Are you ready to take the leap into homeownership but feel overwhelmed by the myriad of home loan options available? Worry no more, because we’ve got you covered! Our expertly curated list of the Top 10 Best Home Loan Lenders is your ultimate guide to finding the perfect mortgage provider that suits your unique needs. We’ve conducted a comprehensive comparison, delving into interest rates, loan terms, customer service, and more to help you make an informed decision. Say goodbye to endless hours of research and hello to the keys to your dream home as you explore the best mortgage lenders in the industry. So, let’s dive in and unlock the door to your future!

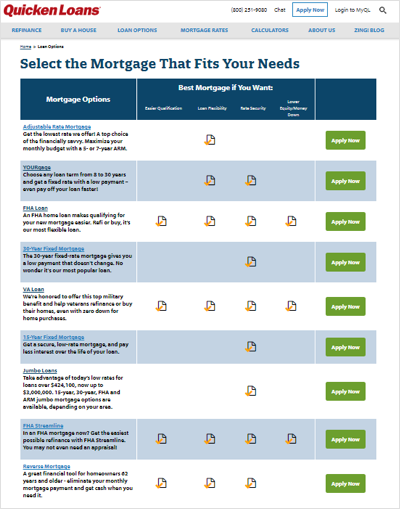

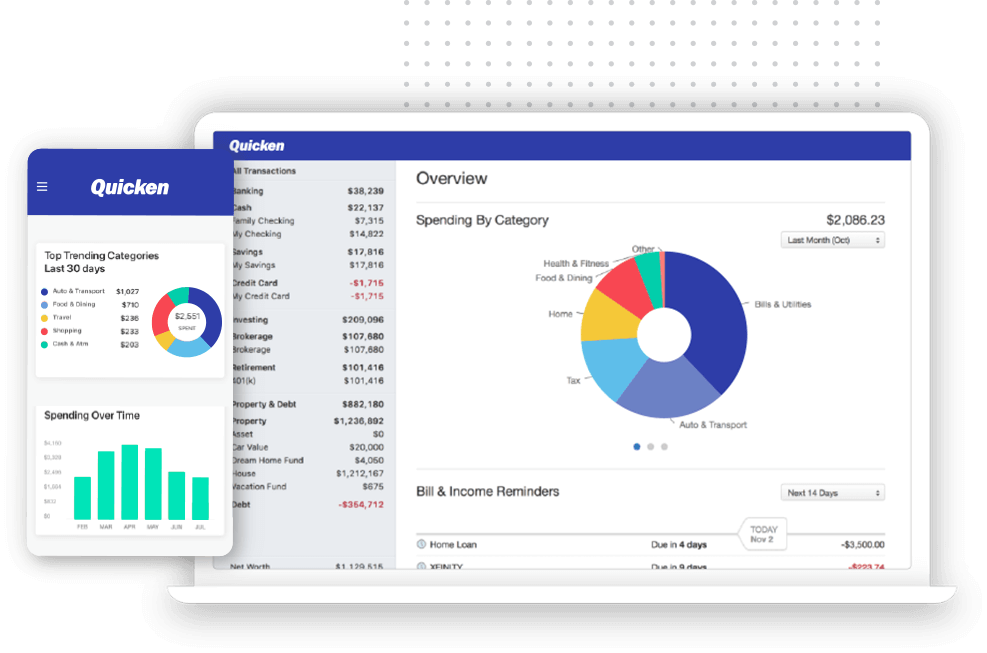

Quicken LoansQuicken Loans is the largest online mortgage lender in the United States, offering a variety of mortgage options to suit different financial situations

Quicken Loans has established itself as a top home loan lender in the industry, boasting a range of flexible and affordable mortgage solutions tailored to meet diverse financial needs. As the nation’s largest online mortgage lender, Quicken Loans offers an intuitive and seamless application process, making it a popular choice among borrowers. Their competitive interest rates, coupled with excellent customer service, and the convenience of their online platform, make Quicken Loans a strong contender in the mortgage market. Whether you’re a first-time homebuyer or looking to refinance your existing mortgage, Quicken Loans provides an array of options to suit your unique requirements.

They are known for their fast approval process, competitive rates, and excellent customer service

When it comes to securing a home loan, finding a lender that offers a seamless approval process, competitive rates, and outstanding customer service is crucial. Our Top 10 Best Home Loan Lenders are renowned for providing these essential features, ensuring a smooth and hassle-free borrowing experience. Their quick approval times enable borrowers to capitalize on time-sensitive opportunities, while the attractive interest rates and loan terms make homeownership more accessible and affordable. Moreover, these lenders’ commitment to exceptional customer service ensures that borrowers receive personalized attention and support throughout the entire loan process. Explore our comprehensive comparison to discover the perfect home loan lender to fit your unique needs and financial goals.

They offer fixed-rate loans, adjustable-rate loans, FHA loans, VA loans, and jumbo loans.

Discover the top 10 best home loan lenders in our comprehensive comparison, featuring a wide variety of loan options to cater to your specific financial needs. These reputable lenders provide fixed-rate loans for predictable monthly payments, adjustable-rate loans for flexibility in changing market conditions, FHA loans for those with limited credit or down payment capabilities, VA loans for eligible veterans and their families, and jumbo loans for larger loan amounts. By understanding the unique features and benefits of each loan type, borrowers can make an informed decision and find the perfect match for their home buying journey. Stay ahead in the competitive housing market by choosing the ideal home loan lender and securing your dream home today.

Bank of AmericaBank of America is one of the largest banks in the United States and offers a wide variety of home loan products, including fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, and jumbo loans

Bank of America is a leading financial institution in the United States, providing a diverse range of home loan options to suit various needs. Their extensive selection includes fixed-rate mortgages for predictable monthly payments, adjustable-rate mortgages for flexibility, FHA loans for lower down payments, VA loans for veterans, and jumbo loans for larger loan amounts. With competitive interest rates, exceptional customer service, and a seamless online application process, Bank of America ensures that securing your dream home is a hassle-free experience. Discover the perfect home loan solution with Bank of America’s comprehensive and customizable mortgage offerings.

They are known for their competitive rates, variety of loan options, and robust online tools to help borrowers understand and manage their loans.

Discover the top 10 best home loan lenders in our comprehensive comparison, featuring those renowned for offering competitive rates, a diverse range of loan options, and cutting-edge online tools that empower borrowers to better understand and manage their loans. We’ve meticulously researched and analyzed the home loan market to bring you the most reliable, trustworthy, and cost-effective mortgage providers to help you secure your dream home. Our in-depth analysis takes into consideration factors such as interest rates, loan terms, customer service, and overall ease of the application process. Don’t miss out on our expert insights and make an informed decision to find the perfect home loan lender tailored to your unique financial needs.

Wells Fargo

Wells Fargo, one of the largest and most well-established banking institutions in the United States, offers a wide variety of home loan options for prospective borrowers. With competitive interest rates, flexible repayment terms, and an extensive network of mortgage consultants, Wells Fargo stands out as a top choice for home loan seekers. Their user-friendly online platform enables borrowers to easily navigate through different loan types, including conventional loans, government-backed loans, and refinancing options. Additionally, their commitment to exceptional customer service and extensive resources make the home buying process a seamless experience for first-time buyers and seasoned homeowners alike.