Are you on the hunt for a mortgage refinance that will save you money and provide financial flexibility? Look no further because we’ve done the research for you! In this comprehensive guide, we’ll reveal the top 5 lenders with the best refinance mortgage rates available today. By comparing interest rates, fees, and customer reviews, we’ve narrowed down the best options to help you make an informed decision. So, sit back, relax, and let us introduce you to the perfect refinance mortgage solution that will pave the way for a brighter financial future.

However, here are some popular lenders known for their competitive refinance mortgage rates

In today’s competitive market, finding the best refinance mortgage rates is crucial to securing a favorable deal. Among the numerous lenders available, there are a few that consistently offer competitive rates and exceptional service. These top-rated lenders excel in providing a seamless refinancing experience, catering to a wide range of borrowers and financial situations. By exploring your options with these leading lending institutions, you can take advantage of the current low-interest-rate environment to refinance your mortgage and potentially save thousands of dollars. So, don’t miss out on the opportunity to secure a better financial future by considering these top 5 lenders with the best refinance mortgage rates today.

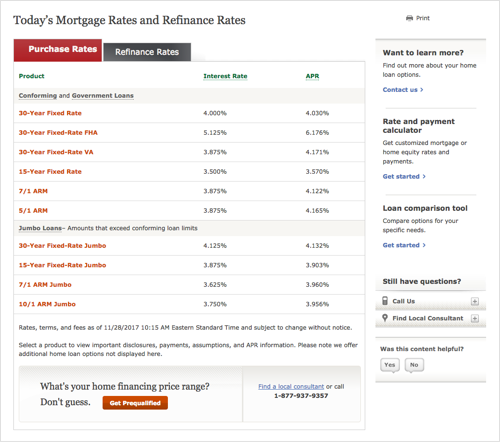

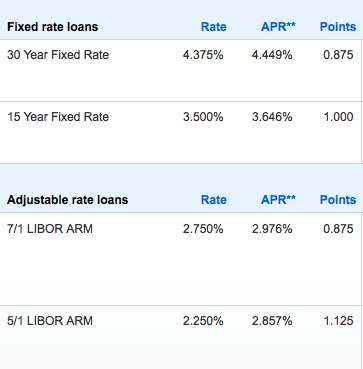

You can visit their websites or use comparison websites to get the latest rates and offers from these lenders:

Discover the top 5 lenders with the best refinance mortgage rates today by exploring their websites or utilizing comparison websites to stay updated on the latest rates and offers. Comparison websites provide a convenient, one-stop destination to compare multiple lenders, ensuring you get the most competitive refinancing options. By researching and comparing these top lenders, you can make an informed decision on which lender best suits your financial needs and goals. Keep in mind that rates and offers may vary based on your credit score, loan amount, and other factors. Stay ahead of the game and secure the best refinance mortgage rates today by leveraging these valuable resources.

Quicken Loans/Rocket Mortgage

Quicken Loans/Rocket Mortgage ranks among the top lenders offering the best refinance mortgage rates in today’s market. With their industry-leading technology and user-friendly online platform, borrowers can easily compare and choose from a wide array of refinancing options. Renowned for their excellent customer service, Quicken Loans/Rocket Mortgage strives to provide a seamless and hassle-free mortgage experience. As a trusted lender with a strong reputation, the company ensures competitive rates and flexible terms to cater to diverse financial needs. So, if you’re looking to refinance your mortgage, Quicken Loans/Rocket Mortgage should undoubtedly be on your list of top choices.

Wells Fargo

Wells Fargo reigns as a leading choice for homeowners seeking the best refinance mortgage rates today. With its extensive portfolio of loan programs, this financial giant caters to a diverse range of borrowers – from first-time buyers to seasoned real estate investors. Wells Fargo’s competitive rates and unparalleled customer support make refinancing a seamless experience. They offer fixed and adjustable-rate mortgage options, as well as government-backed loans, ensuring there’s a perfect fit for every homeowner. Stay ahead with Wells Fargo’s user-friendly online platform and digital tools designed to streamline the mortgage refinance process. Experience the Wells Fargo difference for a smarter, smoother refinancing journey.

Bank of America

Bank of America, a leading financial institution, offers some of the most competitive refinance mortgage rates in the market today. With their extensive range of refinancing options, homeowners can find a suitable solution for their financial goals, whether it’s lowering monthly payments, shortening loan terms, or tapping into home equity. Bank of America’s online tools and resources, such as their refinance calculator, make it easy to compare rates and terms tailored to your unique circumstances. By choosing Bank of America for your mortgage refinance, you can take advantage of their exceptional customer service and potentially save thousands on your home loan.

Chase

Chase Bank stands out as one of the top lenders for refinancing mortgage rates today, offering competitive rates and a streamlined application process. With a variety of loan options, including fixed-rate and adjustable-rate mortgages, Chase caters to the diverse financial needs of homeowners. Their user-friendly online platform and dedicated mortgage professionals make refinancing a hassle-free experience. Moreover, Chase’s reputation for exceptional customer service ensures that clients receive personalized guidance throughout the refinancing journey. So, if you’re looking to lower your monthly payments or shorten your loan term, consider choosing Chase for a mortgage refinance that fits your financial goals.

LoanDepotPlease note that the best refinance mortgage rates may change over time, and the top lenders may also change

LoanDepot, a leading non-bank lender, offers some of the most competitive refinance mortgage rates in the industry today. With their innovative technology and user-friendly online platform, LoanDepot simplifies the refinancing process and helps homeowners find the best mortgage rates to suit their individual needs. Their commitment to excellent customer service and personalized loan solutions has earned them a strong reputation as a reliable and trustworthy lender. With an extensive range of loan products, including fixed-rate, adjustable-rate, and FHA loans, LoanDepot caters to various borrower profiles, ensuring a seamless and hassle-free refinancing experience for all.

Always compare rates and offers from multiple lenders before making a decision.

When searching for the best refinance mortgage rates, it’s crucial to compare offers from multiple lenders to ensure you’re getting the most competitive deal. By carefully evaluating various loan options, you’ll be able to identify the most suitable terms and rates that align with your financial goals. Keep in mind that every lender has unique underwriting criteria, loan products, and fees, which can significantly impact your overall refinancing cost. Therefore, it’s essential to research and review multiple options, allowing you to make an informed decision that can potentially save you thousands of dollars in interest over the life of your loan. Remember, the key to securing the best refinance mortgage rate lies in diligent comparison and thoughtful consideration.