better terms. Moreover, the competitive rates provided by VA loans can help borrowers achieve their homeownership goals without putting excessive strain on their monthly budgets, ultimately enhancing their overall financial stability.

The Department of Veterans Affairs guarantees a portion

The Department of Veterans Affairs (VA) plays a crucial role in providing financial security for eligible veterans by guaranteeing a portion of their home loans. This guarantee ensures that lenders are more willing to offer favorable terms, such as lower interest rates and relaxed credit requirements, to qualified borrowers. As a result, VA loans have become an attractive financing option for veterans and active-duty service members. However, it’s essential to weigh the pros and cons of this type of loan before making a decision. Understanding the ins and outs of VA loan guarantees can help potential borrowers make informed choices about their mortgage options, ultimately leading to a successful homeownership experience.