Are you looking for a way to get a shared mortgage with a partner or family member but don’t know where to start? Don’t worry, we’ve got you covered! In this article, we will provide you with a step-by-step guide on how to get a shared mortgage and the best tips to make it happen. With our advice, you’ll be able to navigate the process quickly and easily so that you can get the mortgage you need and secure your financial future. Let’s get started!

Research lenders & rates

Researching lenders and rates is essential when it comes to getting the best deal on a shared mortgage. Compare different banks, brokers and lenders to find the one that best suits your needs.

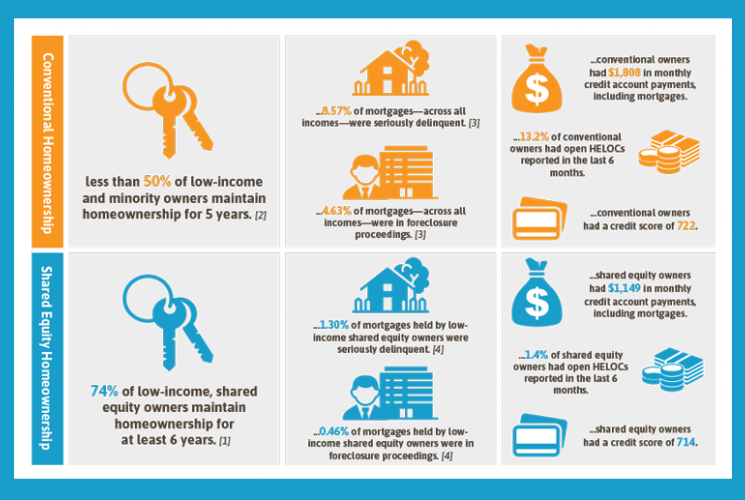

Shared mortgages are becoming increasingly popular for those looking to buy property. Applying for a shared mortgage can be a daunting task, so here are our top tips to help you get approved: Research your options – compare different mortgage products and lenders to ensure you’re getting the best deal possible. Get your finances in order – make sure your credit score is in good shape and that you’re able to afford the repayments. Have a reliable co-borrower – make sure you choose someone who is responsible and can contribute financially.

Calculate affordability

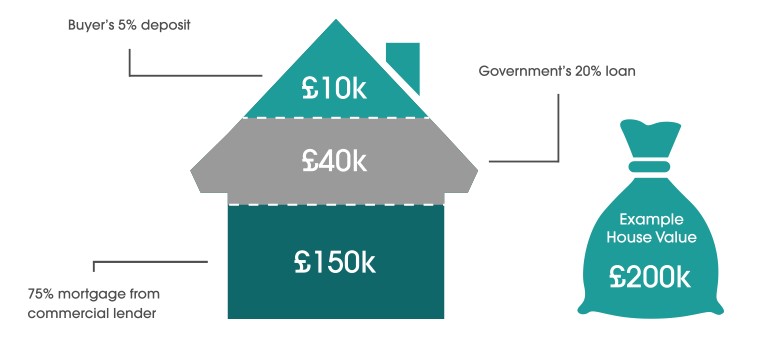

Calculating affordability when it comes to a shared mortgage is a key factor to consider. Knowing how much you can afford to pay each month and how long you plan to have the shared mortgage for will help you determine the best mortgage option. Make sure to take into account taxes, insurance, and other related costs into the total cost of the mortgage.

Shared mortgages are a great way to save money on interest and maintain control of your finances. To get started, it’s important to understand the basics of shared mortgages, compare rates and lenders, and get pre-approved for the loan. Finally, make sure to find the right partner to share the mortgage with, as this will make the process smoother and more successful.

Gather documents

Gathering the necessary documents for a shared mortgage application can be a daunting task; however, with a little preparation and organization, it can be a relatively smooth process. Start by gathering documents such as proof of employment, bank statements, credit score, and proof of income. Once all the documents are collected, make sure to double-check that everything is accurate and up to date. Doing this will help ensure a hassle-free shared mortgage application.

Shared mortgages can be a great way to make your dream home a reality. Divvying up the cost of a mortgage between two or more people can help to lower the overall cost and make the dream of home ownership more achievable.

Submit application.

Submitting an application for a shared mortgage is the first step in the process. Make sure to provide all the necessary documents to ensure a smooth transition. Be sure to double-check the information provided to avoid any costly mistakes.

Compare offers

Comparing mortgage offers can be a daunting task. It’s important to take your time and do your research to make sure you’re getting the best deal possible. Make sure to compare both interest rates and other terms and conditions, such as fees, penalties, and payment schedules. Don’t be afraid to ask questions and get clarifications on any offers you’re considering.

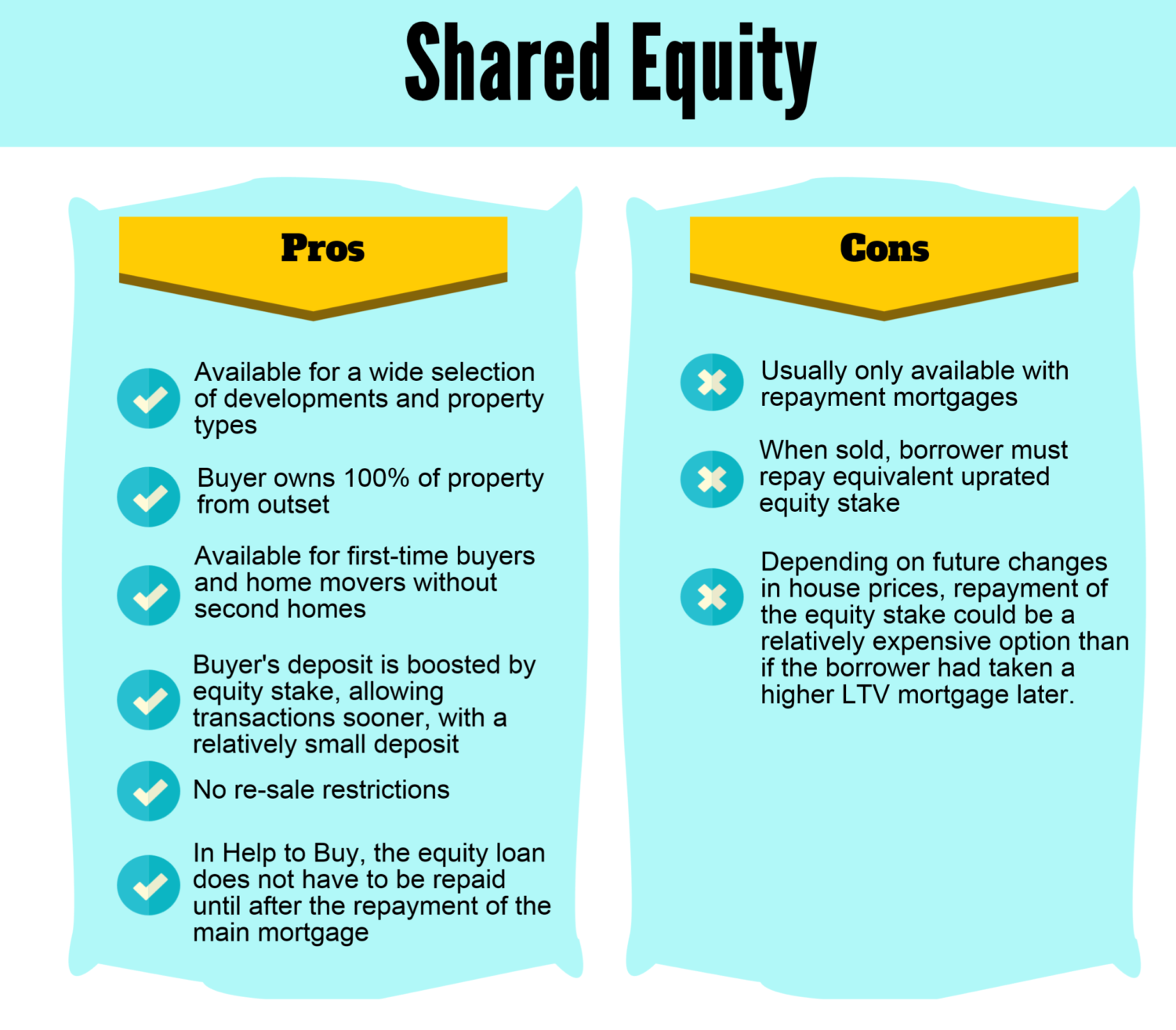

Sharing a mortgage can be a great way to save money and split the costs of ownership. However, there are a few things to consider before taking the leap. Be sure to research the process thoroughly and make sure to understand the legal implications of shared ownership. Additionally, it’s important to work out the details of the agreement with your partner and ensure that both parties are comfortable with the arrangements.

Sign agreement.

Once you have found a co-borrower and discussed a plan, it is important to sign an agreement that outlines the terms of the shared mortgage. This will help protect both parties involved and ensure that all parties are held accountable for their respective financial responsibilities.